Bitcoin Holders Increase Sales Amid New Price Peaks

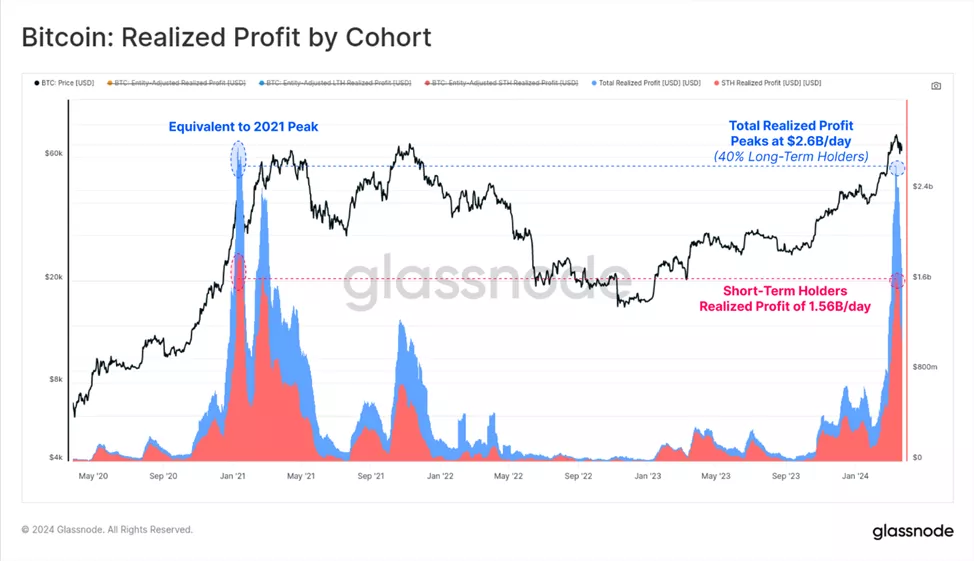

As Bitcoin reached a new ATH above $73,100, daily realized profits from Bitcoin positions exceeded $2.6 billion. According to Glassnode, this was driven by increased distribution from long-term investors.

As the #Bitcoin market hits resistance at a new ATH of $73k, the Long-Term Holder cohort have ramped up their overall distribution pressure.

The market is currently seeing over $2.6B/day in realized profit, as investors start to take chips off the table.

Discover more in the… pic.twitter.com/YHXRnbUnFR

— glassnode (@glassnode) March 26, 2024

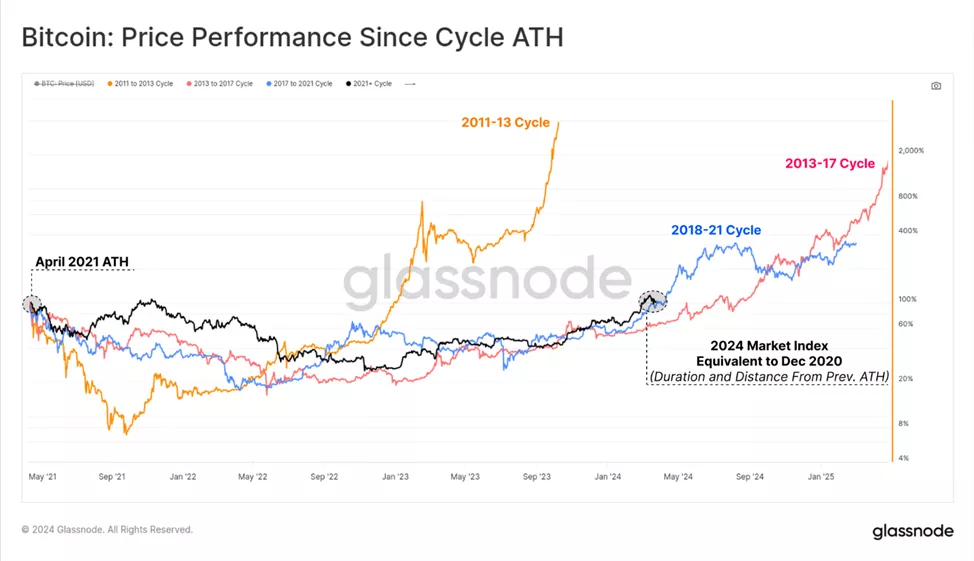

The 15.4% pullback from the ATH to $61,800, followed by a recovery to $70,000 (highlighted in black on the chart below), closely mirrors the trajectory of the previous cycle (in blue).

In terms of both duration and distance from the April 2021 peak, the market is nearly at the same level as it was in December 2020 relative to the 2018–21 cycle.

Experts noted that prices have reached resistance in the form of one standard deviation above the MVRV. This indicates a statistically significant large volume of unrealized profit. As in previous cycles, such a situation often coincided with a wave of closing long positions, they added.

The pullback from the ATH rendered approximately 2 million BTC “unprofitable.” This figure provides an idea of the volume of coins sold at the new higher price, specialists emphasized. The recovery to $66,500 returned half of this figure to “profit.”

Based on these calculations, analysts reached the following conclusions:

- The “cost” of 1 million BTC fluctuates between $61,200 and $66,500;

- The acquisition cost of the next 1 million BTC is distributed in the range of $66,500 to $73,200.

Since the formation of the 2022 lows, these are the largest supply clusters, indicating increased on-chain activity in recent months.

Four different versions of the SOPR indicator pointed to an increase in the volume and amplitude of profit-taking. The metric adjusted for related parties even reached values observed at the height of the 2021 bull market.

Upon reaching the ATH, the daily volume of realized profit rose to $2.6 billion. Such high values were last seen during the peak of the 2021 bull market. 40% of this amount came from long-term investors, including holders of GBTC from Grayscale.

The remaining $1.56 billion was generated by speculators who took advantage of the liquidity influx and positive momentum.

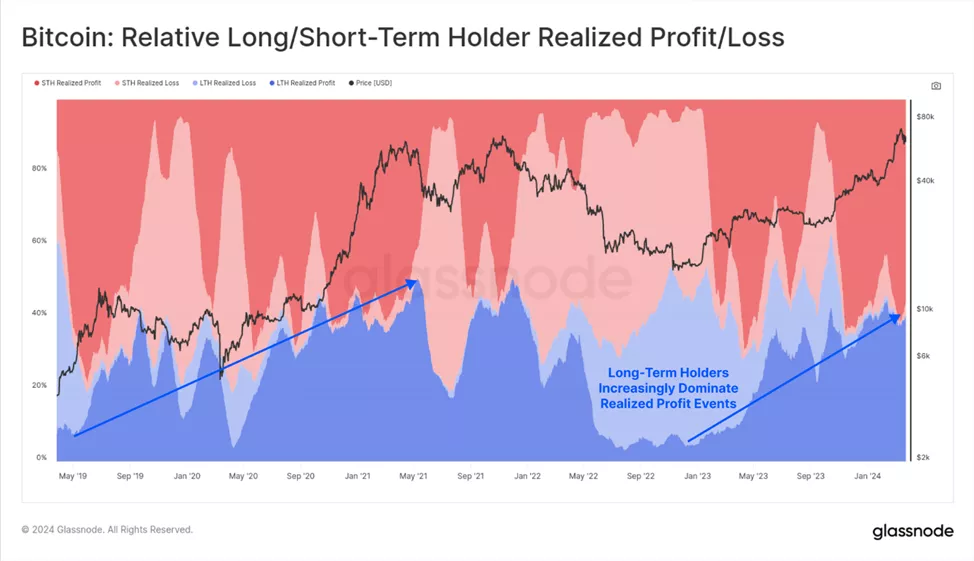

The increase in the share of holders taking profits as prices reach higher levels aligns with previous Bitcoin cycles.

Analysts at Bernstein have revised their Bitcoin forecast from $80,000 to $90,000 by the end of the year. Previously, the company’s specialists considered the correction to around $63,000 a good buying opportunity “at the lows” before the halving.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!