Federal Reserve Holds Key Rate Steady as Bitcoin Dips Below $69,000

On June 12, the U.S. Federal Reserve maintained its key interest rate range at 5.25–5.5% per annum.

The decision aligned with market expectations.

On the same day, the U.S. Bureau of Labor Statistics released its consumer price report. The index value was below the forecast—3.3% compared to 3.4%.

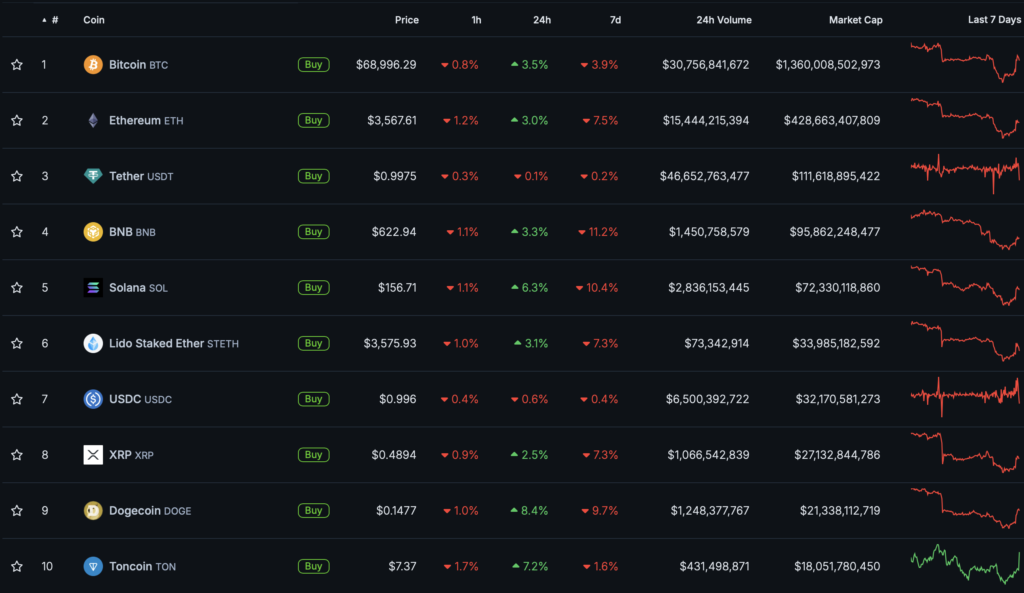

The cryptocurrency market reacted negatively to the decision. Bitcoin tested levels below $69,000. At the time of writing, the leading cryptocurrency is trading at $69,200.

In the last hour, most digital assets in the top 10 by market capitalization showed slight negative dynamics. According to CoinGecko, Toncoin (-1.7%) and Ethereum (-1.2%) lost the most.

On June 10, a record series of inflows into spot Bitcoin ETFs, which lasted for 19 days, came to an end. Investors withdrew $64.9 million from exchange-traded funds based on the leading cryptocurrency in a single day.

Back in July 2023, the Federal Reserve raised the key rate to 5.25-5.5% per annum. Since then, the rate has remained unchanged. This marks the seventh consecutive decision to hold the rate steady.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!