Bitcoin’s Evolution Through the Lens of Halvings

Following the fourth halving, Bitcoin has definitively surpassed gold as the scarcest asset in terms of supply growth. Glassnode conducted a retrospective analysis of events from the perspective of price and fundamental network metrics.

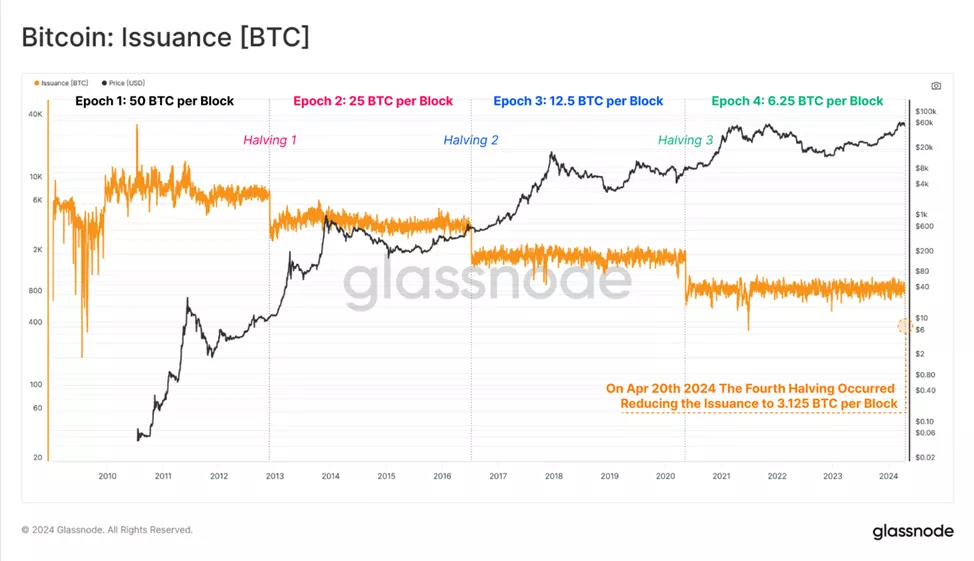

On April 20, the fourth halving occurred in the Bitcoin network. The block reward was reduced from 6.25 BTC to 3.125 BTC. Daily issuance dropped to 450 BTC (with an average of 144 blocks).

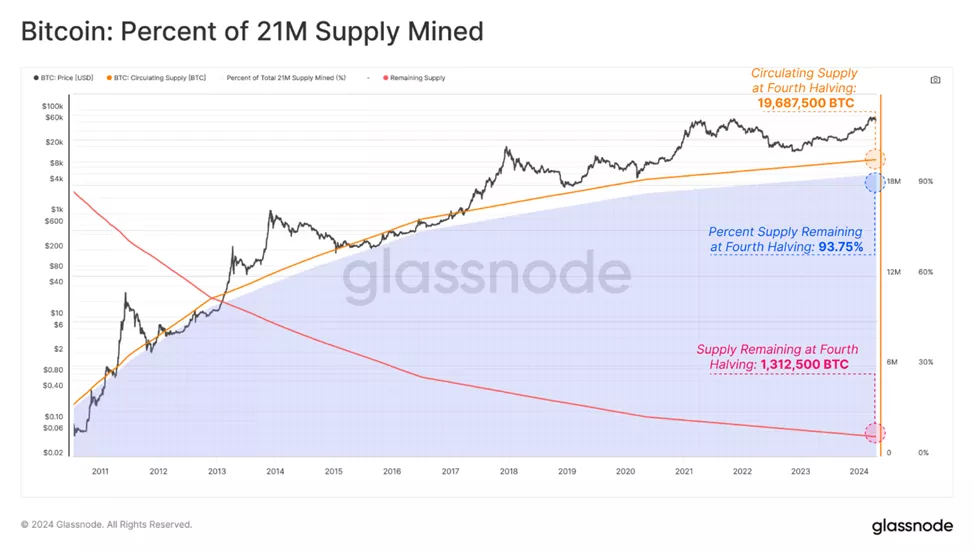

By the end of the fourth epoch, miners had extracted 19,687,500 BTC, which is 93.75% of the total supply of 21 million BTC. Over the next 126 years, only 1,312,500 BTC remain to be issued, with 656,600 (3.125%) or half to be mined in the next four years.

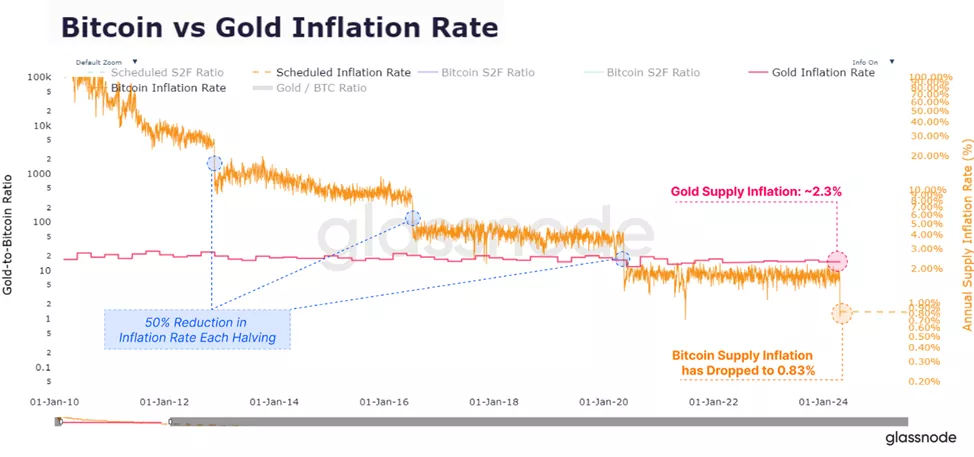

The annual inflation rate slowed from 1.7% to 0.85%. A stable issuance rate of 0.83% is now lower than that of gold (~2.3%).

Issuance accounts for only 0.1% of on-chain transfer volumes, spot, and derivatives market trading turnover.

In other words, the halving’s impact on the available trading supply diminishes over cycles not only due to the reduced number of mined coins but also as the asset and its surrounding ecosystem expand.

The growing market size and the scale of capital flows required for its movement have led to reduced returns and a decrease in price retracement from ATH after each halving:

- ? Epoch 2: price increase of 5315% with a maximum drawdown of -85%;

- ? Epoch 3: +1336% and -83%;

- ? Epoch 4: +569% and -77%.

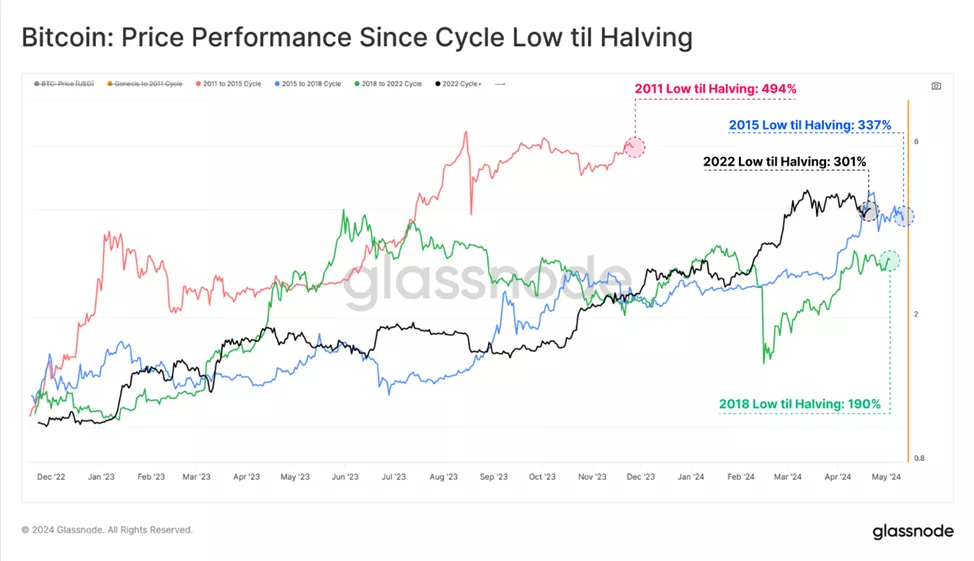

Evaluating price dynamics from the cycle’s low to the halving, analysts highlighted significant similarities between the 2015, 2018, and current cycles, each experiencing growth from ~200% to ~300%.

The current situation differs in that the price reached a new ATH even before the mining rewards were halved.

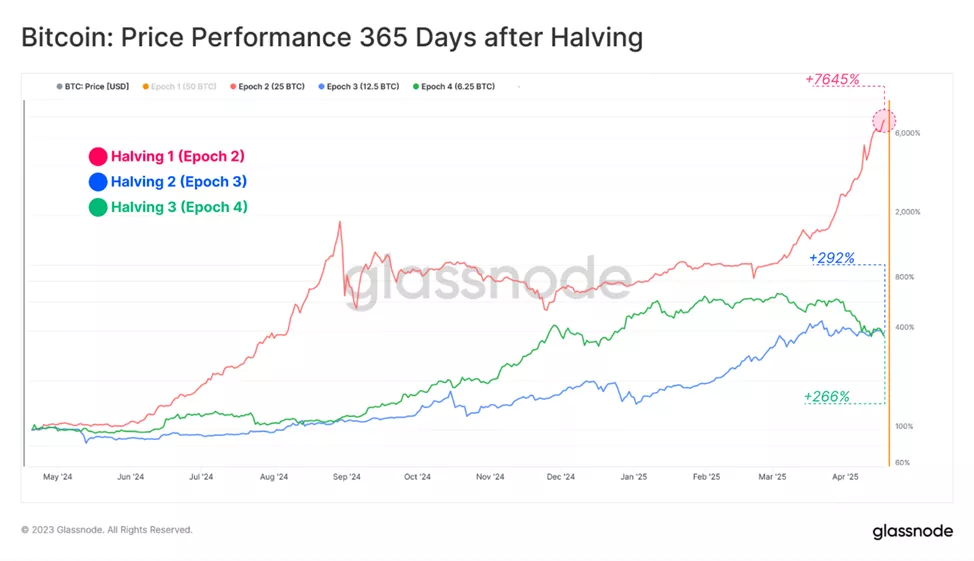

Another way to assess the event’s impact is to examine market indicators over the 365 days following each halving.

The last two epochs (3 and 4) provide more informative insights than the second, due to significant changes in the market landscape, specialists explained.

- ? Epoch 2: price increase of 7258% with a maximum drawdown of -69.4%;

- ? Epoch 3: +293% and -29.6%;

- ? Epoch 4: +266% and -45.6%.

The year following the event has historically been strong but accompanied by drawdowns ranging from -30% to -70%.

The latest growth wave significantly impacted investors’ unrealized profits according to the MVRV ratio (2.26). In other words, each unsold coin provides its owner with an average of 126% additional return on the initial investment.

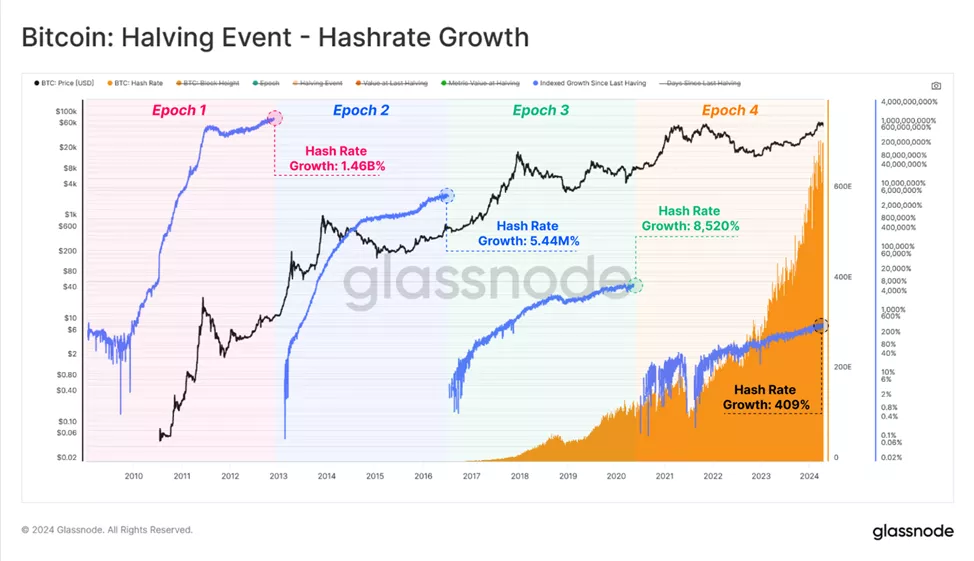

During the fourth epoch, the hash rate increased to 620 EH/s. The metric reached ATH before each halving, indicating growth in the number of ASIC installations and/or the release of more efficient equipment.

As a result, the overall budget for network security remained sufficient not only to cover operational costs but also to encourage further investments, including capital expenditures.

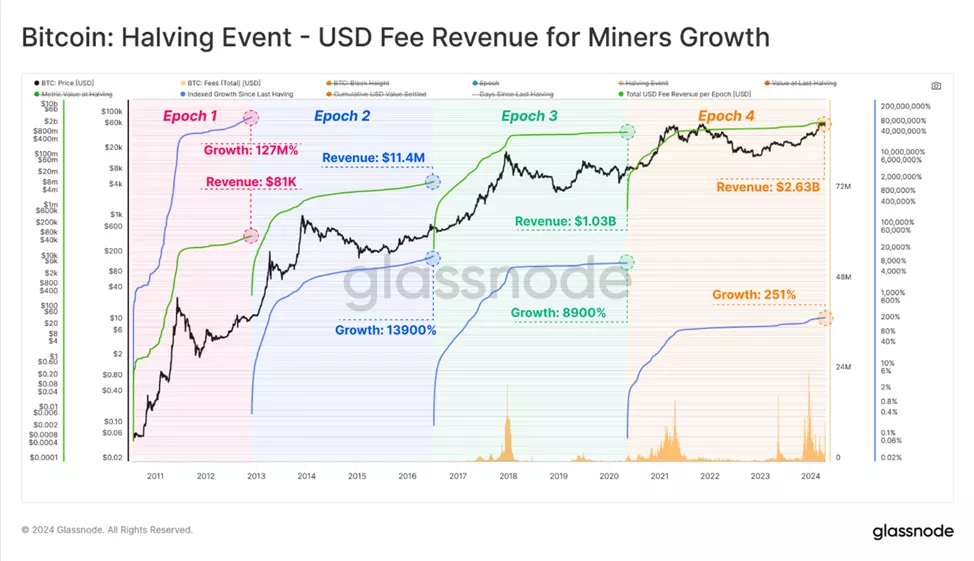

Miners’ revenues also show slower growth rates but increase in absolute terms. Over the past four years, the cumulative figure exceeded $3 billion, growing tenfold compared to the previous epoch.

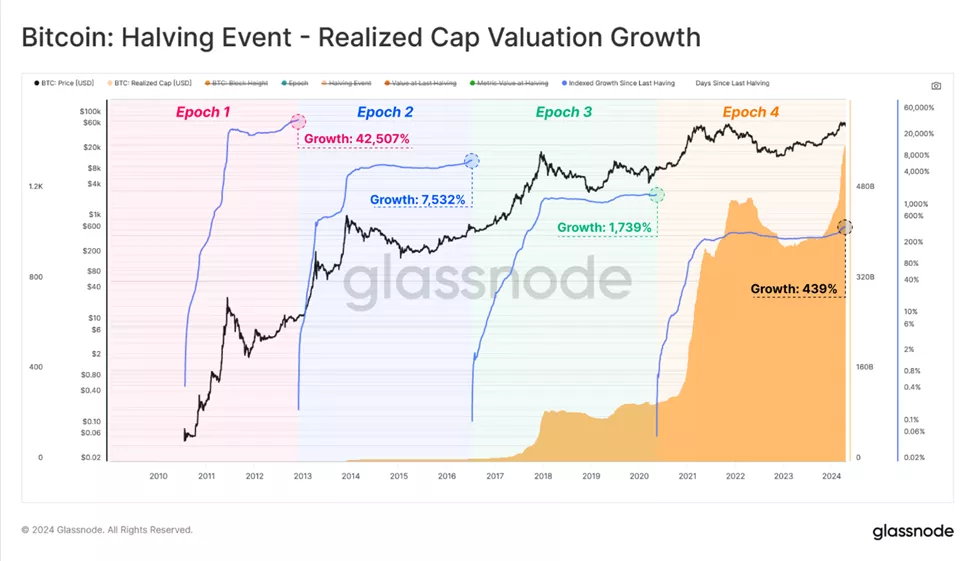

The realized capitalization indicator points to an “accumulation” totaling $560 billion. Over the last epoch, the metric grew by 439%, confirming the asset’s market value at $1.4 million. Capital continues to flow into Bitcoin despite “volatility, bad headlines, and cyclical drawdowns.”

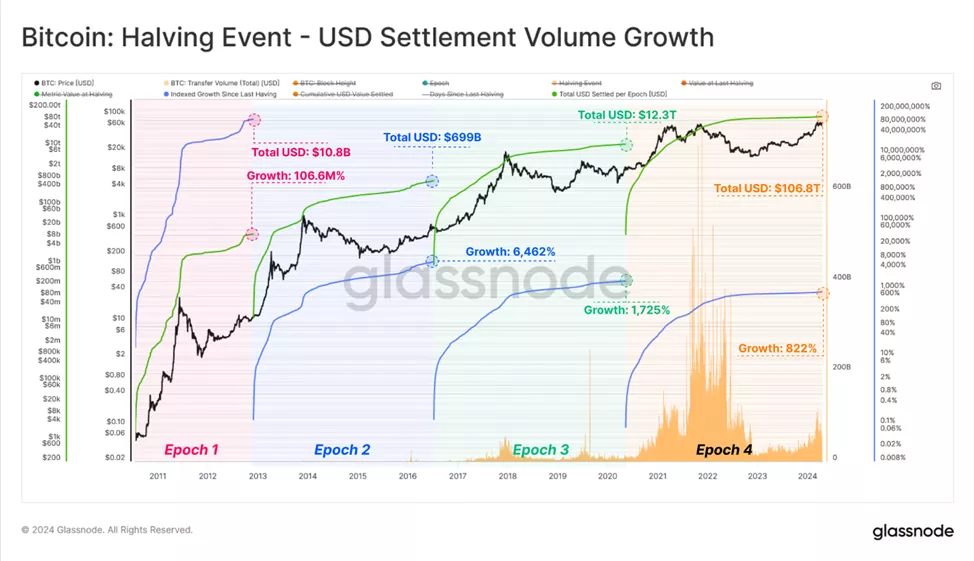

The total on-chain value transferred during the fourth epoch surged by 822% to $106.8 trillion. The figure is not adjusted for transactions related to internal wallet management.

Earlier, QCP promised that the post-halving effect would manifest at least two months later.

Back in April, to mark the event, the ForkLog team held the online forum AllTimeHalf 2024 with developers, entrepreneurs, enthusiasts, and visionaries. Recordings are available on the YouTube channel.

We also suggest exploring halving-related research by CoinGecko and Binance.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!