Record $564 Million Outflow from Bitcoin Spot ETFs in a Single Day

On May 1, the outflow from spot Bitcoin ETFs reached a record high since the approval of these products, amounting to $563.8 million. BlackRock’s IBIT recorded its first negative performance, with an outflow of $36.93 million.

According to SoSoValue, yesterday’s Bitcoin spot ETF had a total net outflow of $564 million, a record high. Grayscale GBTC had a single-day outflow of $167 million, and BlackRock ETF IBIT had its first net outflow, with $36.93 million. The Fidelity ETF FBTC had the largest… pic.twitter.com/jFaWU7q5de

— Wu Blockchain (@WuBlockchain) May 2, 2024

Clients withdrew $191.1 million from Fidelity’s FBTC, surpassing the $167.3 million outflow from Grayscale’s GBTC.

Ark Invest’s ARKB saw an outflow of $98.1 million, marking the third-largest in its history.

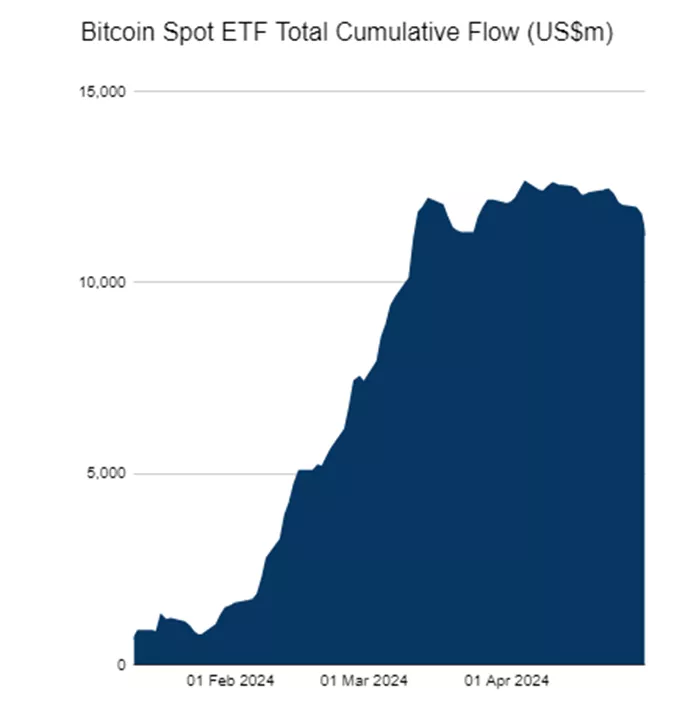

The total inflow into these products since their inception has decreased to $11.2 billion. By the end of April, this figure had fallen by $343.5 million.

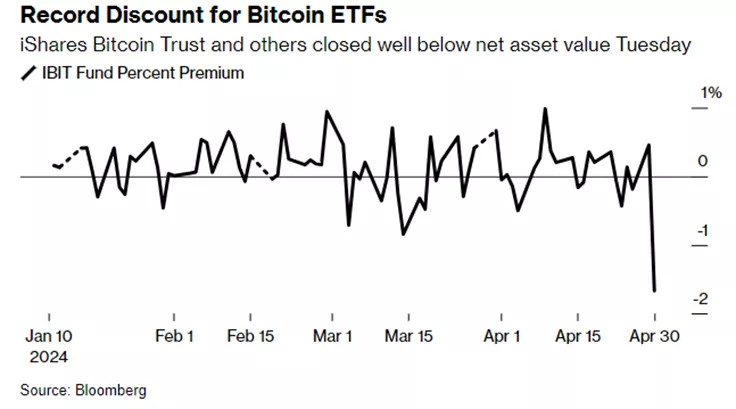

Bloomberg noted the emergence of price discounts on IBIT and FBTC relative to their NAV. The discount reached 1.7% for the former and 1.1% for the latter.

CIO of Bitwise, Matt Hougan, stated that this phenomenon is “more of an accounting quirk than a real issue” due to the specific method of calculating Bitcoin’s value in ETFs.

Exchange-traded funds calculate net asset value using an hourly time-weighted average price of the leading cryptocurrency, which can lead to discrepancies during significant price fluctuations.

Analysts at Standard Chartered have warned that after the digital gold’s price fell below $58,000, there is a risk of liquidations, as more than half of the positions in exchange-traded funds are at a “paper” loss.

Previously, Bernstein described the slowdown in inflows into Bitcoin-based exchange-traded funds as temporary.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!