Glassnode Analyzes Bitcoin and Ethereum Divergence Post-Halving

The relatively poorer performance of Ethereum compared to Bitcoin following the halving is attributed to capital rotation, according to a new review by Glassnode.

After the fourth historical reduction of miner rewards by half, the price of digital gold experienced an 11% correction, the deepest since the FTX collapse, dropping to a two-month low of $57,000. This was followed by a swift recovery, a pattern generally consistent with past post-halving behavior.

Overall, 60-day periods following miner reward halvings tend to exhibit volatile sideways movement with slight declines ranging from -5% to -15%.

Ethereum followed Bitcoin and also returned to positive territory.

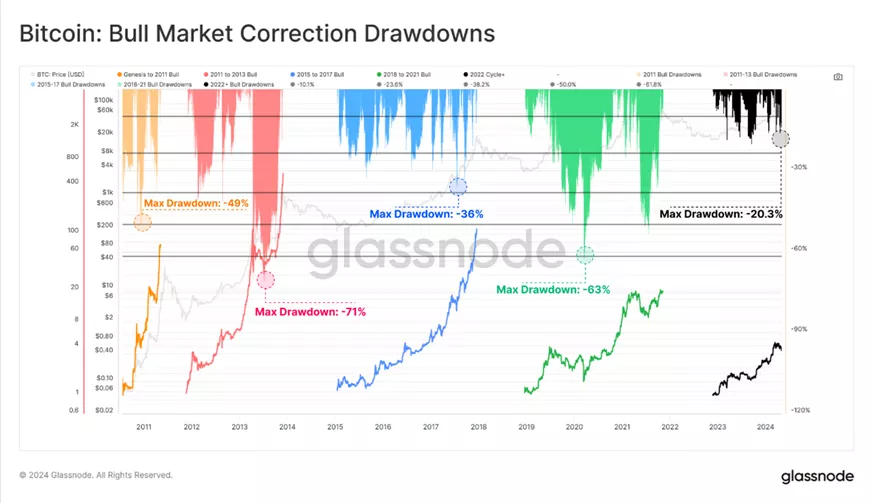

From the $73,000 level (ATH), Bitcoin’s pullback reached 20.3% — the largest since the FTX collapse in November 2022. Meanwhile, the current upward macro trend remains one of the most resilient in history, with its corrections being relatively shallow, experts noted.

Analysts pointed to a high similarity in the structure of declines between the current market and the bull market of 2015–17 (marked in blue). As an explanation for the resemblance to this period, characterized by the absence of derivatives, experts cited a significant reduction in leverage from the 2020–22 cycle and the launch of ETFs in the US.

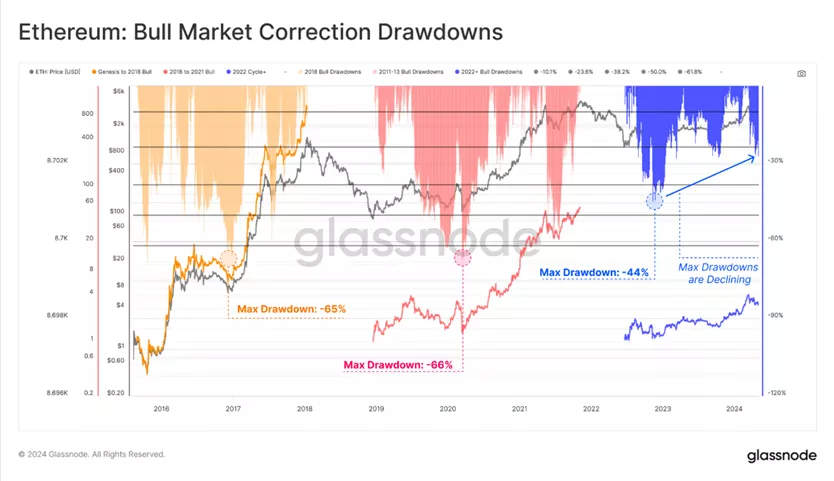

For Ethereum, similar comparisons are valid, but with noticeably smaller corrections following the FTX collapse.

Experts highlighted that Ethereum’s largest drawdown for the entire cycle was 44%, whereas Bitcoin’s was 21%. This underscores the relatively insufficient performance of the second-largest cryptocurrency by market capitalization over the past two years, which is also reflected in the ETH/BTC dynamics, they added.

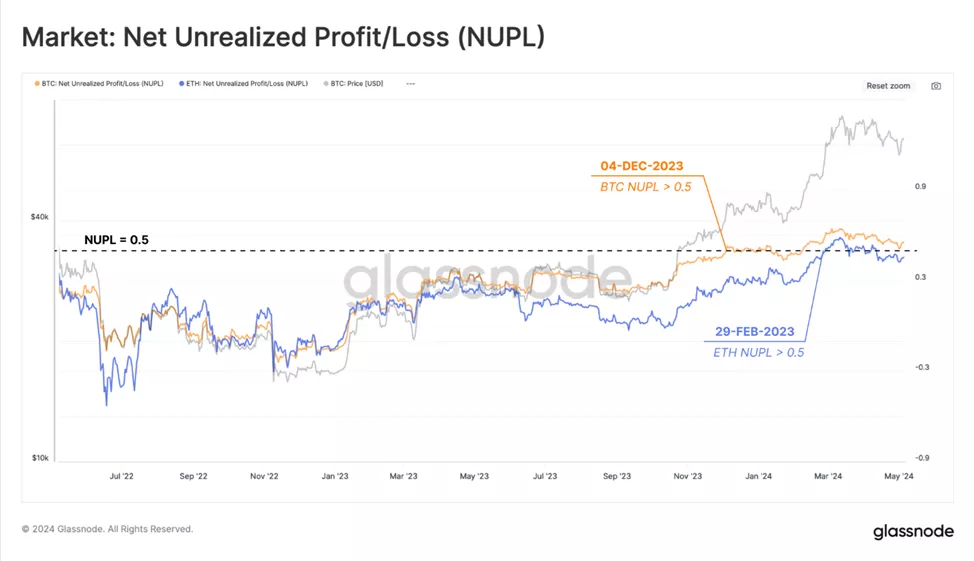

In the next stage, Glassnode compared the two assets in the context of the NUPL metric, which relates market participants’ profitability to the average on-chain cost of the asset.

Amid the excitement and rally associated with the approval of spot Bitcoin ETFs, the unrealized profit of digital gold holders grew significantly faster than that of investors in the second-largest cryptocurrency. As a result, Bitcoin’s NUPL crossed the threshold of 0.5, entering the euphoria phase three months earlier than Ethereum’s indicator.

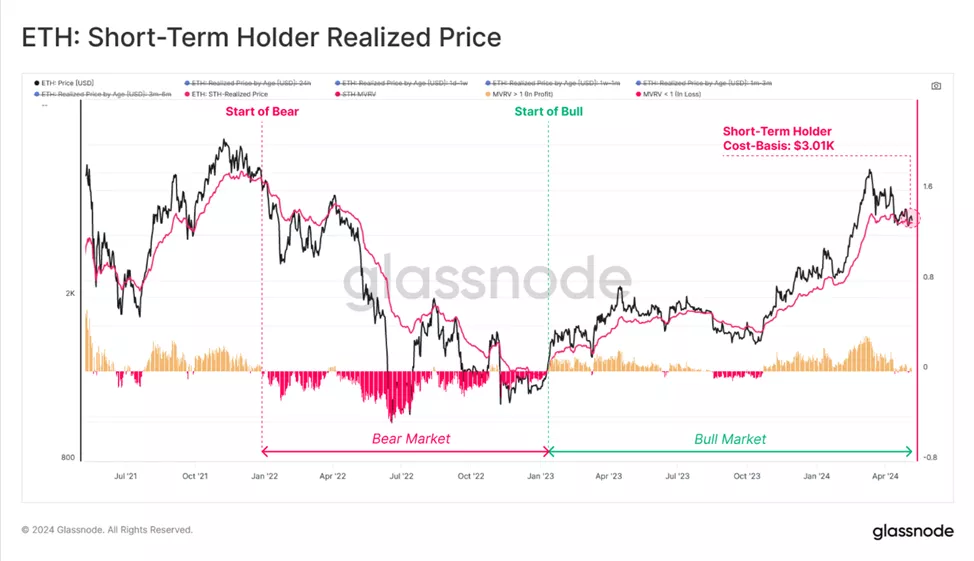

At the time of writing, the “cost” of Ethereum for speculators slightly exceeds $3,000, which is close to the current price. This indicates the risk of panic selling in the event of increased volatility. In Bitcoin, the premium is higher, with the average acquisition level for short-term investors at $59,800.

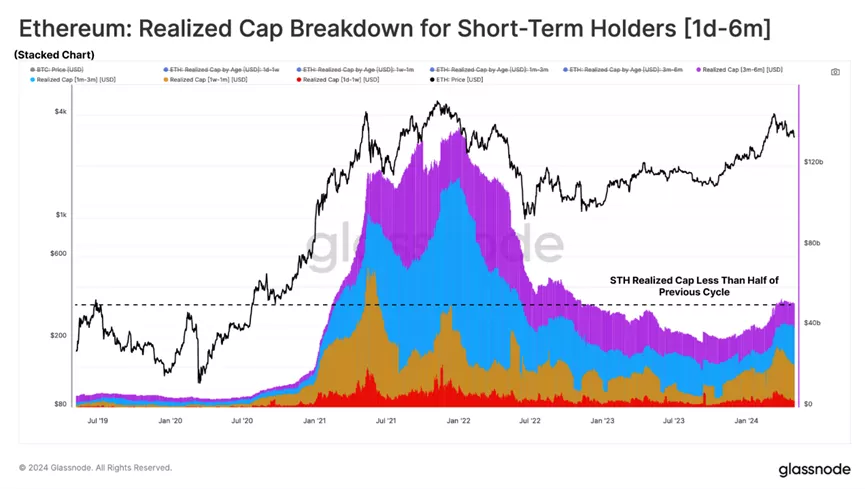

The realized capitalization metric shows an insufficient influx of fresh capital into the second-largest cryptocurrency. While the on-chain “wealth” transferred by Bitcoin speculators in dollar terms approached ATH, in Ethereum it barely rose from the lows.

According to analysts, this largely explains the asset’s “lagging” performance. They attributed this to the shift in focus to ETFs, while similar products based on the second-largest cryptocurrency await the final decision from the SEC in May.

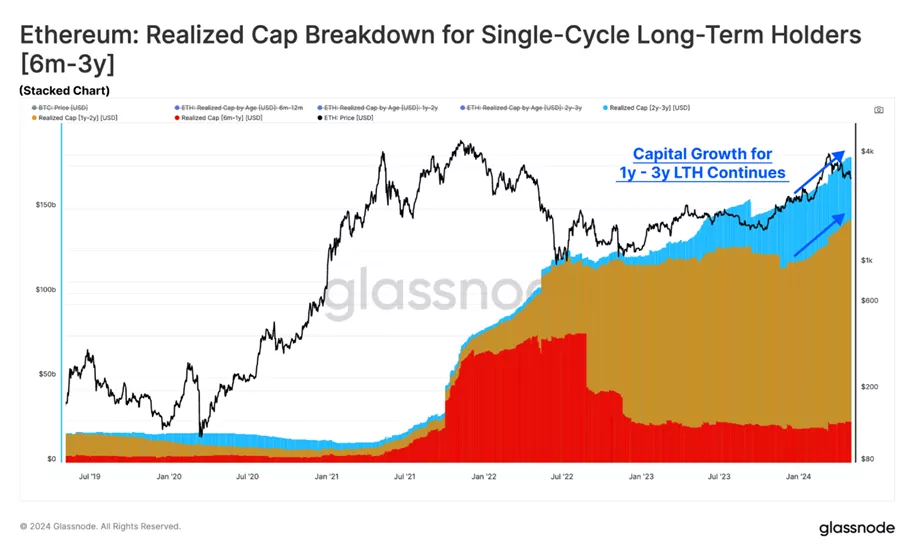

Divergence is also observed in the behavior of long-term holders. In Bitcoin, hodlers, especially those holding coins “aged” two to three years, took advantage of the rally on expectations and the launch of ETFs to lock in profits, whereas in Ethereum, they have to “patiently wait for price increases.”

Back in Standard Chartered, it was stated that Bitcoin formed a local bottom at $56,500 following the decision by the Fed and positive signals in the US employment report. Previously, the bank’s experts joined the camp of skeptics doubting the approval of spot ETH ETFs in May.

Earlier, ForkLog reported that Ethereum options traders’ expectations became less optimistic, while in Bitcoin contracts, bets on a rise to $100,000 increased.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!