GBTC Sales Drive Cryptocurrency Product Outflows to $0.5 Billion

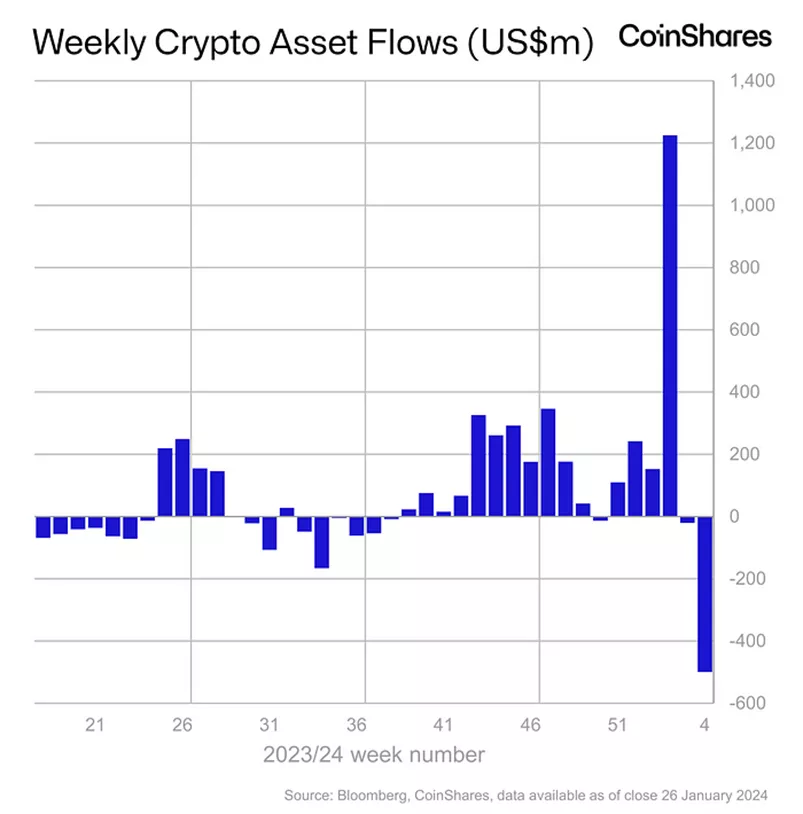

From January 20 to 26, outflows from cryptocurrency investment products reached $499.7 million, up from $20.8 million the previous week, according to a report by CoinShares.

Experts estimate that Grayscale Investments recorded outflows of $2.23 billion from GBTC and other products over the week, totaling $5.1 billion since the approval of digital gold-based exchange-traded funds by the SEC.

This figure surpassed the net inflow into competitors’ spot Bitcoin ETFs ($1.8 billion). Since January 11, products excluding GBTC have attracted $5.94 billion.

“Total inflows across all instruments amounted to $807 million. We believe the majority of the price decline is due to digital gold purchases by issuers occurring mainly before January 11,” experts explained.

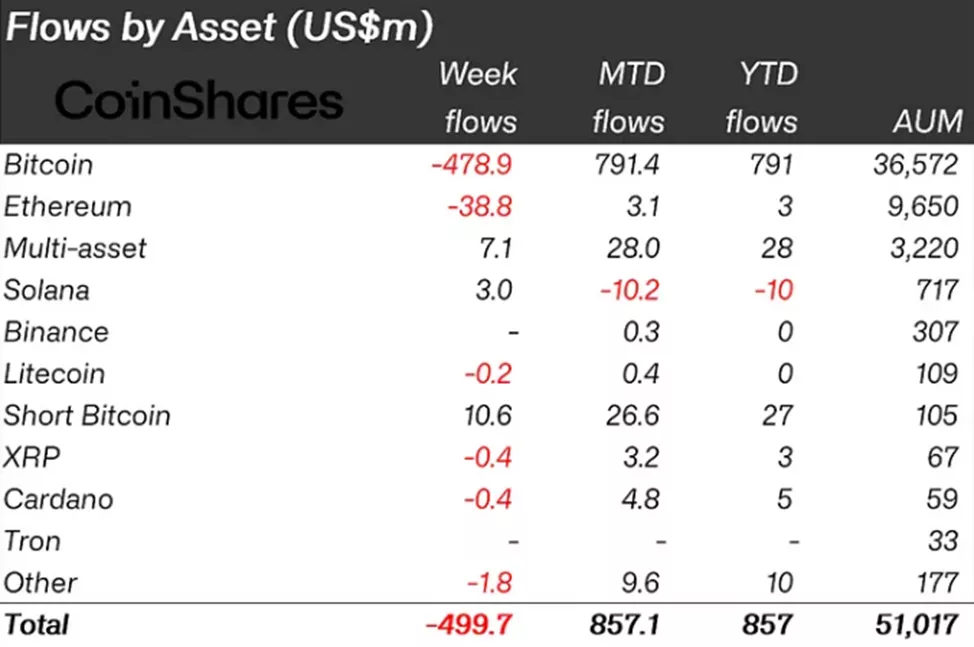

As a result, Bitcoin-related products saw outflows of $478.9 million over the past week ($24.7 million in the previous reporting period).

Investors poured $10.6 million into structures allowing short positions on the leading cryptocurrency (compared to $12.7 million the previous week).

Altcoins, excluding Solana (+$3 million), experienced outflows ranging from $0.4 million (XRP and Cardano) to $38.8 million (Ethereum).

CEO of Galaxy Digital, Mike Novogratz, downplayed the impact of GBTC sales on the prospects of digital gold.

Previously, several experts noted the price dependency on the wave of position liquidations in Grayscale’s exchange-traded fund.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!