Bitcoin Spot ETFs See Inflows for 15 Consecutive Days

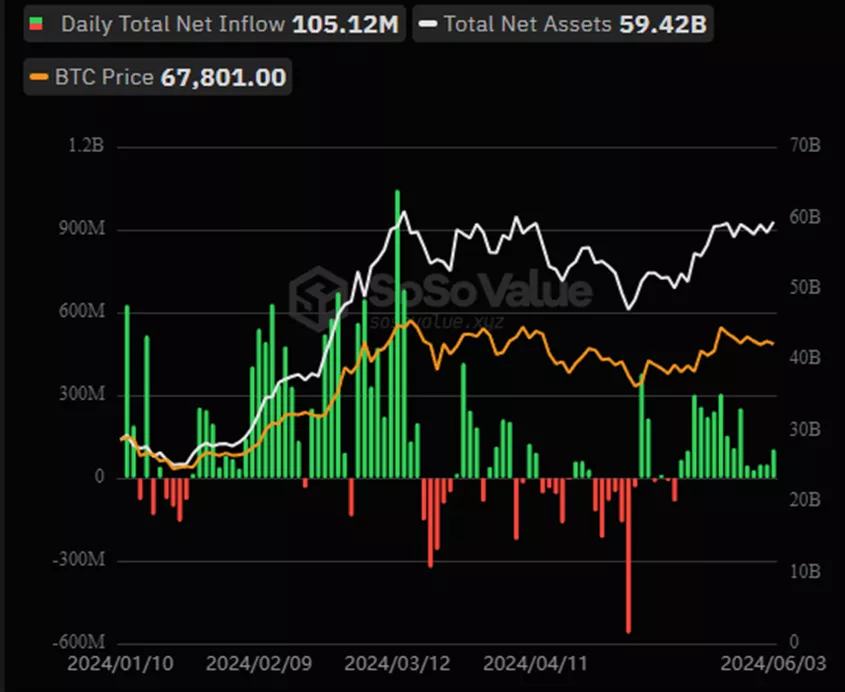

On June 3, inflows into 11 approved spot Bitcoin ETFs amounted to $105.1 million. This positive trend has continued for 15 consecutive days, according to SoSoValue.

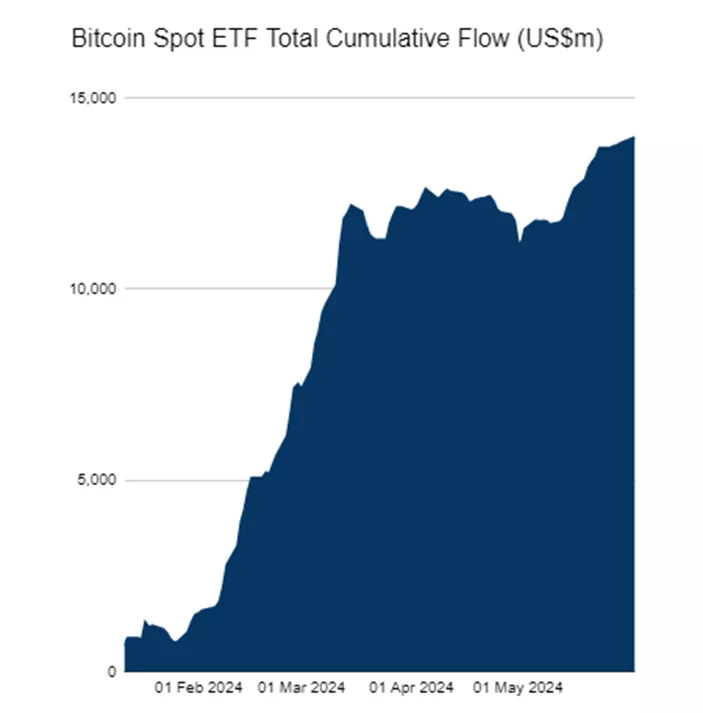

During this period, the segment attracted $2.28 billion. Since the registration of these products, the total has reached $13.96 billion.

A longer trend of 17 trading days was observed only once before, in January, following the launch of ETF trading.

The pace of inflows has significantly slowed compared to the peak levels in March.

According to BitcoinTreasuries, the total volume of Bitcoin products held by issuers has reached 1,035,233 BTC ($71.4 billion), equivalent to 4.93% of the digital gold’s supply. Specifically, BlackRock’s IBIT holds 291,563 BTC (1.39%), while GBTC holds 286,957 BTC (1.37%). The gap between them has widened.

On June 3, Fidelity’s FBTC led in terms of dynamics with $77 million. It was followed by Bitwise’s BITB ($14 million) and Ark Invest and 21Shares’ ARKB ($11 million).

IBIT and GBTC, which hold the first and second places in AUM, did not record any inflows.

In May, investors directed $2 billion into crypto products, according to CoinShares.

Bernstein analysts have forecasted inflows into digital asset-based ETFs to reach $100 billion over the next 18–24 months.

Earlier, Matrixport co-founder Daniel Yan suggested that Solana could be the next candidate for an ETF launch after Ethereum.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!