Bitcoin Spot ETF Outflows Persist for Third Consecutive Day

On March 20, the total net outflow from Bitcoin spot ETFs amounted to $261 million, continuing a negative trend for the third consecutive day.

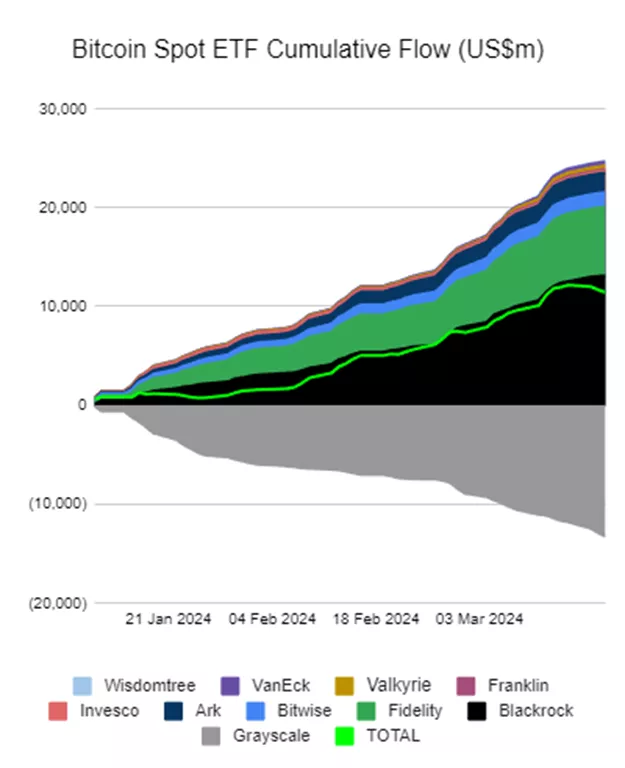

According to SoSoValue data, on March 20, the total net outflow of Bitcoin spot ETFs was $261 million, marking three consecutive days of net outflows.

The ETF GBTC had a single-day net outflow of $386 million, with GBTC’s total historical net outflow reaching $13.27 billion.… pic.twitter.com/8yAN4N917x

— Wu Blockchain (@WuBlockchain) March 21, 2024

In the past day, investors reduced their positions in Grayscale’s GBTC by $386 million. Since the approval of the ETF in January, the total withdrawal from the instrument has reached $13.27 billion.

Investors poured $49.28 million into BlackRock’s IBIT. Since its launch, the net inflow has increased to $13.09 billion. The corresponding figures for Fidelity’s FBTC, ARK Invest’s ARKB, and Bitwise’s BITB are $6.93 billion, $2 billion, and $1.49 billion, respectively.

The total inflow across all products has declined from a peak of $12.1 billion to $11.4 billion.

[3/4] $11.4bn of net inflow since 11 Jan 2024, down from a peak of over $12.1bn pic.twitter.com/2Z8ICHWNah

— BitMEX Research (@BitMEXResearch) March 21, 2024

In March, Bitwise’s CIO Matt Hougan predicted that major investment platforms would add support for BTC-ETFs “within the coming weeks.”

Hougan’s comments align with the views of Bloomberg analyst Eric Balchunas, who described the addition of spot exchange-traded funds based on digital gold by major platforms as one of two “powerful catalysts” for demand.

James Butterfill, head of research at CoinShares, expressed a similar opinion. According to him, only Carsen Group has permitted trading of spot Bitcoin ETFs so far. The implementation of this option by other players, considering the upcoming halving, will lead to a demand shock, the expert noted.

Earlier in March, it was revealed that Bank of America and Wells Fargo clients were granted access to the product upon request.

Prior to this, media reported that Morgan Stanley had initiated due diligence regarding the addition of spot Bitcoin ETFs to its brokerage platform.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!