IMF Highlights CBDC Benefits for Oil-Exporting Nations

CBDCs could enhance the efficiency of cross-border payments, a crucial priority for oil-producing nations in the Persian Gulf. This conclusion was reached by the International Monetary Fund.

According to the organisation’s experts, this primarily concerns exporters of black gold such as Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the UAE.

“This is due to international payments typically being associated with challenges such as differences in data formats and regional regulations, as well as complex compliance checks,” noted IMF specialists.

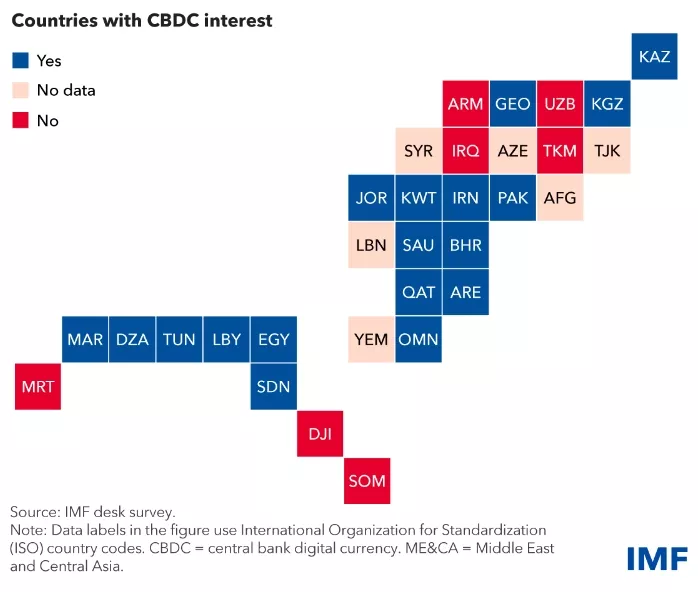

The study found that nearly two-thirds of countries in the Middle East and Central Asia are exploring the implementation of national digital currencies.

Of these 19 jurisdictions, Bahrain, Georgia, Saudi Arabia, and the UAE have advanced to the proof-of-concept stage. Kazakhstan is ahead, having already implemented a second pilot project for the digital tenge.

The IMF believes that CBDCs could also promote greater access to financial services and reduce costs by eliminating intermediaries and fostering competition. This would modernise payment platforms and enhance their efficiency.

Besides oil importers, countries in the Caucasus and Central Asia are also interested in these potential benefits of digital currencies, according to experts. However, they emphasised that the regions encompass diverse economies, each requiring consideration of unique characteristics.

“Our study shows that selecting the appropriate features for implementing CBDCs is a key task for regional policymakers. Achieving policy goals of promoting financial inclusion and payment system efficiency will depend on choosing the right design,” wrote IMF specialists.

Without addressing these factors and overcoming other obstacles such as insufficient digital and financial literacy, lack of identification, low wealth, and distrust of institutions, the launch of CBDCs will bring only “marginal benefits,” experts warned.

“Ultimately, the implementation of digital currencies will be a long and complex process, which central banks should approach with caution,” they concluded.

In April, IMF specialists discussed the potential benefits of CBDCs and stablecoins for Pacific island nations.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!