Ethereum Staking Value Surpasses $117 Billion

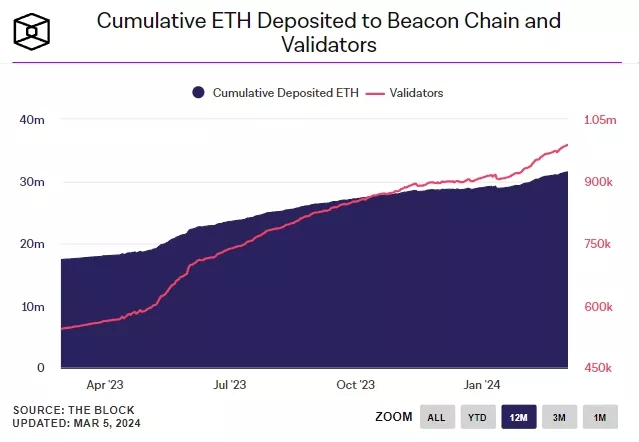

Ethereum validators have locked over 31.5 million ETH in staking, according to The Block. The market value of this cryptocurrency volume exceeds $117 billion.

The total supply of ETH is approximately 120 million coins with a capitalization of ~$450 billion. Thus, around 26% of the asset’s issuance is engaged in securing the network.

Due to partial fee burning, the cryptocurrency has a negative inflation rate of -0.33% at the time of writing.

Since the activation of the mechanism as part of the major update The Merge in October 2022, the total amount of the asset has decreased by 400,700 ETH. Experts at Amberdata have called the network’s deflationary policy a fundamental advantage that could help Ethereum outpace Bitcoin in price growth.

The popularity of ether staking increased after the Shapella hard fork in April 2023. The upgrade enabled the withdrawal of locked cryptocurrency.

According to a dashboard on Dune, since the activation of the update, the net inflow of assets into staking has exceeded 11.6 million ETH.

The number of validators in the network has approached 988,000.

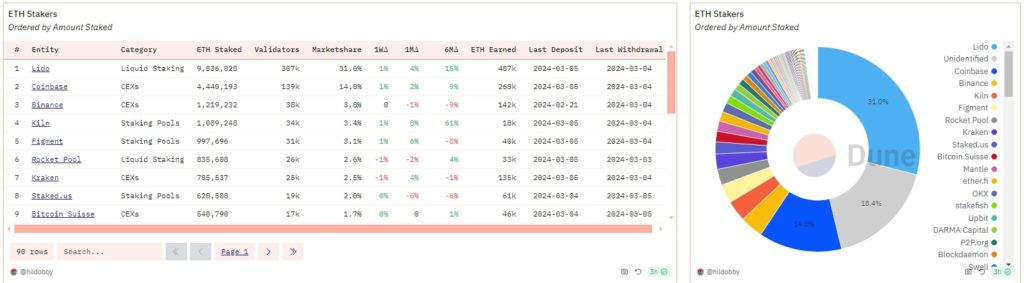

Among protocols, the liquid staking platform Lido dominates with a 31% share. The centralized exchange service Coinbase controls 14% of the market.

In February, experts at Coin Metrics concluded that community narratives about the threat of Ethereum being overtaken by platforms like Lido accumulating a 34% share of validators are misplaced.

Theoretically, such control allows for a so-called 51% attack — for Ethereum, as a PoS network, this threshold is lower.

Specialists at the company calculated that such malicious actions, due to deposit and withdrawal restrictions, would require at least six months of preparation. They estimated the potential costs for an attacker at approximately $34 billion.

On March 13, Ethereum developers scheduled the Dencun upgrade on the mainnet. One of the main components of the upgrade is EIP-4844.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!