Renewed Interest in Crypto Funds After Four Weeks of Outflows

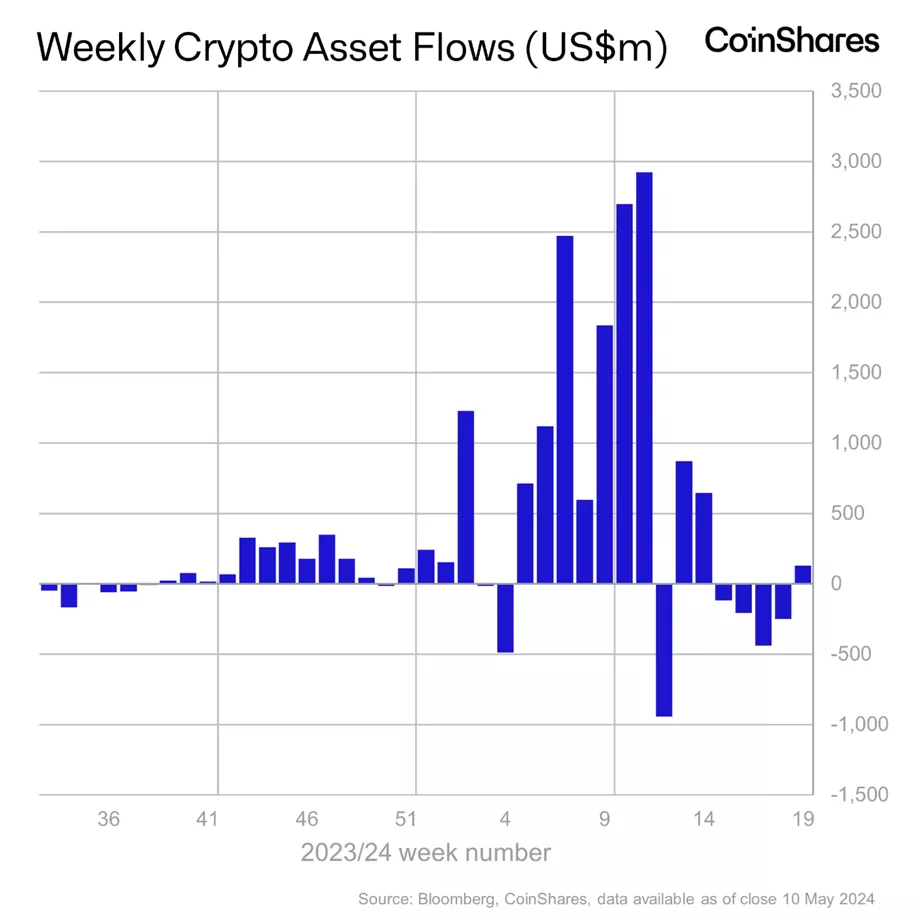

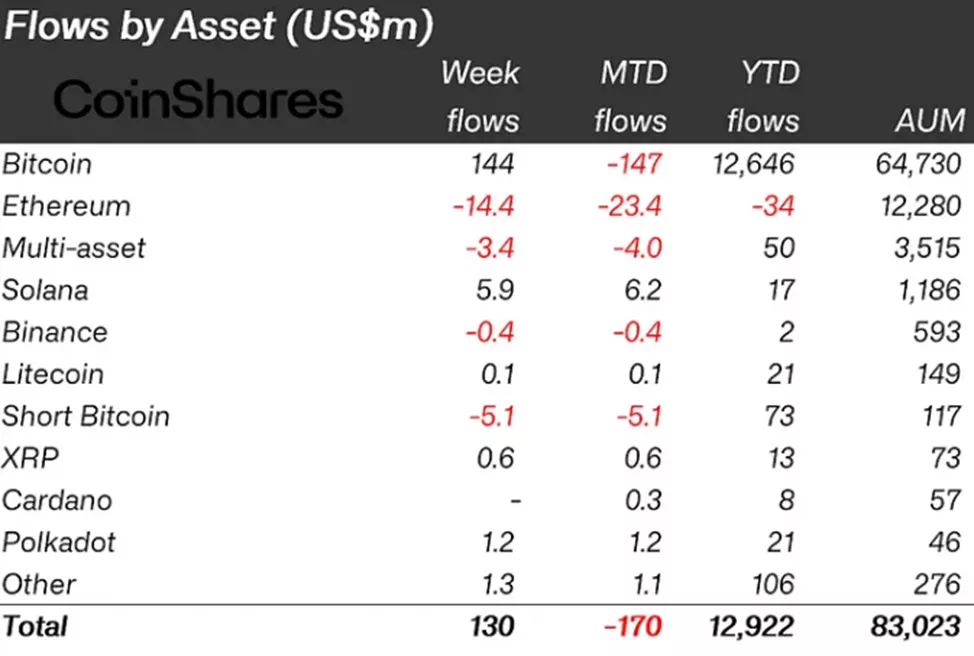

Inflows into cryptocurrency investment products amounted to $130 million from May 4 to May 10, according to calculations by CoinShares.

Trading volumes for ETP fell from an April average of $17 billion to $8 billion.

The share of crypto products in the total turnover of digital assets on reputable platforms dropped from 31% to 22%.

Clients directed $144 million into bitcoin-related instruments, compared to an outflow of $251 million in the previous reporting period.

One of the drivers was the reduction in withdrawals from GBTC and other Grayscale products to $171 million — the lowest since January.

Investors withdrew $5.1 million from structures allowing short positions on the leading cryptocurrency.

In Ethereum funds, after a week-long pause (+$30 million), outflows resumed ($14 million). Analysts attributed the negative trend to growing doubts about the approval of an ETH-ETF amid inactive interaction between the regulator and issuers.

Among other altcoins, notable inflows were seen in Solana-based instruments ($5.9 million) and Polkadot ($1.2 million), while there was an outflow of $3.4 million from products based on a basket of assets.

Experts at Bitfinex have forecasted a sideways trend for bitcoin in May and further growth of the asset.

Earlier, Standard Chartered stated that the leading cryptocurrency has already formed a low at $56,500, confirming a target of $150,000 by the end of the year and $200,000 by the end of 2025.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!