Arbitrum’s Revenue Surges 16,680% Following LayerZero’s ZRO Launch

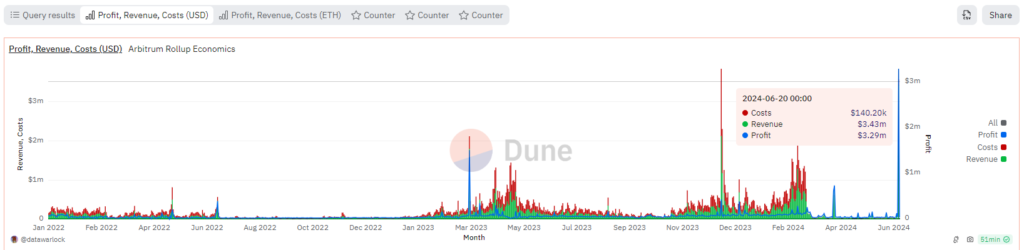

The launch of the ZRO token by the omnichain protocol LayerZero on June 20 triggered a surge in fees within the Arbitrum L2 network, propelling the blockchain’s daily revenue to a record $3.43 million.

Revenue exceeded the previous day’s figure by 16,680%.

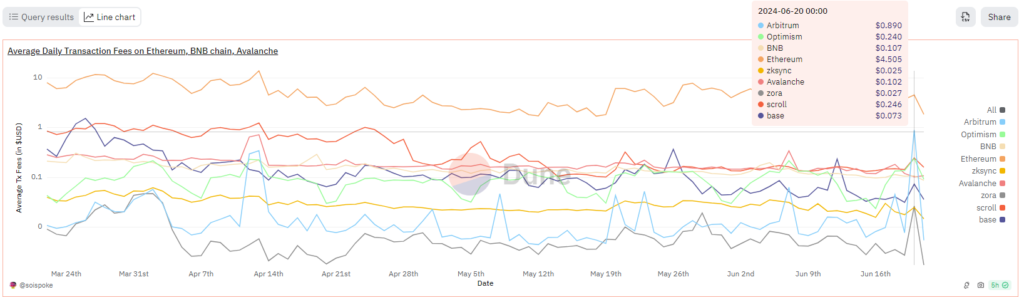

On June 20, the average network fee in Arbitrum spiked to $0.89. At the time of writing, it had returned to its usual level of around $0.005.

Upon launching ZRO, the LayerZero Foundation required eligible users to make mandatory donations of $0.1 in USDC, USDT, or ETH for claiming each governance token through the Proof-of-Donation mechanism. This decision, which sparked mixed reactions in the community, is believed to have led to the sharp increase in Arbitrum fees.

The previous fee spike was recorded on December 15, 2023, when the blockchain’s daily revenue rose to $2.13 million. However, publishing data on Ethereum cost the L2 network $1.72 million, leaving a net profit of approximately $414,000.

On June 20, Arbitrum’s base layer service costs barely exceeded $140,000, ensuring a record “profit” of $3.29 million.

Airdrop or Token Sale?

During the token distribution that began on June 19, 85 million ZRO, or 8.5% of the total 1 billion ZRO supply, were allocated among 1.28 million eligible wallets.

According to the project’s tokenomics, the community is ultimately entitled to 38.3%.

Introducing ZRO

25% unlock Day 1 – 8.5% at TGE. 11.0% for future Snapshots and RFPs. 5% to LayerZero Foundation. 0.5% to community members.

Claims open on June 20 at 11:00 am UTC.

?https://t.co/UCYPPoIe26 pic.twitter.com/tsdTR4xDC8

— LayerZero Foundation (@LayerZero_Fndn) June 20, 2024

The initial phase of token distribution on the prediction platform Polymarket sparked debate among users. Some commentators argued that the mandatory donations signified a token sale by the team.

This view was echoed by Yearn.Finance developer banteg, who likened the ZRO distribution to “glorified ICOs” — initial coin offerings.

mandatory donations sound more like a glorified ico.

and stop bulk funding protocol guild, it’s been wildly successful at attracting funds, find other smaller initiatives to support.

— banteg (@bantg) June 20, 2024

However, several opponents disagreed with these conclusions.

“It’s an airdrop because only users who interacted with the protocol could request free tokens, but part of them must be donated to ‘charity.’ Not to the team selling coins, but to anyone who wants to buy them. If this isn’t an airdrop, then what is it?” questioned one user.

Another commentator noted that ZRO could be obtained from the distribution without donations by using a flash loan for this purpose.

“In this case, you just come and get free money in the form of ZRO, which is essentially an airdrop. It’s not an ICO, token sale, or anything like that, because you can immediately sell the asset for an amount far exceeding the donation,” he emphasized.

In a statement explaining the rationale behind mandatory donations, the LayerZero team suggested not using the term “airdrop” for ZRO distribution, replacing it with “token issuance.”

The developers explained that the DEX Uniswap’s initial 2020 initiative to reward early project users with tokens no longer serves its purpose of attracting long-term interest. In their view, the tool has led to token distributions being used by speculative capital for quick profit.

Since the beginning of the year until mid-June, crypto projects have distributed assets worth approximately $4 billion through airdrops.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!