Starknet Foundation to Unlock 1.3 Billion STRK for Developers and Investors

- On April 15, 1.314 billion STRK will be distributed among investors and developers—nearly double the amount of the airdrop.

- The community has labeled the actions as fraudulent.

- The fully diluted market value of StarkNet could exceed $16 billion.

The Starknet Foundation will unlock 1.314 billion native tokens of the Ethereum-based StarkNet Layer 2 network, valued at $2.1 billion, intended for core developers and investors.

This will occur on April 15—less than two months after the airdrop scheduled for February 20. In the airdrop, nearly 1.3 million addresses will receive a total of 728 million STRK (7.3% of the issuance).

The early unlocking and nearly double the share of tokens for developers and investors have drawn criticism from the community. Discontent was further fueled by the anticipated lifting of vesting for new portions of STRK on a monthly basis.

The Starknet Foundation explained these “early” unlocks by the long-standing generation of tokens in November 2022. Since then, STRK has been used for governance purposes, but moving and trading the asset were unavailable.

It was initially expected that distribution to developers and investors would occur 12 months later—in November 2023. However, the event was postponed by five months to April 15.

Community Criticism

In the crypto industry, a minimum cliff period of one year is typical—this prevents investors from immediately selling their assets at a discount to new buyers.

Thanks to the generation of tokens long before they became available for trading and the slowing down of the unlocking time, this period has been significantly shortened.

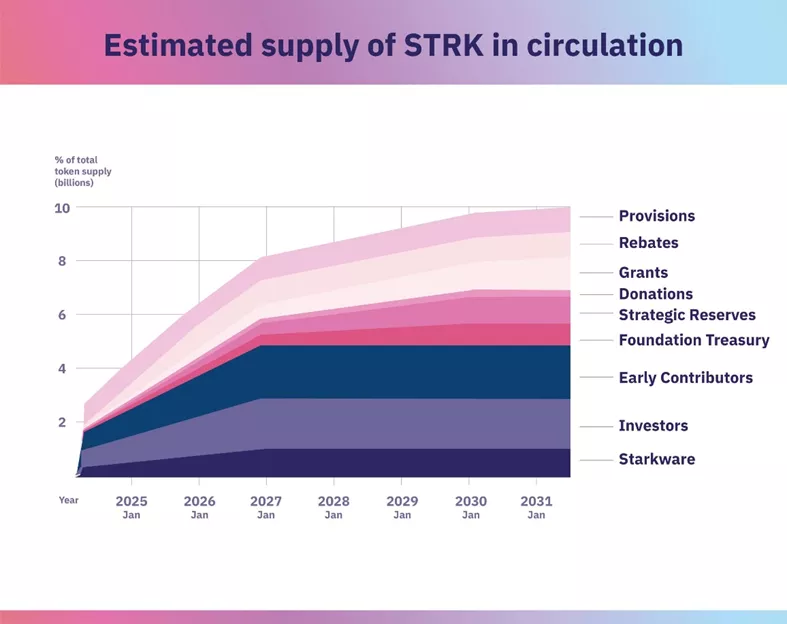

“StarkWare is a project that will be valued at several billion [FDV]. The unlock schedule looks more like […] a fair launch of a DeFi shitcoin,” complained influencer known as Sisyphus.

Starkware is a t1 launch that will price at a multibillion FDV and it has an unlock schedule that looks more like how the devs would pay themselves for a fair launch defi shitcoin https://t.co/BRFDkVjJz4

— Sisyphus (@0xSisyphus) February 14, 2024

Another user named WazzCrypto called Starknet Foundation’s actions “a crime on the edge.”

LOL What the fuck is this graph????

Another blatant case of teams making tokenomics as contrived and scammy as possible

This is the kind of thing the SEC needs to look at, not suing random exchanges pic.twitter.com/01I7RwKhGv

— Wazz (@WazzCrypto) February 14, 2024

“Another blatant case of teams making tokenomics as contrived and scammy as possible. This is the kind of thing the SEC needs to look at, not suing random exchanges,” emphasized the enthusiast.

The founder of Endless Clouds, known as Loopify, also expressed outrage in a conversation with The Block.

“It’s predatory—to unlock such a large portion of tokens to investors in such a short time after the real launch, masking it with a fake generation event two years ago. […] Their airdrop criteria are commendable, but this unlocking step destroys their reputation. The only way to fix this is to delay the process,” the specialist pointed out.

Reaction from StarkWare CEO

In response to the criticism, StarkWare co-founder and CEO Eli Ben-Sasson expressed commitment to the original plan.

“Developers and investors supported the STARK technology when its success seemed improbable. The tokenomics appear balanced,” he explained.

In an interview with Decrypt, the top manager stated that “deviation from norms” reflects StarkWare’s strengths, not its weaknesses.

“We build and look at things a little differently,” he noted.

According to Ben-Sasson, longer token lock-ups for investors and developers serve to increase trust in the team behind the project. This norm is one of several indicators that can point to a project’s reliability. In his view, StarkWare has already proven this.

One proof of commitment to the project is his personal example. Ben-Sasson left a “lucrative” position as a professor at the Haifa Institute of Technology, which he held from 2010 to 2018. The top manager does not plan to leave StarkWare.

The founder believes that extending the lock-up period will not prevent a scenario where investors and developers dump tokens. Such a problem could also arise in a year, he added.

Market Valuation

According to STRK futures, the project’s capitalization after listing could be ~$1.21 billion with contract prices at $1.66 at the time of writing.

Considering the future unlocking of all tokens, the fully diluted market value [FDV] is estimated at ~$16.6 billion.

“The market is clearly excited about Starknet, as it is the most well-known ZK-network,” commented CoinDesk co-founder and CEO of Aevo Julian Koh.

Experts at CoinGecko have included the project’s airdrop in the list of promising token distributions expected in 2024.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!