DYOR: What it is and why it matters to crypto investors

The cryptocurrency market is a world of uncertainty. Even seasoned investors are sometimes wrong-footed by abrupt price swings and sudden turns of events.

An industry with a high project “mortality” rate, it demands not just intuition but a grasp of the fundamental principles of token valuation.

- Fundamental analysis is the assessment of an asset to determine its investment potential.

- Before putting money into another ambitious project, it is vital to conduct thorough research yourself to limit risks.

- Investors should take a holistic approach, weighing tokenomics, roadmap, audits, the quality of project documentation, and more.

Consistent unpredictability

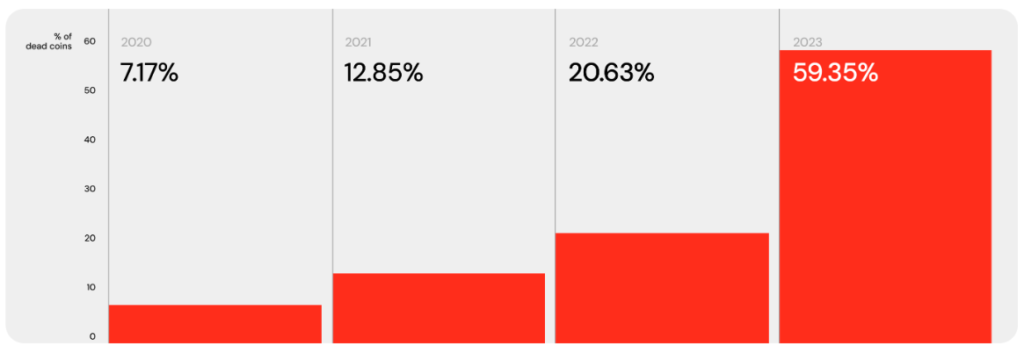

The crypto market is capricious—often surprising even battle-hardened investors. Another hallmark is a high death rate. In 2023 alone, developers abandoned 59.35% of tokens tracked on CoinMarketCap.

Before wiring funds into the next supposed Bitcoin or Ethereum “killer”, reduce uncertainty: dig deeper and do DYOR on the project. Whether you are a veteran or a newcomer, understanding the basics of assessing token viability helps avoid many pitfalls.

Fundamental analysis (FA) is not merely importing terms from traditional finance. Unlike equities, where FA focuses on a firm’s financials, digital assets work differently. Tokenomics, the team, utility, and the depth and activity of the community matter most.

Traditional FA relies on economic conditions, quarterly and annual reports, and other public information that can affect an asset’s future value.

Whereas companies can issue new shares in later funding rounds after board approval, the decentralised nature of cryptocurrencies implies a different approach. Communities typically vote on changes to tokenomics and supply—say, raising the maximum number of coins.

In traditional markets, shares and bonds are issued by firms under the eye of securities regulators. By contrast, crypto tokens can be distributed via airdrops, farming or staking programmes, and on-chain activities such as mining.

Financial metrics

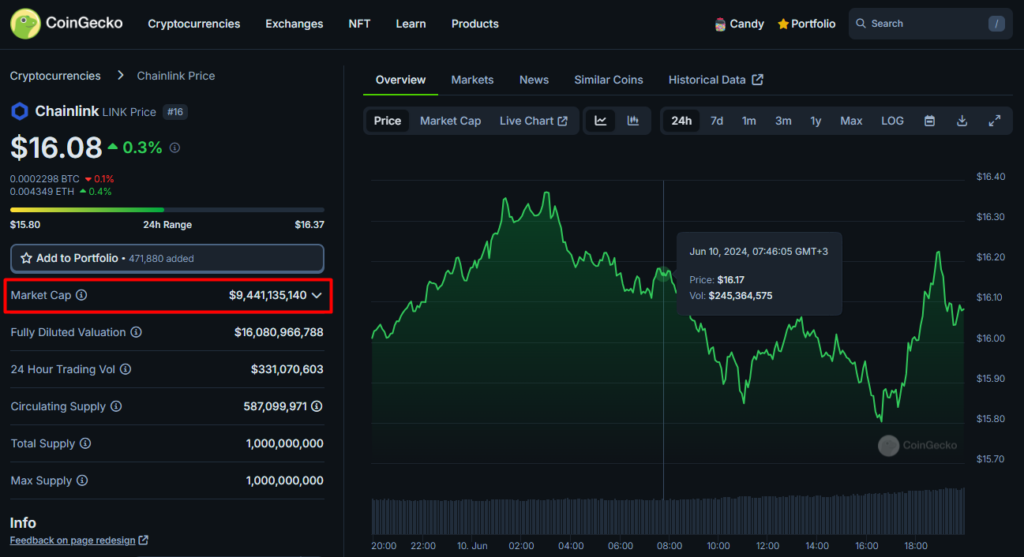

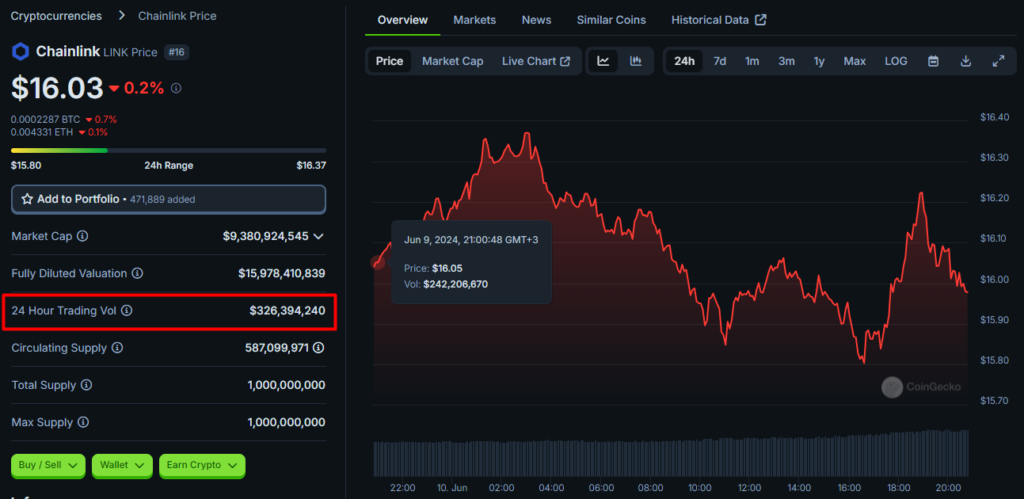

A project’s financials include trading activity, liquidity and supply distribution mechanisms. Platforms such as CoinGecko offer a wide range of current metrics.

Market capitalisation and FDV

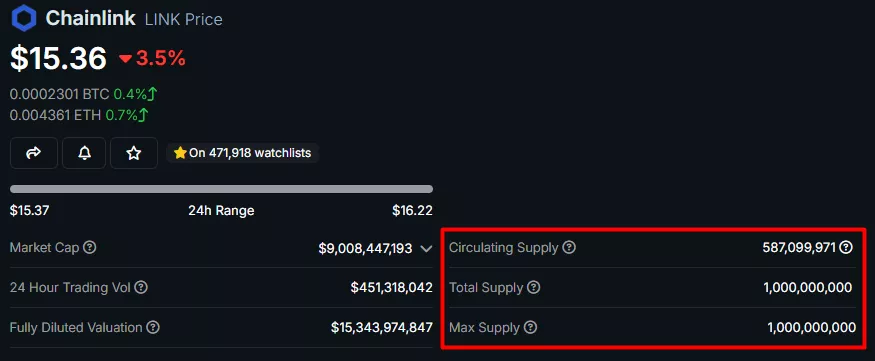

Market capitalisation (Market Cap, MC) shows the total market value of a cryptoasset at a given moment. It is calculated by multiplying the current token price by the circulating supply.

CoinGecko also shows FDV for various tokens. Fully diluted valuation is a statistical representation of a project’s maximum value assuming all tokens are in circulation.

Comparing projects within the same or adjacent segments by these parameters—particularly the MC/FDV ratio—helps gauge fair value and the potential overhang from future issuance.

Trading volume and liquidity

Trading volume reflects the total value of purchases and sales over a set period. Beyond the aggregate 24-hour figure, you can review 24-hour volumes of specific trading pairs on individual exchanges listed on CoinGecko.

Consistently high volume suggests strong interest. Many investors view this as evidence of sufficient demand and liquidity—the ease of buying or selling without large price moves.

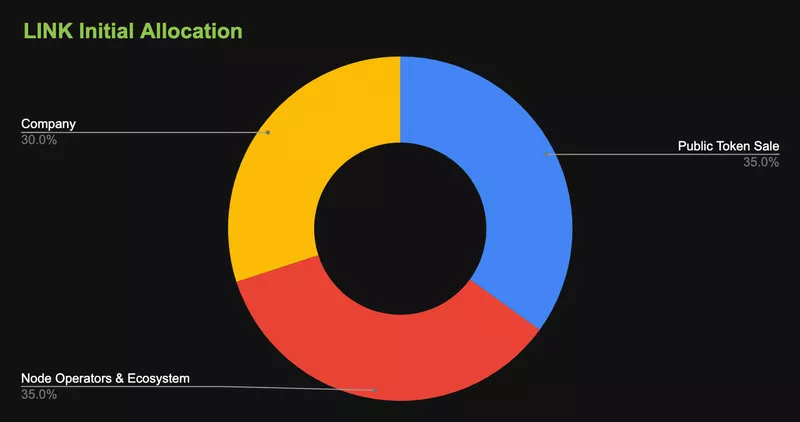

Tokenomics

Tokenomics is the economics of tokens: the rules and mechanisms that govern creation, distribution, governance and use. It matters because it influences price, liquidity and a project’s long‑term resilience.

Main aspects of tokenomics:

- supply: the total number of coins to be issued and how they will be distributed (eg through a token sale, mining, airdrops);

- demand: factors that affect demand for tokens, such as utility in the ecosystem, scarcity, marketing and overall interest in the project;

- burn mechanisms: processes that reduce the circulating supply, potentially lifting the token price;

- rewards and incentives: how network participants (miners, validators, users) are compensated for contributing to the network;

- governance: how decisions about development and tokenomics changes are made (eg via DAO votes).

For many cryptoassets CoinGecko offers a dedicated section:

The pace of new issuance directly affects prices. If demand lags supply, token prices can sink. Studying tokenomics is therefore a must for anyone pursuing prudent investment decisions.

“Given that tokens are the lifeblood of a crypto project, it is hard to overestimate how important it is to have adequate and truthful data on what is available to buy on the secondary market, what is locked, and how many tokens have been burned.

Investors must also have a clear understanding of when a large number of tokens will unlock and be ready to come onto the market,” — stressed experts at Hacken.

In their view, investors would do well to answer the following questions:

- is the token’s supply capped?

- is the cryptoasset inflationary, deflationary or disinflationary?

- how many tokens have already been issued, and how does this compare with the maximum supply?

- how many coins are locked in vesting contracts?

- how many “dormant” tokens sit in the wallets of project participants?

Exchange presence

When researching fundamentals, consider where a token is listed. A listing on a big exchange signals confidence in the project, especially if the venue is a leader in its segment. Getting listed typically requires rigorous checks, including verification of the team and roadmap.

You can also consider tokens not yet listed on exchanges if they meet your criteria and risk appetite. Prices may jump on listing, though such moves are often short‑lived.

In that case, a good way to gauge potential is to combine on-chain metrics that reflect real blockchain usage and may signal rising popularity even before a listing.

On-chain metrics

On-chain metrics are data pulled directly from the blockchain. They offer insights into network health, user activity and overall market conditions.

Consider the main types.

Address metrics:

- active addresses: the number of unique addresses that sent or received transactions over a period. Rising activity may indicate growing adoption. High activity alongside a relatively low market cap can hint at undervaluation; the reverse may suggest overvaluation;

- new addresses: the number of addresses that appeared for the first time over a period, which may signal an influx of new users.

Transaction metrics:

- on-chain value transferred over a period. A high figure may indicate strong market activity. Large moves by “whale” addresses matter: big purchases may reflect lofty expectations; conversely, numerous large sales can be a sign that participants are exiting;

- number of transactions processed over a period. Growth may point to rising interest in the asset.

Mining metrics:

- hashrate: the computing power used to mine a Proof‑of‑Work cryptocurrency. A high hashrate signals a more secure network;

- difficulty: a network parameter showing how hard it is to find a new block and earn the reward. Rising difficulty may indicate growing competition among miners.

As more miners join, hashrate rises. Mining becomes harder, but the network becomes more secure and decentralised. Bitcoin’s price tends to rise as hashrate and mining difficulty increase.

Also consider the dynamics of transaction fees—the costs users pay to process on-chain activity. Rising fees can point to heavy usage and occasional congestion.

Some DeFi projects, including DEXs, charge fees for providing liquidity and other services. Some funnel these revenues into further development, turning them into a source of income. In such cases fees serve not only as a gauge of user activity but also as a financial indicator: the higher the fees, the more resources a project has for development, token buybacks or other initiatives.

On-chain metrics can help both traders and investors:

- traders use them to analyse short‑term trends, identify entry and exit points, and gauge sentiment;

- investors assess them to judge long‑term prospects, infer fundamental value and make considered decisions.

Plenty of platforms provide on-chain metrics across cryptocurrencies. Popular resources include:

Do not rely solely on on-chain metrics when making investment decisions. Always consider other factors such as news and broader market trends.

Project metrics

After analysing the metrics above, round out the picture with qualitative factors—future plans, competitive position, and so on.

White paper

A white paper is the official document that sets out a blockchain project in detail—a “map” of its core features, goals and technical specifics.

It is not just a marketing leaflet but a technical dossier that gives investors insight into the project’s inner workings, team, roadmap and economic model.

The white paper is a key tool for conducting due diligence.

Team, partnerships and communications

Before committing funds, know who is at the helm, which partners are involved, and how openly the team engages with the community.

Key contributors are the project’s brain and heart. Their track records—successes and failures alike—tell you a lot about risks. It is crucial to check whether anyone has been involved in scams or rug pulls.

Partnerships can catalyse growth, adding a dose of synergy. But assess partners’ reputations and backgrounds objectively. Distinguish genuine strategic partners from names “famous within a narrow circle” added to create a false impression of credibility.

Openness and honesty in community communications signal maturity and accountability. Teams that hide information or ignore their community are a red flag.

Project roadmap

The roadmap is an integral component of any serious crypto project: a structured plan that charts key development stages and strategic goals within specific timeframes.

Why the roadmap matters to investors

For long‑term investors, the roadmap is a vital analytical tool. It allows you to:

- assess potential: understand the scope and ambition of the team’s plans;

- forecast progress: identify milestones and expected outcomes that may affect the asset’s value;

- track execution: compare stated goals with actual achievements to judge the team’s effectiveness.

Key components of a roadmap:

- technical milestones: testnet launch, mainnet release, new features and protocols;

- business goals: raising capital, exchange listings, expanding the partner network;

- marketing activities: promotion campaigns, conference appearances and events;

- community development: growing the community, loyalty and incentive programmes.

A roadmap is not static. Market conditions, technological shifts and other factors may require adjustments. Regular updates signal flexibility, adaptability and a commitment to transparent engagement with the community.

Competitors

A rounded analysis of the competitive landscape helps you make a considered investment decision.

Perhaps the key question: “Which other startups use a similar technology?” Also find out:

- what are the project’s competitive advantages?

- does the technology outperform its peers?

- does the team have deeper experience?

- is its development plan clearer and more credible than competitors’?

If the project is at an early stage, it may face stiff competition from more mature, established and better‑funded players.

Conclusions

The crypto market is unpredictable and marked by a high project death rate. DYOR is therefore not just advice but a necessity to reduce risks and make informed decisions.

Fundamental analysis of cryptocurrencies is multifaceted: it spans financial metrics (market cap, FDV, volume, liquidity), tokenomics, on-chain indicators, the team, roadmap and the competitive landscape. A holistic grasp of these elements helps investors judge a project’s potential and make a reasoned allocation.

Crypto is dynamic and changeable. Constantly refreshing your knowledge—and doing DYOR—is the bedrock of successful investing.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!