Investors Withdraw $621 Million from Bitcoin Products Following Federal Reserve Shock

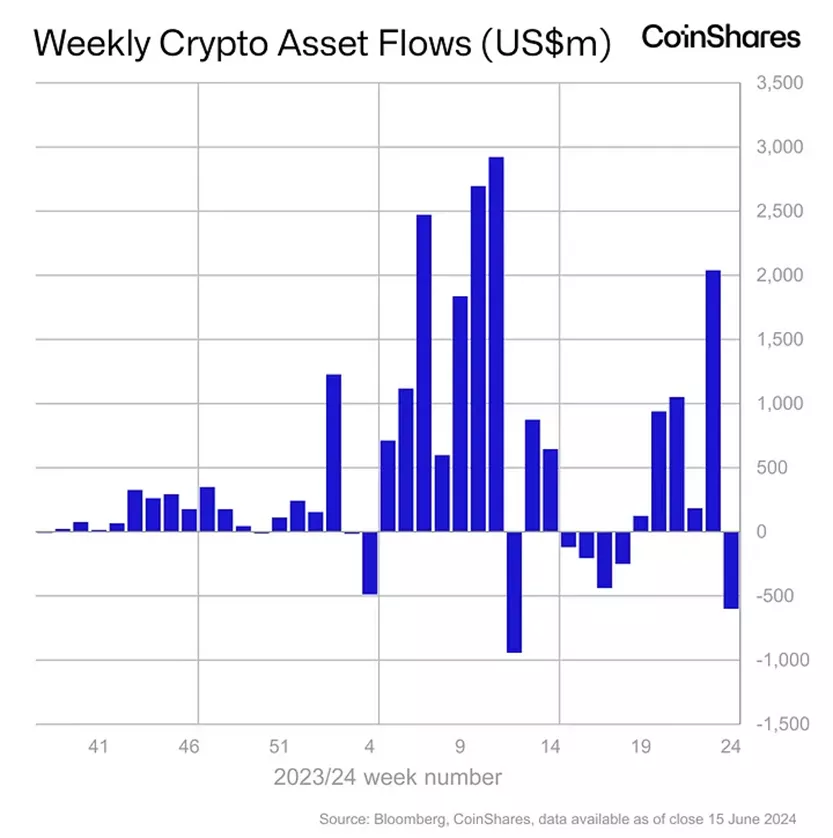

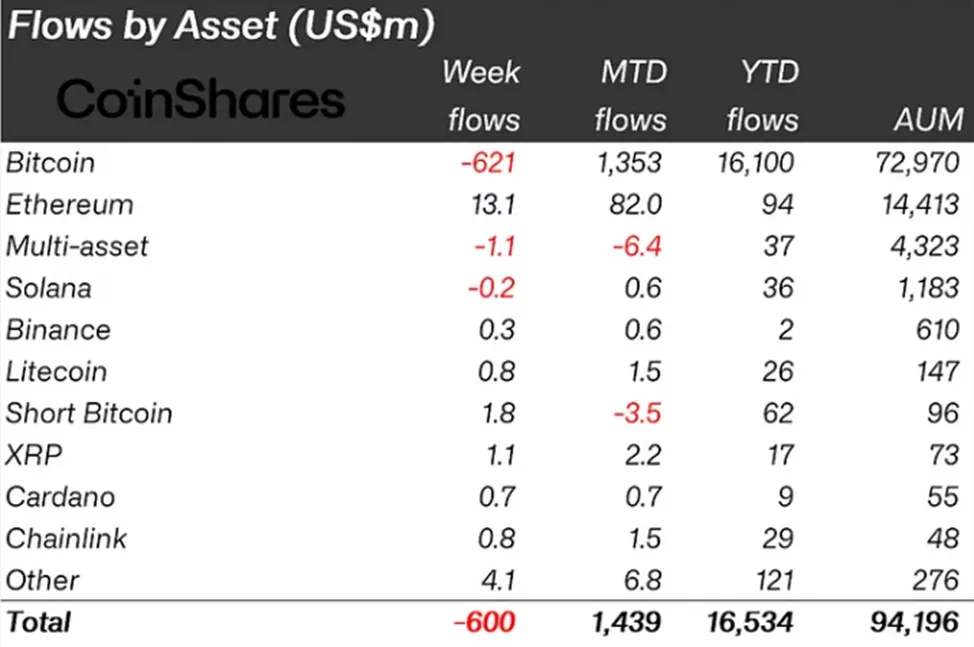

The outflow from cryptocurrency investment products between June 8 and June 14 amounted to $600 million, including $621 million from bitcoin-based products, according to calculations by CoinShares.

These figures were the highest since March 2024, equivalent to a third of the inflows from the previous week.

The total volume of assets under management fell to $94.2 billion.

The trading volume of ETP decreased from $12.8 billion to $11 billion.

Analysts attributed the change in sentiment to the publication of Federal Reserve forecasts on the key rate, which did not meet expectations.

Clients withdrew $621 million from bitcoin-related instruments, whereas in the previous reporting period, they had invested $1.97 billion.

Investors added $1.5 million to structures that allow shorting digital gold, after previously withdrawing $5.3 million.

Inflows were observed in a range of altcoins, primarily in Ethereum, LIDO, and XRP, with the latter two recording inflows of $2 million and $1 million, respectively.

Funds based on the second-largest cryptocurrency by market capitalization continued to show positive dynamics for the fourth consecutive week, although the pace slowed from a March high of $68.9 million to $13.1 million.

Previously, experts cited the approval of 19b-4 applications for ETH–ETF issuers by the SEC as a driver. Trading will commence once the agency signs the registration statements on Form S-1.

Previously, Bloomberg analyst Eric Balchunas reported the postponement of the product launch date to July 2 after issuers received comments on Form S-1.

Earlier, Arthur Hayes and Raoul Pal speculated on the emergence of exchange-traded funds based on Dogecoin.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!