Grayscale Anticipates Positive Bitcoin Market Structure Post-Halving

Fundamental shifts in supply and demand dynamics, alongside other factors, are likely to positively influence Bitcoin prices following the halving, according to Grayscale.

NEW REPORT: fundamental onchain activity and positive market structure updates could make the spring 2024 $BTC halving fundamentally different from the ones that came before. pic.twitter.com/SIjBg11cpV

— Grayscale (@Grayscale) February 9, 2024

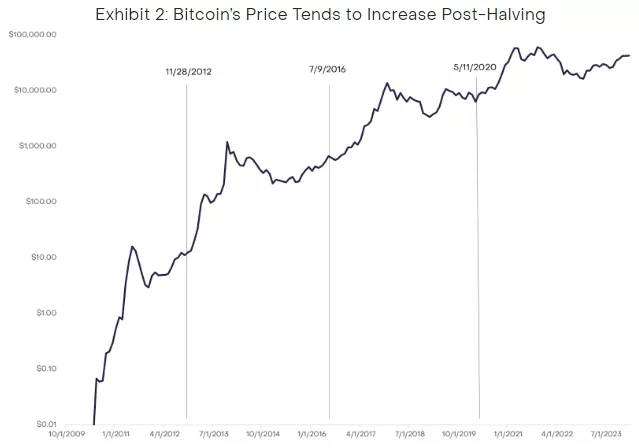

Historically, bullish rallies in cryptocurrency have followed the halving of block rewards. However, it is important to note that “past performance is no guarantee of future results,” emphasized the asset management firm’s experts.

The relationship between reduced asset inflow to the market and prices is illustrated by the well-known Stock-to-Flow model from trader PlanB.

Grayscale noted that this concept overlooks the predictability of scarcity. Meanwhile, investors are not rushing to buy Bitcoin before the halving, thereby driving up the price, which, according to this theory, will inevitably soar. Examples from other cryptocurrencies like Litecoin show that a block reward reduction does not necessarily lead to growth, the company added.

According to experts, Bitcoin rallies are largely linked not to the halving itself but to coinciding major macroeconomic events. For instance, in 2012-2013, it was the European debt crisis, and in 2016-2017, the $5.6 billion ICO boom indirectly affected Bitcoin. Massive support measures during the COVID-19 pandemic prompted investors to view digital gold as a hedge against inflation — by November 2021, the asset reached $68,000.

A Different Post-Halving Scenario

In the absence of potential global economic shocks, the situation following the April block reward reduction will differ significantly from previous post-halving periods due to several factors. One of them is ETFs, Grayscale analysts highlighted.

According to their calculations, the current mining rate of 6.25 BTC per block translates to an asset inflow of about $14 billion annually at a price of $43,000. To offset selling pressure, “adequate” market inflows are necessary.

“After the halving, these [equilibrium inflow] requirements will halve: with only 3.125 BTC mined per block, corresponding to a reduction to $7 billion annually. This will effectively ease the pressure from sellers,” the report states.

Following the approval of spot Bitcoin exchange-traded funds in the US in January, these products attracted approximately $1.5 billion in just the first 15 trading days. Considering daily inflows ranging from $1 million to $10 million, these instruments at the upper limit are already capable of significantly absorbing the new asset supply, which will be reduced anyway. This fundamentally transforms the market model in a positive direction for Bitcoin, experts believe.

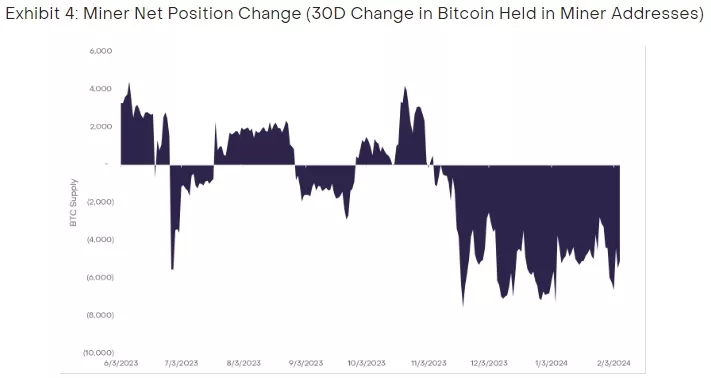

Traditionally, miners are among the main sellers of digital gold post-halving. Since the fourth quarter of 2023, there has been a trend of them liquidating reserves and mined coins.

In recent months, cryptocurrency miners have also significantly strengthened their balances, reduced debt burdens, and improved the efficiency of their operations, analysts noted. The financial position of industry players suggests that major liquidations in the sector are unlikely.

Another significant factor was the emergence of Ordinals in 2023. “Inscriptions” brought Bitcoin miners over $200 million in fee income, supporting profitability, analysts noted.

“The trend is expected to continue, supported by renewed developer interest and ongoing innovations in the Bitcoin blockchain,” Grayscale specialists stated.

Earlier, ForkLog compiled a report featuring the most interesting expert forecasts regarding the price prospects of the leading cryptocurrency post-halving.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!