KuCoin’s Market Share Halves Following US Regulatory Scrutiny

- KuCoin’s market share fell from 6.5% to less than 3%.

- The platform’s client asset coverage level was 112%, with a 20% drop in deposited assets.

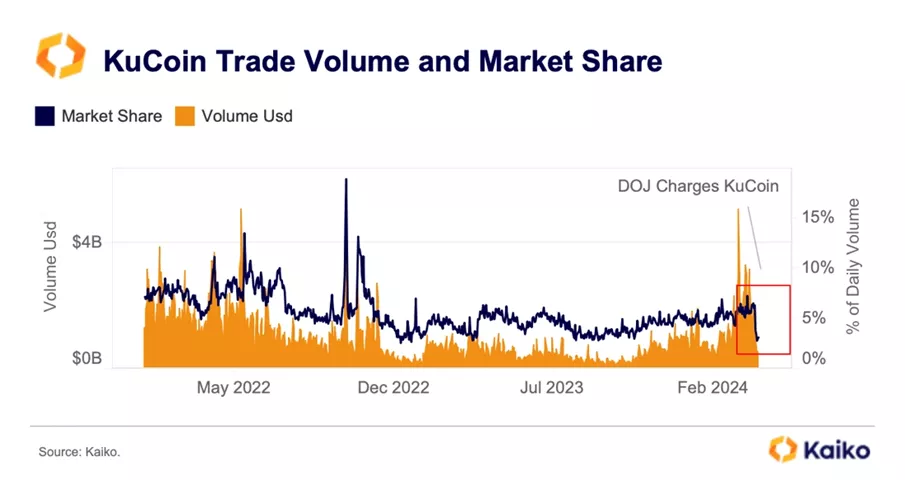

KuCoin’s market share has more than halved, dropping from 6.5% to less than 3%, while daily trading volume decreased from $2 billion to $520 million, according to Kaiko analysts.

Kucoin’s volume and market share has plummeted since last week’s charges.

In today’s Debrief, we break down the impact and explore:

? The #BTC halving

? Correlation with #alts

? Rising token listingsand much more….https://t.co/2kcYvGjX8e

— Kaiko (@KaikoData) April 2, 2024

The decline in KuCoin’s competitive position is linked to accusations from US authorities. Experts note that until these events, the platform was among the fastest-growing players since the beginning of the year.

On March 26, the CFTC filed a lawsuit against KuCoin. The exchange was accused of failing to comply with KYC regulations and not registering as a futures commission merchant, swap execution facility, or designated contract market.

On the same day, KuCoin faced allegations from the US Federal Prosecutor’s Office. The organization and two of its founders were accused of laundering $9 billion, including proceeds from suspicious and criminal activities such as sanctions violations, darknet markets, and ransomware schemes.

“The allegations and fund outflows could pose a significant challenge to the exchange’s future growth,” analysts suggested.

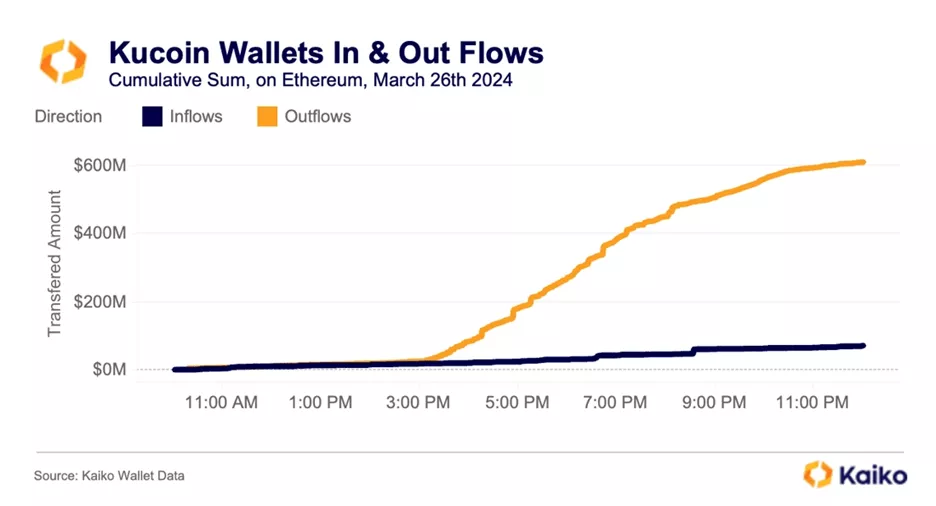

Kaiko specialists noted that KuCoin users are transferring funds to accounts at Coinbase, Binance, OKX, MEXC, and Gate.io, as well as to non-custodial wallets. Some outflows may be linked to market makers leaving the exchange, they added. These are mainly denominated in ETH and USDT.

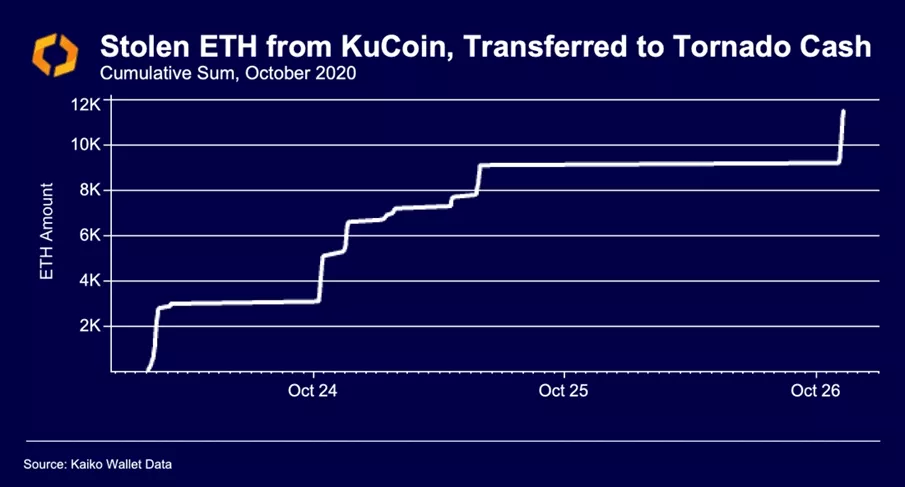

Experts emphasized that they could not find the direct interaction between KuCoin and Tornado Cash alleged by the US Department of Justice. They clarified that nearly all funds stolen in the 2020 platform hack were sent to the Ethereum mixer.

According to the exchange’s PoR, the client asset coverage level at the end of March was 112%.

Compared to February, the volume of deposited assets decreased by 22-33.6%.

KuCoin released the latest (March 31) asset reserve certificate. The user’s BTC assets were 12,114, a decrease of 25.4% from the last time (February 29); the user’s ETH assets were 112,000, a decrease of 21.91%; users USDT assets are 963 million, a decrease of 21.5%.… pic.twitter.com/Bpk5Z9djCj

— Wu Blockchain (@WuBlockchain) April 3, 2024

In March 2023, the New York State Attorney General’s Office accused KuCoin of violating securities laws. In December, the company agreed to pay over $22 million.

Previously, journalist Colin Wu reported that the organization considered ceasing operations and selling the platform back in 2023.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!