CryptoQuant Advises USDe Holders to Monitor Reserve Fund

Holders of the CDP-stablecoin USDe from Ethena Labs should monitor the reserve fund to manage risks, according to advice from CryptoQuant, as reported by CoinDesk.

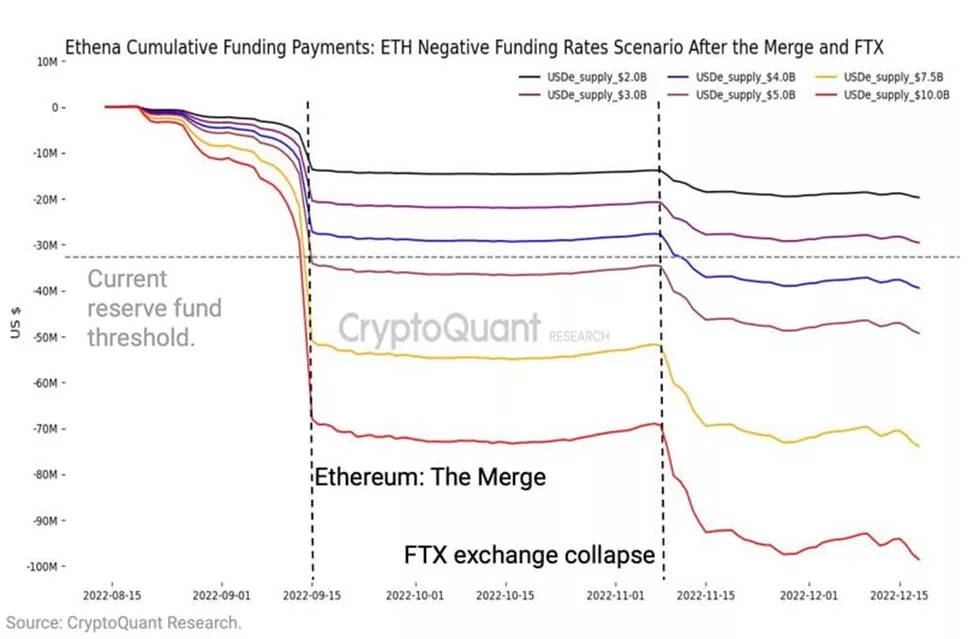

Calculations suggest that under conditions of negative funding rates, the reserve fund can be maintained if the capitalization of the “synthetic dollar” does not exceed $3 billion.

The architecture of USDe is based on a TradFi strategy of delta-neutral trading and portfolio management, which has gained popularity.

This strategy is often used in the options market to manage risks associated with changes in the price of the underlying asset. It is a variant of Cash–and–Carry trading and is considered safe under favorable conditions.

To issue USDe, users deposit bitcoin, Ethereum, stETH, or USDT into the protocol.

The collateral assets are used to open equivalent short positions on perpetual contracts. Through rewards received from long holders in the form of funding rates, Ethena can offer an attractive yield of 17.2% annually in USDe.

In a bear market, the situation changes — the issuer will have to pay funding rates to long position holders. This amount will increase as the project’s capitalization grows. Currently, the figure stands at $2.37 billion, according to CoinGecko.

According to CryptoQuant, the current reserve fund of $32.7 million will only cover payouts if the market value of USDe does not exceed $3 billion.

These assessments were derived from modeling conditions similar to those during the FTX collapse.

The report also states that the portion of income directed to the reserve fund should remain above a certain level depending on the funding rates.

“To withstand a bear phase, this parameter must be maintained above 32%,” the report states.

Previously, experts analyzed the vulnerabilities of USDe during extreme market fluctuations.

In April, Ethena Labs increased rewards for those staking a large volume of ENA.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!