Coinbase Highlights Potential Risks for Bitcoin’s Continued Growth

Despite Bitcoin reaching a new all-time high, the market may face challenges in maintaining its upward trajectory in the short term, according to Coinbase’s weekly report.

“The unwinding of bearish positions, which initially fueled the rise, is likely exhausted. However, spot Bitcoin ETFs in the US remain a significant anchor for demand,” noted analysts David Dong and David Han.

Over the past two weeks, the average daily inflow into products was $400 million. In previous cycles, liquidity conditions dictated price dynamics, but this is likely not the case now, experts believe.

They suggest that growth-supporting factors are likely to encounter some “significant macroeconomic and technical hurdles.”

For instance, the Fed is expected to allow the expiration of the BTFP regional bank support program on March 11. This will close the opportunity for arbitrage but will reintroduce financial vulnerabilities.

On March 12, the US Consumer Price Index will be released, and “any negative surprises could lead to an outflow from cryptocurrencies along with other risky assets,” the analysts added.

Liquidity constraints may also arise from a reduction in fund managers’ cash reserves combined with end-of-quarter rebalancing, the report states.

According to Coinbase experts, the most likely scenario for Bitcoin in the coming weeks is trading within a narrow range. The asset will reach a new “price formation territory” as the next major event, the halving, approaches, Dong and Han believe.

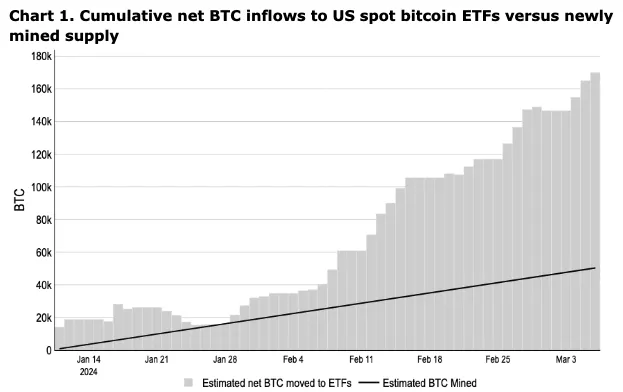

However, they consider extrapolating historical market dynamics around block reward reductions to be a contentious decision. The emergence of spot ETFs has significantly altered the situation: the demand from exchange-traded structures for Bitcoin has nearly tripled the inflow of cryptocurrency from miners.

Earlier, analysts at JPMorgan predicted a Bitcoin correction to $42,000 post-halving.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!