Altseason? In short: never

In 2017 the first true altseason arrived, when Ethereum and other coins posted bigger market-cap gains than bitcoin. Many assumed digital gold would yield pole position to upstart projects.

Those hopes did not pan out. Still, a measure of cyclicality emerged in subsequent years. Reading recent charts, analysts expect another upswing in altcoins. Oleg Cash Coin explains why such forecasts will probably not materialise.

A brief history

The success of the first cryptocurrency drew in enthusiasts of every persuasion, eager to popularise their principles and ideas. Bitcoin opened the way to a host of technological and social experiments in building and growing distributed networks.

As a market-shaping protocol, Bitcoin was the first project to offer a balanced answer to the blockchain trilemma: decentralisation, security and performance.

Not every user, it turned out, prized balance. Two camps emerged: bitcoin diehards and backers of alternative coins. The latter’s developers largely prioritised performance, sacrificing security or decentralisation.

Promotion often relied on aggressive marketing with taglines such as “bitcoin killer”. Yet bitcoin’s adoption and market value proved out of reach for all altcoins.

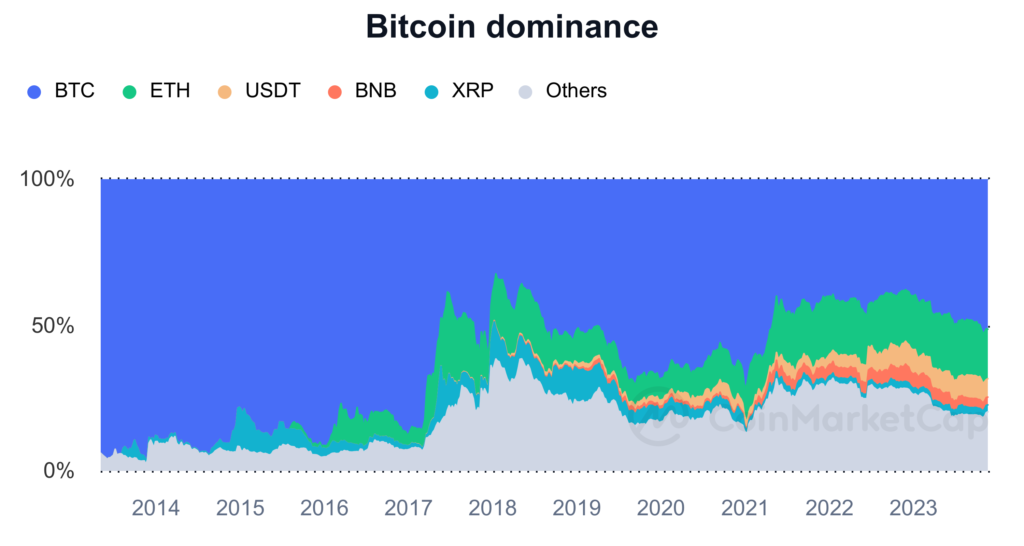

The tug-of-war is visible on the long-run chart of bitcoin dominance, which shows BTC’s share, and that of other coins and tokens, as a percentage of total crypto market capitalisation.

In 2016 bitcoin’s share began to fall. Hard forks, including Bitcoin Cash, the launch of Ethereum, the ICO boom and adoption of the ERC-20 standard all played a part.

That was when the notion of a “season” first appeared—periods when coins and tokens other than bitcoin outperformed the original cryptocurrency. In 2017 Blockchain Center launched an analytical tool, the Altcoin Season Index, which tracks the performance of such assets relative to BTC.

If 75% of the top-50 assets by market cap outperform bitcoin over a 90-day stretch, it is deemed “altcoin season”. “Stablecoins” (USDT, DAI, USDC) and wrapped tokens (WBTC, stETH) are excluded.

Another gauge is futures-market volume dominance. Coinalyze offers a version of this chart. If altcoins’ share exceeds 35%, traders are signalling risk appetite—liquidity rotating towards non-bitcoin coins and tokens.

What sets up an altseason

In 2017 altseason came with a narrative that bitcoin might be toppled from first place by market cap. Later episodes were really about shifts in dominance and capital rotating from one sector to another.

The chief driver of altcoins’ advances is the market wealth effect: investors who profit on the big projects park some winnings in newer coins and tokens.

For instance, Ethereum’s success and miners’ windfall profits drew substantial capital into its ecosystem. Solana’s rise spurred growth in projects on the platform.

Capital can rotate across sectors outside ecosystems, too. Many who made outsized gains on the rise of memecoins also invest in NFTs, GameFi and AI tokens.

Such assets are far more volatile and less resilient. Altseason is therefore a time of FOMO.

What an altseason looks like

Many still await altseason, taking their cue from past bull-market waves. Optimists overlook a crucial fact: there are far more coins than in previous cycles.

By the most conservative estimates, the number of cryptocurrencies is seven to eight times greater than during the first altseason of 2017–2018.

Include tokens not tracked by CoinGecko and CoinMarketCap, and the tally runs into several million. In May 2024 alone, 455,000 tokens were issued on Solana, 177,000 on Base and 39,000 on BNB Chain. Roughly 20,000 more were created over the same period on Ethereum mainnet as well as the Arbitrum and Optimism L2s.

Sheer numbers make it impossible for the whole market—or any large slice of it—to rise in unison. Previous years show that discrete categories and fads lifted off, not altcoins as a whole.

Take memecoins: the market grew from effectively a single coin, Dogecoin, into a sector worth about ~$50bn, with nearly 900 entries on CoinGecko.

The artificial-intelligence boom likewise helped OpenAI chief Sam Altman promote Worldcoin in parallel.

Market fractalisation is accelerating, sometimes to absurd proportions. By early July 2024 CoinGecko distinguished 354 separate categories, a number likely to keep growing. Not every narrative catches on, however. Data for 2023 showed that five areas accounted for over half of traffic: AI, GameFi, memecoins, the Solana ecosystem and RWA.

Some categories remained popular in 2024. According to BiteyeCN, memes were the best-performing market, up more than 1,800%. The RWA segment also far outpaced BTC and ETH, rising over 213%.

【 2024上半年,什么赛道最赚钱??】

最近几个月行情反反复复震荡,相信大家都挺难熬。但不管怎么说,牛市主升浪尚未到来,还会有遍地是机会的时候,莫要着急。

我们对2024至今不同加密赛道回报率进行统计和比较,分析如下? 点开Thread 认真细品,浪来了才能好好把握!? pic.twitter.com/mU6U8BeSrP

— Biteye (@BiteyeCN) June 24, 2024

In short, the market’s capacity for simultaneous gains is limited across the swelling ranks of coins and tokens. The heavy lifting on aggregate capitalisation tends to come from the large caps: bitcoin, ETH and a few others.

Do not, then, expect a classic, market-wide altseason—or broad-based rallies across entire categories. What is emerging instead looks like a profusion of index-like narratives.

Consider US equities: performance is commonly gauged by the S&P 500, in which roughly 30% of the weight comes from just seven firms (Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia and Tesla) out of 500 constituents.

In future, altseason may amount to brief, localised bursts in specific trends and blue chips within select categories—leaving some participants with windfall gains while others see little change, or even losses, in their portfolios.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!