South Korean Won Surpasses Dollar in Crypto Exchange Turnover, Reports Kaiko

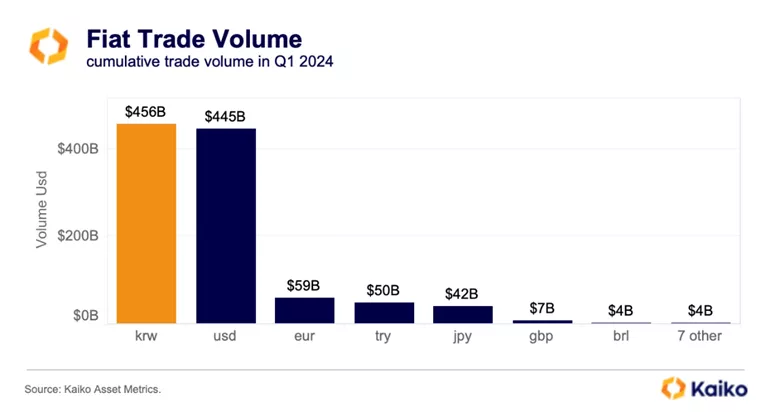

In the first quarter of 2024, the South Korean won surpassed the US dollar in total trading volume on Bitcoin exchanges, reaching $456 billion compared to $445 billion. These estimates were presented by Kaiko.

The last time such high activity was observed on South Korean cryptocurrency platforms was two years ago. The drivers were an improved macroeconomic situation and intense competition.

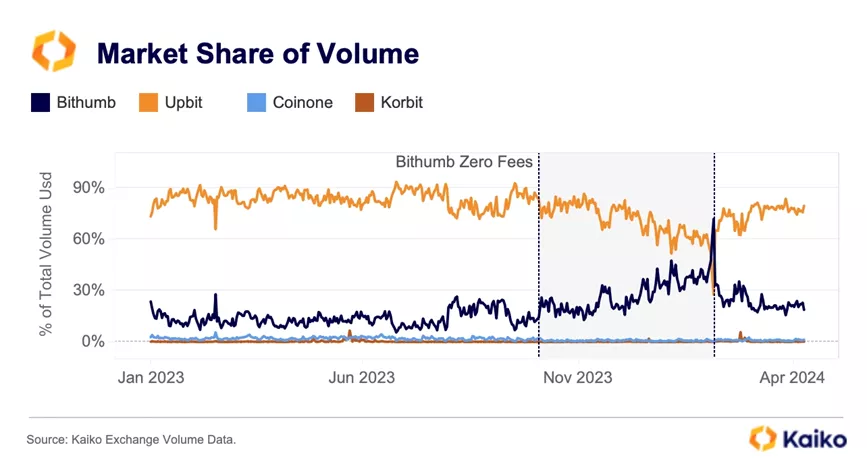

Experts noted that at the end of 2023, Bithumb and Korbit launched aggressive zero-fee campaigns in an attempt to challenge the leading Upbit, which held an average market share of 82% over the past three years.

While Korbit’s market position (1%) remained largely unchanged, Bithumb managed to triple its share following a policy change in October 2023.

According to analysts, turnover decreased at the beginning of April, but the approval of spot ETFs for Bitcoin and Ethereum in Hong Kong could change the situation.

The Block recalled that in March, during a rally, cryptocurrency trading volumes on local platforms briefly exceeded the country’s stock market figures.

On April 10, the opposition Democratic Party won the local parliamentary elections in South Korea, securing 175 out of 300 seats.

In February, media reported that the two main political forces were considering the approval of spot Bitcoin ETFs.

Such plans diverge from the position of the FSC, which warned about the lack of retail client access to such instruments. On January 11, the agency confirmed its commitment to a rule that restricts the launch of exchange-traded products based on the first cryptocurrency.

Back in June 2023, the South Korean parliament passed a law to protect digital asset users.

The document consolidated 19 different bills related to cryptocurrencies. It introduces the concept of “digital assets” and defines liability for offenses such as insider trading, market manipulation, and unfair trading practices.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!