OKX Faces Challenges in Korea, TVL Reaches $57.8 Billion, and Other Crypto Industry Developments

We have compiled the most important news from the crypto industry over the past two weeks.

- Bybit and Crypto.com have applied for licenses in Hong Kong.

- OKX launched a platform in Argentina and encountered issues in South Korea.

- Kraken received a license from the Dutch Central Bank.

- Solana Foundation entered a strategic partnership with Dubai authorities.

- Ripple acquired a crypto custodian from New York.

Bybit and Crypto.com to Register in Hong Kong

Cryptocurrency exchanges Bybit and Crypto.com have submitted applications to Hong Kong’s SFC for a license to operate a virtual asset trading platform. These details are found in the regulator’s registry.

In a press release received by ForkLog, Bybit representatives stated that the platform operator is Spark Fintech Limited. The organization intends to introduce a broader range of innovative crypto services to further strengthen Hong Kong’s position as a key financial center in the region.

OKX Faces Challenges in South Korea and Launches Platform in Argentina

OKX launched an exchange, P2P platform, and Web3 wallet in Argentina. The company’s president, Hong Fang, described the country as a crucial launchpad for regional growth strategy.

The platform’s manager in Argentina, Alejandro Estrin, noted that OKX aims to accelerate the adoption of innovations among retail and institutional market participants while complying with legal requirements.

It was also revealed that South Korea’s financial intelligence unit accused OKX of operating without registration.

According to the regulator, the company promoted an unlicensed Jumpstart platform for token sales among local investors. Additionally, the firm lacked a Korean-language website.

Kraken Receives License from Dutch Central Bank

Bitcoin exchange Kraken received a license as a crypto service provider from the Dutch central bank. The document will allow the platform to offer exchange and transfer services for virtual assets, as well as custody and wallet services.

Previously, the organization achieved similar recognition from regulators in the UK, Spain, Ireland, and Italy. Kraken also offers crypto services in Belgium through a licensed subsidiary.

In October 2023, the exchange announced the acquisition of Dutch digital asset exchange Coin Meester B.V. to expand its presence in the country’s market.

In January 2024, Kraken hired former top managers from N26 and Coinbase for “further growth in a changing global regulatory environment.”

Solana Foundation Enters Strategic Partnership with Dubai Authorities

The leadership of the Abu Dhabi Global Market (ADGM) signed a memorandum of understanding with the Solana Foundation to implement DLT solutions.

The announcement followed the emirate’s adoption of the world’s first regulatory framework focusing on Web3-related non-profit organizations and DAOs.

The partnership aims to explore joint initiatives and projects to further refine legislation and promote blockchain technology and the Web3 ecosystem.

Previously, a similar agreement was signed by the IOTA Foundation.

Ripple Acquires New York Crypto Custodian

Fintech company Ripple completed a deal to acquire Standard Custody & Trust Co from New York for an undisclosed amount. The purchase awaits approval from the local regulator.

The initiative will allow Ripple to enhance existing products and offer new ones, including those related to asset tokenization. The company seeks to expand beyond its payment network and broaden its service line, enabling institutional clients to benefit from blockchain technology.

In May 2023, Ripple and Swiss-based custodian Metaco agreed on a $250 million acquisition. Later, the Swiss subsidiary of one of Spain’s largest banks, BBVA, began using the company’s digital asset custody service.

In February 2024, Ripple forecasted significant changes in the cryptocurrency market structure favoring institutional demand.

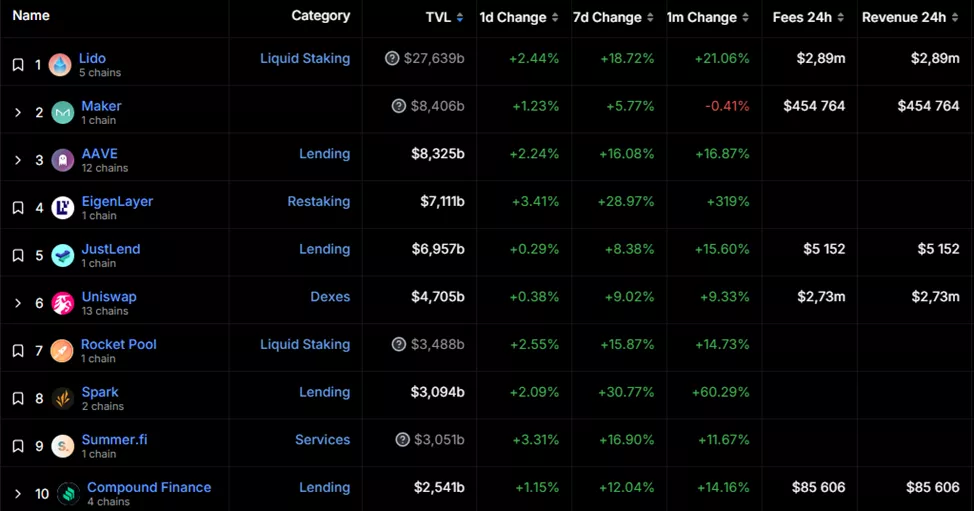

Key DeFi Segment Metrics

The total value locked (TVL) in DeFi protocols rose to $57.8 billion. Lido led with $27.6 billion, followed by Maker ($8.4 billion) and Aave ($8.3 billion).

TVL in Ethereum applications increased to $43.6 billion. Trading volume on decentralized exchanges (DEX) over the past 30 days amounted to $68.6 billion.

Uniswap continues to dominate the non-custodial exchange market, accounting for 58.2% of total turnover. The second-largest DEX by trading volume is PancakeSwap (16.5%), followed by Curve (5%).

Also on ForkLog:

- The court allowed Genesis to sell GBTC shares worth $1.3 billion.

- Taurus agreed with Lido on liquid staking integration.

- MicroStrategy shifts focus to Bitcoin development.

- Bitget became the leader among CEX in derivatives trading volume.

- The sentencing of Binance’s founder was postponed to April.

- The asset value in the EigenLayer restaking protocol surged to $3.6 billion.

- Uniswap clarified the launch timeline for the fourth version of its protocol.

Weekend Reading Suggestions

The US Securities and Exchange Commission adopted amendments requiring DeFi sector participants to register as dealers. ForkLog gathered comments from industry players and some supportive officials regarding these “hostile” regulations.

The magazine also presented a feature on the 50 leading fintech companies of 2024 by Forbes. Among them were three crypto firms — Chainalysis, Fireblocks, and Gauntlet.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!