Bitcoin ATMs Experience Growth Despite Spot ETFs

The pace of Bitcoin ATM installations is expected to accelerate post-halving, when FOMO traditionally peaks in the market. This view was expressed by Bitcoin Depot CEO Brandon Mintz in an interview with Cointelegraph.

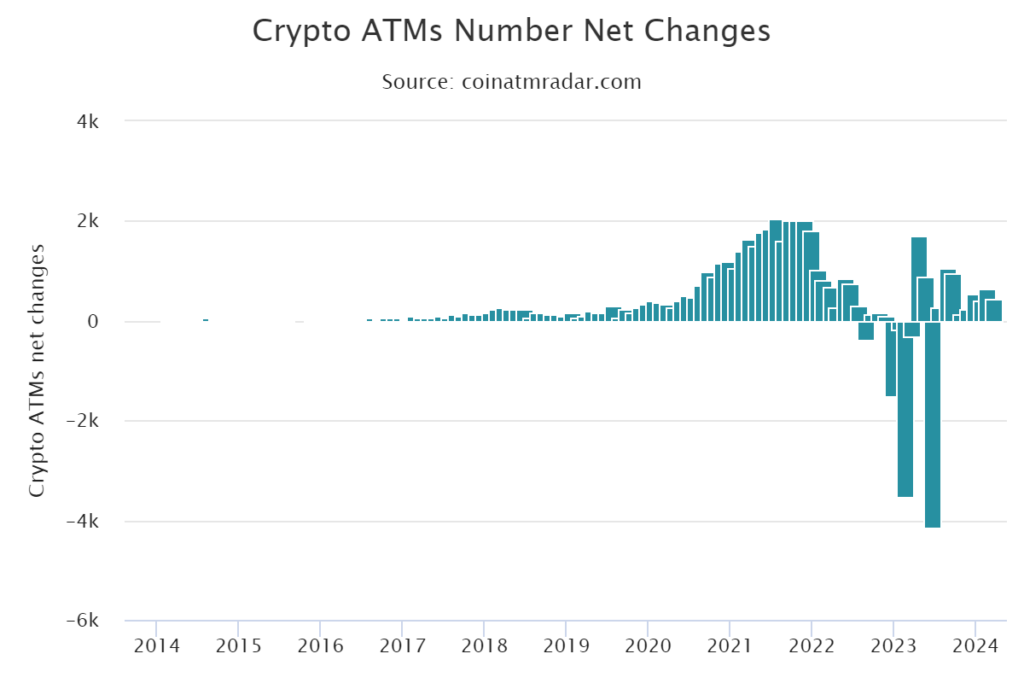

In 2023, the number of crypto ATMs declined for the first time in a decade, dropping by 11.4%. This was attributed to bearish sentiments in the industry, exacerbated by the collapse of several major firms.

However, 2024 began with optimism, Mintz noted. In the first three months, 1,469 new ATMs were installed compared to over 3,000 removed during the same period last year.

“It is very positive to see significant growth in the number of ATMs in the industry again,” the entrepreneur believes.

According to Mintz, the rate of new crypto ATM installations typically increases in the late stages of a bull market. This is due to the broader adoption of digital assets and the demand for these devices.

The expert estimates that the market has not yet reached the midpoint of the current Bitcoin bull cycle.

“In the past, the greatest growth was observed post-halving. That’s when the price surged the most and the FOMO phase began,” Mintz noted.

He also pointed out that despite the increase in crypto ATMs over the past 18 months, the number of operators has decreased. The biggest loss was the bankruptcy of Coin Cloud in February 2023, which managed over 4,000 ATMs.

However, according to Mintz, more businesses ceased operations due to difficulties than publicly known. A sharp decline in the sector occurred after the collapse of FTX in November 2022, which impacted the crypto market as a whole, added the head of Bitcoin Depot.

In July 2023, the company went public on Nasdaq through a reverse merger with SPAC GSR II Meteora Acquisition Corp. According to year-end results, Bitcoin Depot reported a 7% revenue increase to $689 million. However, net profit fell by 54% to $1.6 million. The firm also acquired 900 crypto ATMs for deployment in the first quarter of 2024 in the US.

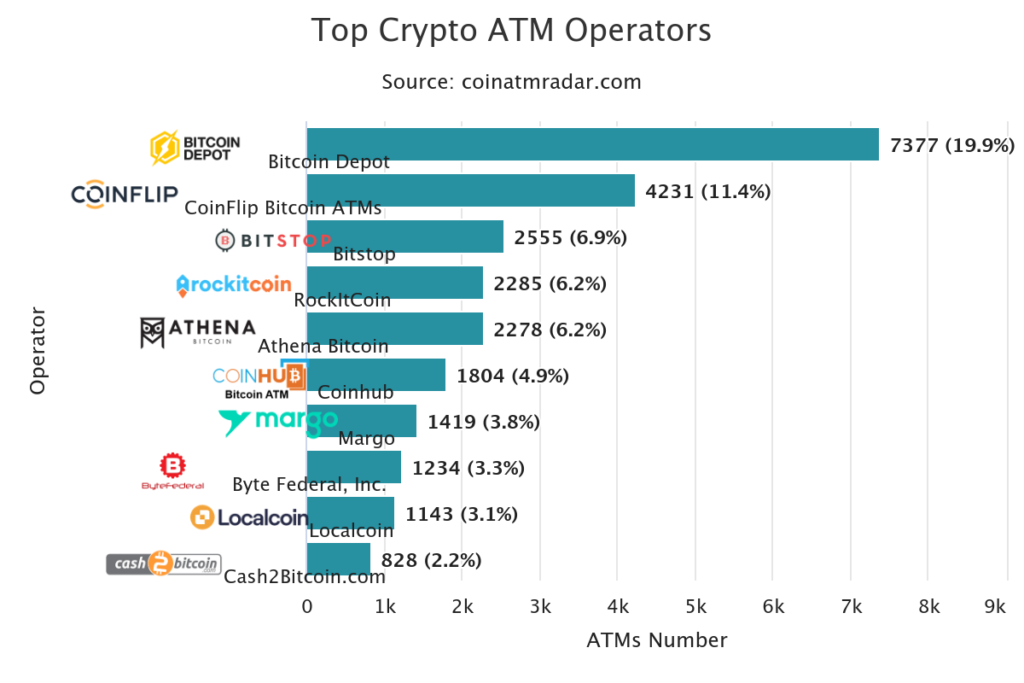

According to Coin ATM Radar, Bitcoin Depot operates 7,377 devices, capturing nearly 20% of the market share. The nearest competitor, Coinflip, has almost half the figures (4,231 and 11.4%).

Spot Bitcoin ETFs and Crypto ATMs: No Competition

The US accounts for 83% of the global crypto ATM market: over ~31,000 out of ~37,000 total. In January, the SEC approved ETFs based on the spot price of the first cryptocurrency. These exchange-traded instruments have opened new opportunities for retail investors to enter digital gold.

Mintz is convinced that this segment and Bitcoin ATMs have different customer bases and do not threaten each other.

“Most of our users transact mainly or exclusively in cash because they do not have access to banking services,” he noted.

Bitcoin ETF buyers are “wealthier individuals with their own brokers.”

Mintz estimates that the vast majority of crypto ATM users earn $90,000-100,000 annually and “are unlikely to have brokerage accounts.” For them, purchasing digital assets through ATMs remains the most accessible way to invest.

On the other hand, the inflow of funds into Bitcoin ETFs stimulates the price growth of the first cryptocurrency, which positively impacts the industry’s development overall.

“If adoption expands, we think it will likely lead to increased use of crypto ATMs. So, on the whole, I believe there’s much more benefit to the industry than negative impact on us,” Mintz concluded.

Back in March, investors withdrew a record $942 million from crypto funds. The outflow also affected Bitcoin ETFs.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!