Bitcoin ETF Interest Wanes, Fueling Crypto Fund Outflows

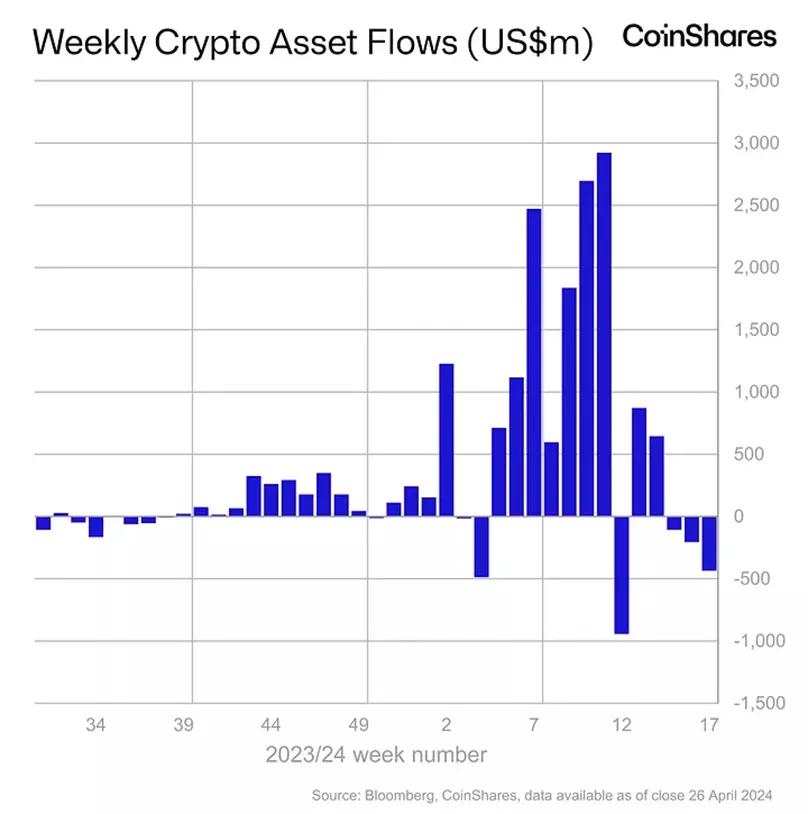

Outflows from cryptocurrency investment products amounted to $435 million from April 20 to 26. This negative trend continued for the third consecutive week, according to CoinShares.

While withdrawals from Grayscale’s GBTC are slowing down [a nine-week low of $440 million], we observe a weakening in inflows to “new” ETFs — inflows amounted to only $126 million [compared to $254 million previously],” experts commented.

Trading volumes for these products decreased from $18 billion to $11.8 billion amid a 6% drop in the price of the leading cryptocurrency.

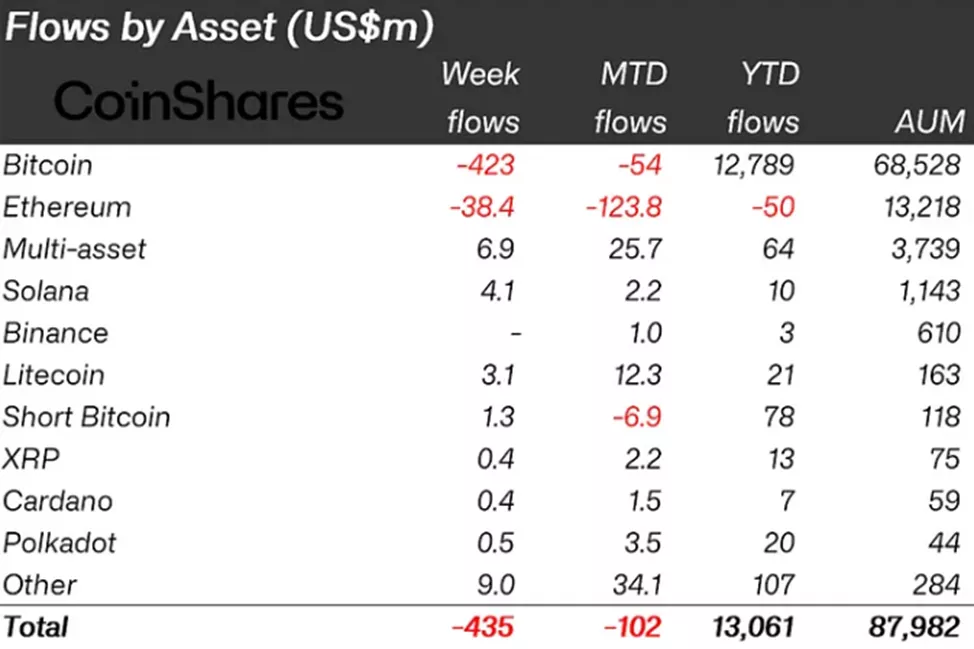

Overall, clients withdrew $423 million from bitcoin-related instruments, compared to $192 million in the previous reporting period. Investors allocated $1.3 million ($1.7 million) to structures allowing short positions on the leading cryptocurrency.

Outflows from Ethereum funds increased from $34.2 million to $38.4 million, marking the seventh consecutive week of negative dynamics.

Demand prevailed in other altcoins. Asset-based products attracted $6.9 million, with Solana ($4.1 million), Litecoin ($3.1 million), and Chainlink ($2.8 million) emerging as favorites.

Earlier, experts at Santiment pointed to signs of a potential altseason.

Analyst PlanB had forecasted the start of a trend in the summer, followed by a correction in the third quarter.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!