21Shares Likens Ethereum to Amazon in the 1990s

Ethereum holds the potential akin to Amazon in the early 1990s, which grew into a tech giant with a $2 trillion market cap. This conclusion was drawn by 21Shares, as reported by Cointelegraph.

“Just as Amazon moved beyond the book business and redefined entire industries, Ethereum might surprise us with revolutionary use cases that we cannot fully imagine today,” the review states.

Few could have predicted that the company would change “the way we shop and use digital services.” Similarly, Ethereum emerged in 2015 as a smart contract platform and now supports DeFi worth over $140 billion.

The asset’s total market value of $320 billion is equivalent to 6.25% of Amazon’s figure. Ethereum shares with one of the largest U.S. corporations a team of talented specialists working to make the network useful.

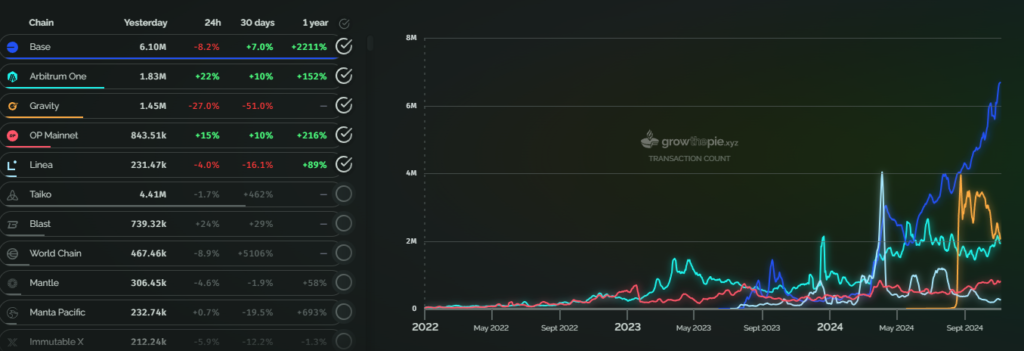

Although Solana and other L1 competitors have challenged Ethereum, it still dominates in the realms of DEX, lending and borrowing, stablecoins, and RWA.

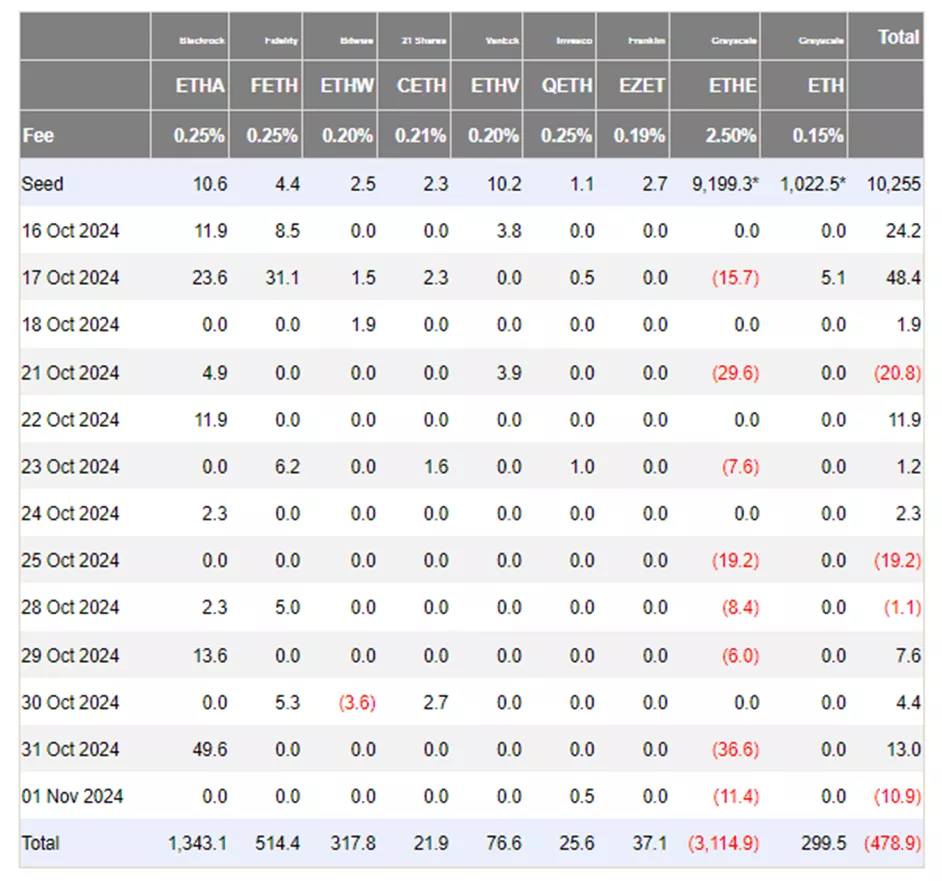

Experts attributed the low inflows into ETH-ETF compared to Bitcoin-based products to investors in TradFi lacking an understanding of the second-largest cryptocurrency’s potential. A “greater clarity” regarding Ethereum’s prospects and use cases is needed to shift the inflow dynamics.

“As the market matures and the range of applications expands, sentiment and asset adoption will follow a similar path of sustainable growth,” the review notes.

Sygnum Bank explained the muted interest in ETH-ETF by the absence of staking income and investors “digesting” Bitcoin funds.

Experts suggested that the picture might change 12 months after investors have more time to consider the “bullish” case for the cryptocurrency.

Chang Guan Zheng of ZX Squared Capital highlighted the decline in Ethereum’s revenues due to activity migration to L2. He noted that many on Wall Street use cash flow analysis to assess value.

21Shares emphasized that a scaling strategy relying on the second layer allows for attracting millions of new customers at low costs. In the 1990s, Amazon recorded losses quarter after quarter, which did not prevent it from reaching profitability.

Ultimately, revenues from L2 will become “substantial enough” to return the main network’s figures to levels before the advent of BLOBs.

Previously, Cointelegraph noted Ethereum’s readiness for a turnaround and potential recovery to $6000.

Earlier, Hashkey Capital concluded that altseason is likely to begin after Bitcoin reaches $80,000.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!