Weekly Highlights: Ethereum Classic Halving and Notcoin’s Resurgence

The fourth halving of Ethereum Classic has occurred, Notcoin surged by 300% over the week and reached a new all-time high, a former FTX executive was sentenced to 7.5 years in prison, among other events of the past week.

Bitcoin Price Returns to $68,000

The leading cryptocurrency began the week at $68,000. On Monday, May 27, digital gold tested the $70,000 mark but failed to hold and plummeted.

On Tuesday, May 28, Bitcoin fell below $68,000, and on Thursday, May 30, it recovered above $69,000. The following day, the leading cryptocurrency entered a correction.

At the time of writing, Bitcoin is trading at $68,100.

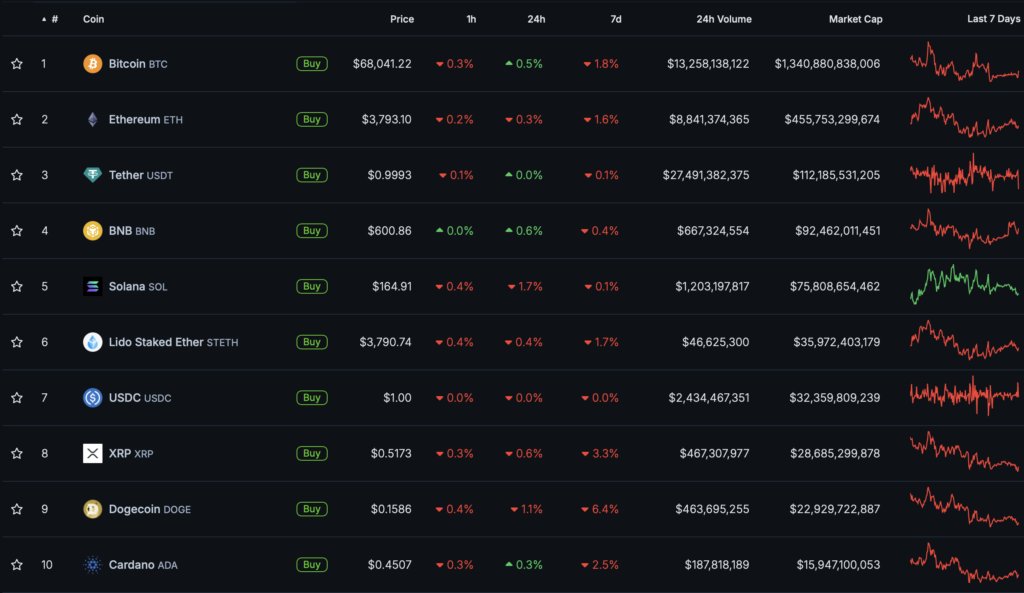

All digital assets in the top 10 by market capitalization ended the week in the “red zone.” Dogecoin (-6.4%) and XRP (-3.3%) lost the most.

The total cryptocurrency market capitalization is $2.68 trillion. Bitcoin’s dominance index is 54.2%.

Ethereum Classic Undergoes Fourth Halving

On May 31, at block height #20,000,001, Ethereum Classic underwent a halving. The reward for a mined block was reduced to 2.048 ETC.

This programmed event occurs approximately every two years, reducing the reward by 20% to achieve a total emission of 210.7 million ETC. This marks the fourth halving on the blockchain since 2017.

The coin’s price did not show significant movement. After the halving, ETC lost about 1%. Over the past week, the cryptocurrency fell by 7.4%, according to CoinGecko.

Notcoin Surges 300% in a Week, Reaches New ATH

On Sunday, June 2, Notcoin (NOT) prices reached a new all-time high above $0.021. Over the past week, the gaming token increased by 317%, according to CoinGecko.

On May 16, NOT was listed on major cryptocurrency exchanges. After trading commenced, the token’s price reached $0.012 and began to decline. On May 28, NOT recovered to $0.009, and on May 30, it returned to $0.012.

What to Discuss with Friends?

- The creator of meme tokens in Caitlyn Jenner’s name earned $405,000.

- The first Neuralink patient shared life after surgery.

- Aptos processed over 115 million transactions in a new cat clicker game in a single day.

- A trader achieved a 762-fold profit on a meme coin.

Former FTX Executive Sentenced to 7.5 Years in Prison

The Southern District of New York sentenced former CEO of FTX’s Bahamian division, Ryan Salame, to 90 months (7.5 years) in prison.

According to the U.S. Department of Justice, he also received three years of probation, must pay $6 million in forfeiture, and over $5 million in restitution.

Prosecutor Damian Williams emphasized that Salame’s actions undermined public trust in elections and the financial system.

“Salame agreed to promote the interests of FTX, Alameda Research, and his associates through an illegal campaign of political influence and unlicensed money transmission activities. These illegal actions helped FTX grow faster and become larger,” he stated.

In September 2023, Salame pleaded guilty to criminal charges related to the collapse of the cryptocurrency exchange. The charges involved conspiracy to make illegal donations and operate an unlicensed money transmission business.

Earlier, lawyers requested a 1.5-year prison sentence for the defendant, but the prosecution demanded a harsher sentence.

Joe Biden Vetoes Resolution to Repeal SEC’s SAB 121

U.S. President Joe Biden vetoed a resolution to annul the Securities and Exchange Commission’s (SEC) Staff Accounting Bulletin 121 (SAB 121).

“SAB 121 reflects the SEC staff’s considered view on the accounting obligations of certain firms safeguarding crypto assets. […] This Republican-led resolution would unjustifiably limit the SEC’s ability to establish appropriate protections and address future challenges,” the statement read.

In a letter, Biden noted that his administration “will not support measures that jeopardize the well-being of consumers and investors.”

Hours before the president’s decision, lobbying groups representing major banks, as well as Senator Cynthia Lummis, Congressmen Patrick McHenry, Tom Emmer, and others, sent letters urging not to veto the resolution.

SAB 121 was issued in April 2022. The document contains recommendations for storing cryptocurrencies. In particular, banks must reflect them on their balance sheets. This makes the process costly and limits the ability of institutions to provide custodial services on a large scale.

Also on ForkLog:

- Traders reaped hundredfold gains from trading the meme coin MAGA Hat.

- A Canadian researcher profiled the average Bitcoin investor.

- An investor earned $1.2 million from Shiba Inu over three years.

- A trader earned $1.7 million in four days on the PEW token.

CryptoQuant Predicts Continued Bitcoin Bull Rally

Indicators suggest that the bull market phase is not yet over, noted specialists from CryptoQuant.

“During past rallies, the MVRV reached peaks of 4.83 and 3.97, and it has currently only reached 2.78. It has not yet entered the overvaluation zone, and further growth can be expected,” wrote on-chain analyst Crypto Dan.

Head of Research at CryptoQuant Julio Moreno pointed to the low unrealized profit of Bitcoin investors, which stands at 3% compared to 69% in March. For this reason, he ruled out significant pressure on the price from sellers.

What Else to Read?

This week, ForkLog explained how Telegram became the go-to venue for crypto scams.

In the traditional digest, we compiled the main events of the week in the field of cybersecurity.

The cryptocurrency industry is attracting an increasing number of institutional players. This is evidenced by new infrastructure investments and the growing attention companies are paying to Bitcoin as an asset class. The most important events of recent weeks are in ForkLog’s review.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!