Weekly Inflows to Crypto Funds Decline to $598 Million

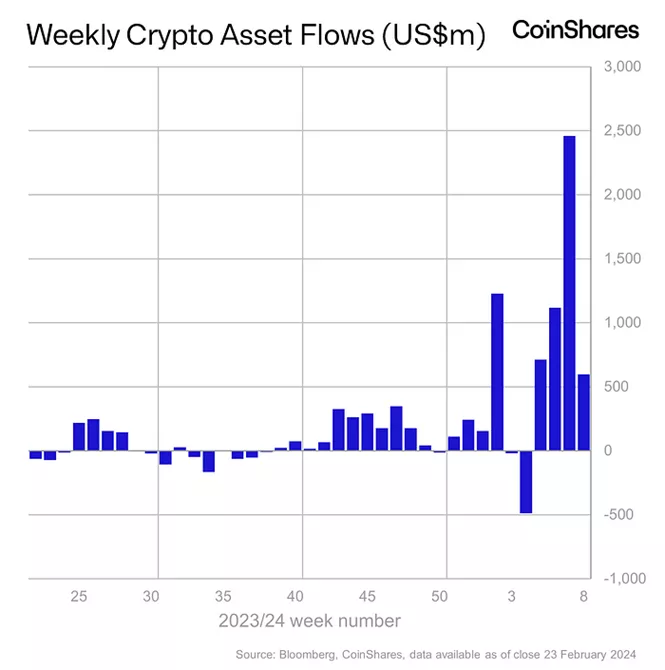

Funds flowing into cryptocurrency investment products from February 17 to 23 amounted to $598 million, following a record $2.45 billion in the previous reporting period, according to a report by CoinShares.

Net inflows since the beginning of the year have reached $5.76 billion—55% of the all-time high inflows recorded in 2021.

The positive trend continued for the fourth consecutive week, despite ongoing withdrawals from the GBTC, resulting in Grayscale recording a net outflow of $432.9 million across its range.

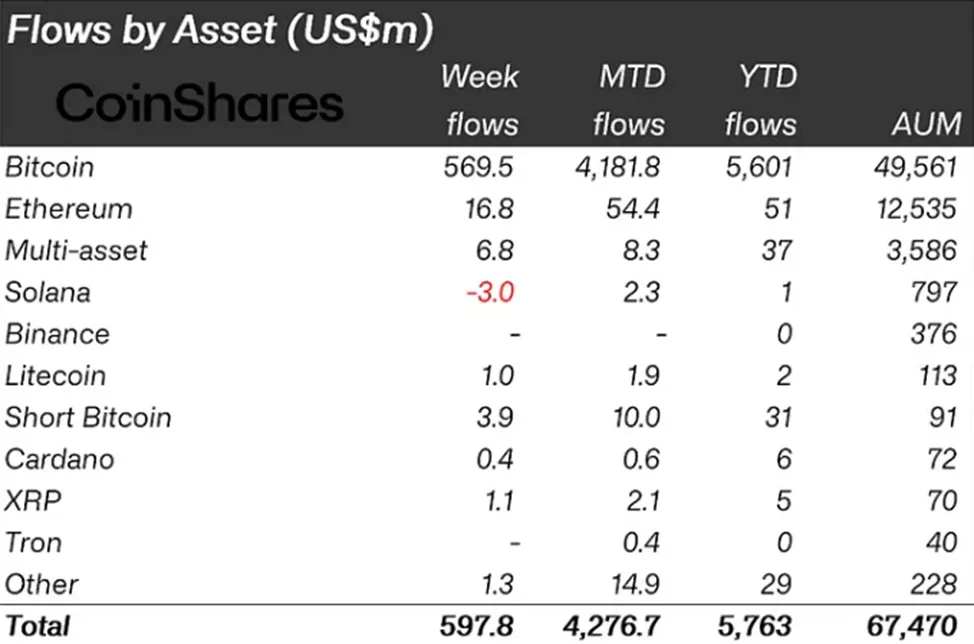

During the week, the total volume of assets under management rose to $68.3 billion, the highest since December 2021. For comparison, in November 2021, the figure reached a record $87 billion.

Investors poured $569.5 million into bitcoin-related instruments after $2.42 billion in the previous reporting period. Year-to-date inflows have exceeded $5.6 billion.

Clients invested $3.9 million in structures that allow shorting the leading cryptocurrency (compared to $5.8 million the previous week).

Altcoins, excluding Solana (-$3 million), showed positive dynamics. Ethereum funds attracted $16.8 million, while products based on Chainlink, XRP, and Cardano drew $1.8 million, $1.1 million, and $1 million, respectively.

On February 24, NFT sales volume on the Solana network surpassed $5 billion.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!