Institutional Investment in Cryptocurrencies Set to Rise, Experts Predict

Institutional investors holding cryptocurrencies are planning to increase their investments amid positive industry prospects. This is according to a survey by Nickel Digital, reports The Block.

“The compelling returns of the sector, combined with the approval of spot Bitcoin ETFs, have understandably boosted optimism, but the number of respondents intending to increase investments is noteworthy,” said Anatoly Crachilov, founding partner of a London-based crypto fund management firm.

According to the study, 74% of institutional investors and asset managers plan to increase their positions in cryptocurrencies.

Approximately 87% of respondents described current investment opportunities in the sector as “enticing,” with 20% finding them “very attractive.”

Survey participants expressed even more positive sentiments regarding the long-term outlook. For a five-year period, the aforementioned assessments rose to 92% and 41%, respectively.

About 13% of investors plan to “significantly” increase their capital in digital currencies.

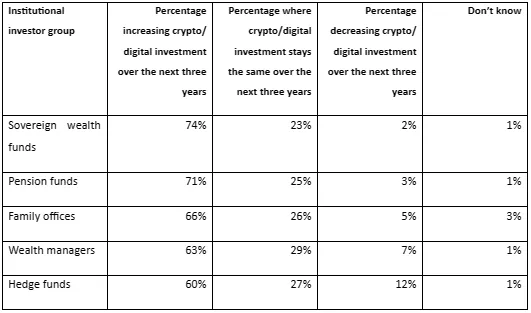

Among categories, sovereign and pension funds showed the highest intent to increase cryptocurrency investments, at 74% and 71% respectively.

Hedge fund managers outlined the most cautious plans: 12% intend to reduce investments, while only 60% are ready to increase them.

Crachilov noted that the survey results differ significantly from those obtained a year ago, when institutional investors remained wary of the crypto market.

In December, Bitfinex analysts predicted increased activity from corporate players in the cryptocurrency market in 2024.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!