Cryptocurrency Products Experience First Fund Outflow of the Year

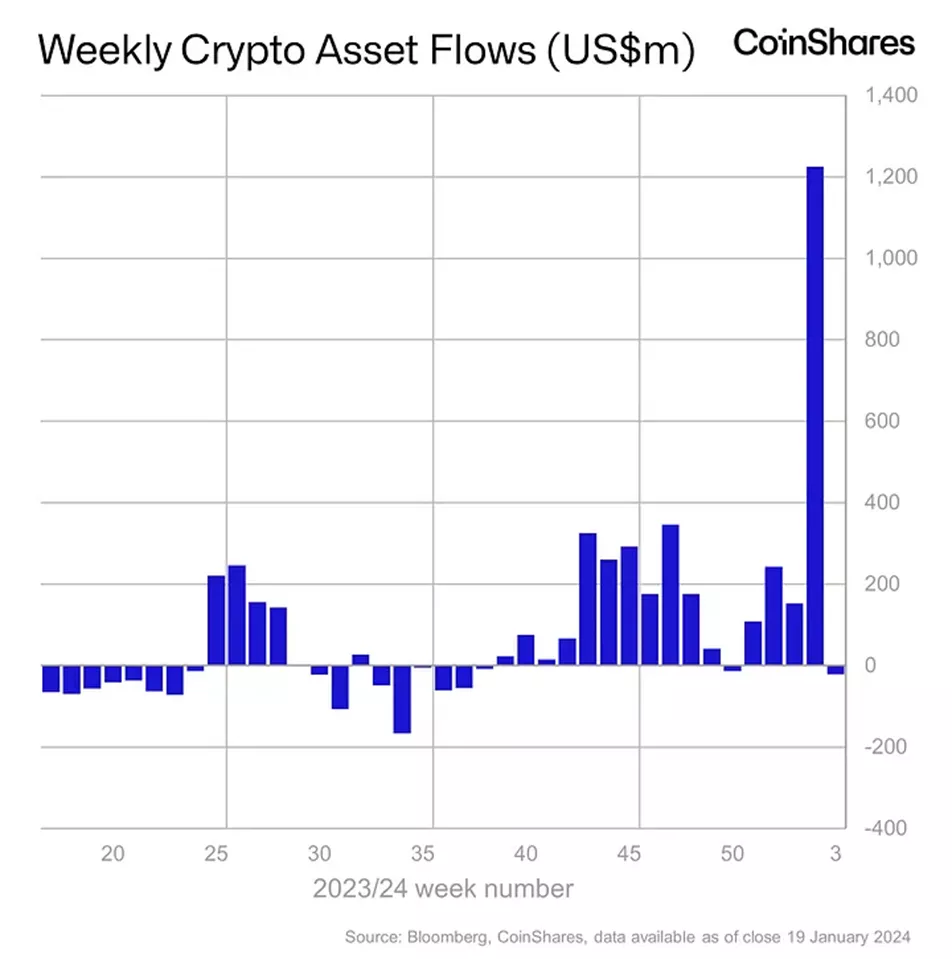

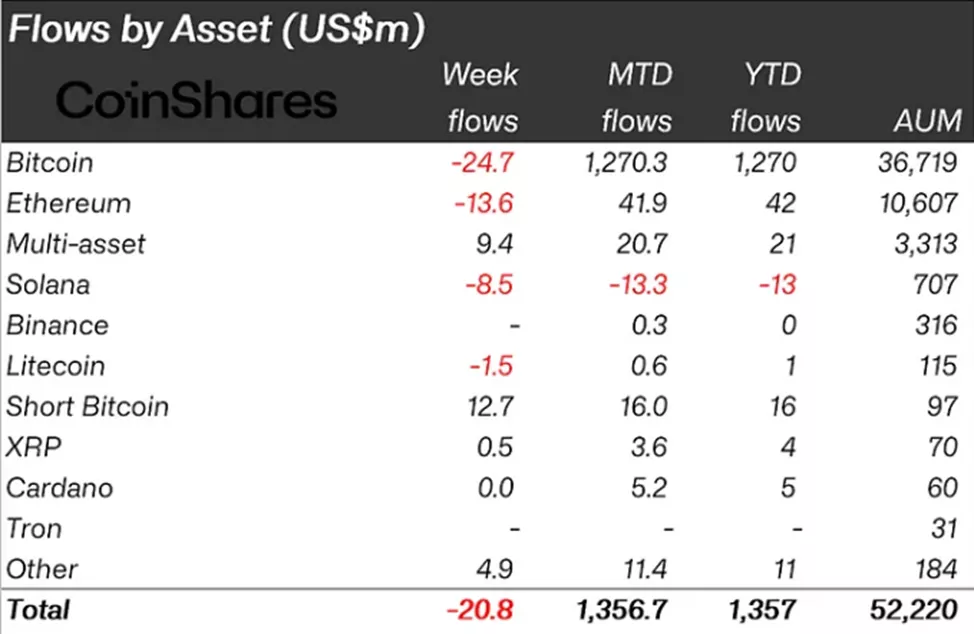

From January 13 to 19, cryptocurrency investment products saw an outflow of $20.8 million, following a near-record inflow of $1.19 billion the previous week, according to a report by CoinShares.

Trading volumes decreased from a historic high of $17.5 billion to $11.8 billion, a figure nearly six times the 2023 average (~$2 billion).

Issuers of the “new” Bitcoin ETFs in the US recorded inflows of $4.13 billion since the product launch on January 11. Part of this was formed by the withdrawal of $2.9 billion from existing products [GBTC].

Overall, Bitcoin-related instruments experienced an outflow of $24.7 million over the past week.

Investors put $12.7 million into structures allowing short positions on the leading cryptocurrency (the previous week saw a withdrawal of $4.1 million).

Ethereum funds recorded an outflow of $13.6 million (the previous reporting period saw an inflow of $25.7 million).

Negative trends resumed in Solana-based products, with an $8.5 million outflow compared to a $0.5 million inflow the previous week.

Galaxy Digital CEO Mike Novogratz downplayed the impact of GBTC sales on the prospects of digital gold.

Earlier, several experts noted the price dependency on the wave of position liquidations in the Grayscale exchange-traded fund.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!