Ondo Finance Team Suspected of ONDO Token Dump

Addresses linked to the Ondo Finance tokenization platform team have been transferring coins to exchanges Coinbase, Gate, KuCoin, and Bybit over two days. Each transfer was followed by a subsequent price dump, reported user ai_9684xtpa.

ONDO 项目方疑似抛售 2,000 万枚代币,使得币价短时下跌 13%?

地址 0x415…72298 三天前从项目方多签地址处收到 5000 万枚 $ONDO (价值 1097 万美金),三小时前分别向 #Gate 和 #Kucoin 充值 1000 万枚代币,或许就是今早 09:20 币价下跌的主要原因

转出地址 https://t.co/KyqXVawtf9 pic.twitter.com/gbvwiN3m4G

— Ai 姨 (@ai_9684xtpa) January 22, 2024

“Address 0x415…72298 received 50 million ONDO (~$10.97 million) from a project participant three days ago and sold 10 million on Gate and KuCoin three hours ago. This may be the main reason for the asset’s price drop at 09:20 this morning,” reported a specialist.

The mentioned address continues to hold 118 million tokens valued at $24.7 million.

Earlier in 2024, the project unlocked 14.3% of the ONDO supply.

According to CoinGecko, the asset has depreciated by 20.7% over the past day.

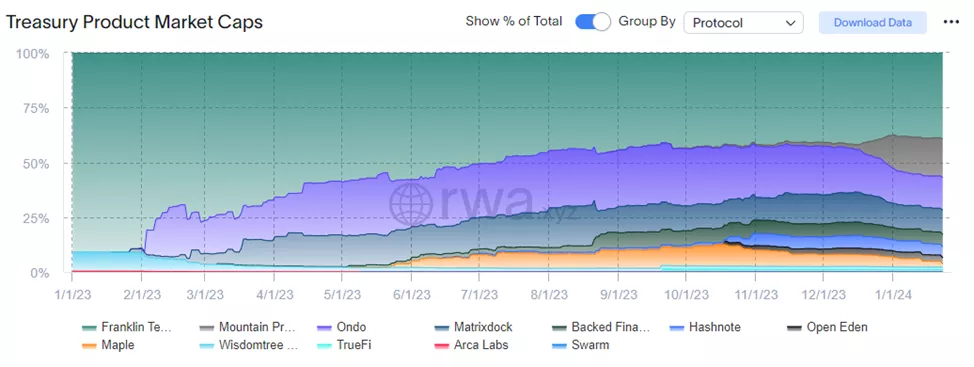

Data from rwa.xyz indicates that Ondo holds 14.93% of the tokenized US Treasury bond market, valued at $865.8 million.

The project offers three products:

- Ondo Short-Term US Government Bond Fund (OUSG) on Ethereum and Polygon;

- Ondo U.S. Dollar Yield (USDY) on Ethereum;

- Ondo US Money Markets (OMMF) on Ethereum.

On January 23, Ondo Finance announced the opening of its first office in the APAC.

The firm’s founder and CEO, Nathan Allman, noted an active and rapidly growing user community in the region.

Back in September, the L2 project Mantle Network integrated the stablecoin USDY.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!