Glassnode Assesses Impact of ETF Flows, Mt.Gox Payouts, and German Government Actions

The Bitcoin market has absorbed 48,000 BTC linked to the German government and is anticipating further sales from Mt.Gox clients. Analysts at Glassnode have examined these factors, as well as the role of ETFs.

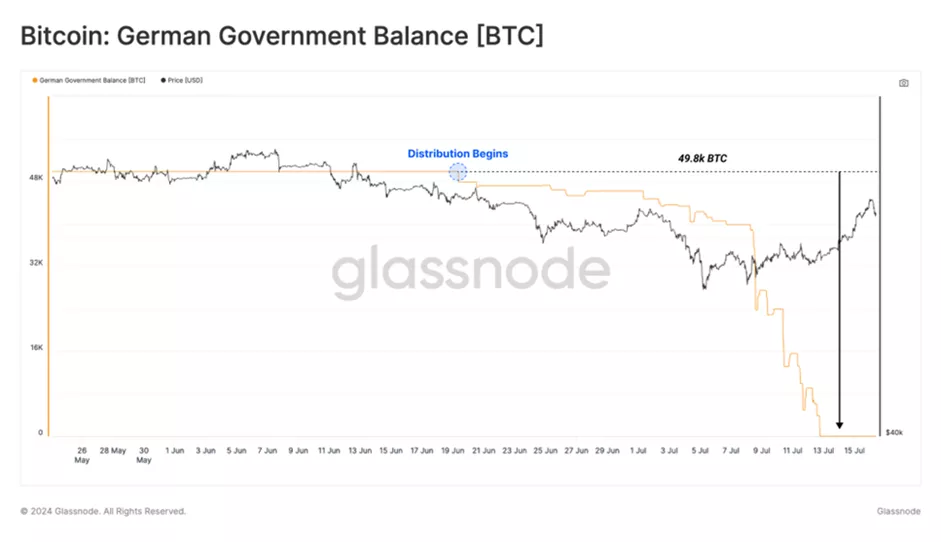

The #Bitcoin market recently absorbed over 48k BTC in sell-side sourced from the German Government.

With Mt Gox distributions also on the horizon, we examine these major sell-side forces, as well as the role ETFs have on price action.

Discover more in the latest Week On-Chain… pic.twitter.com/RhK8Pj7tPt

— glassnode (@glassnode) July 16, 2024

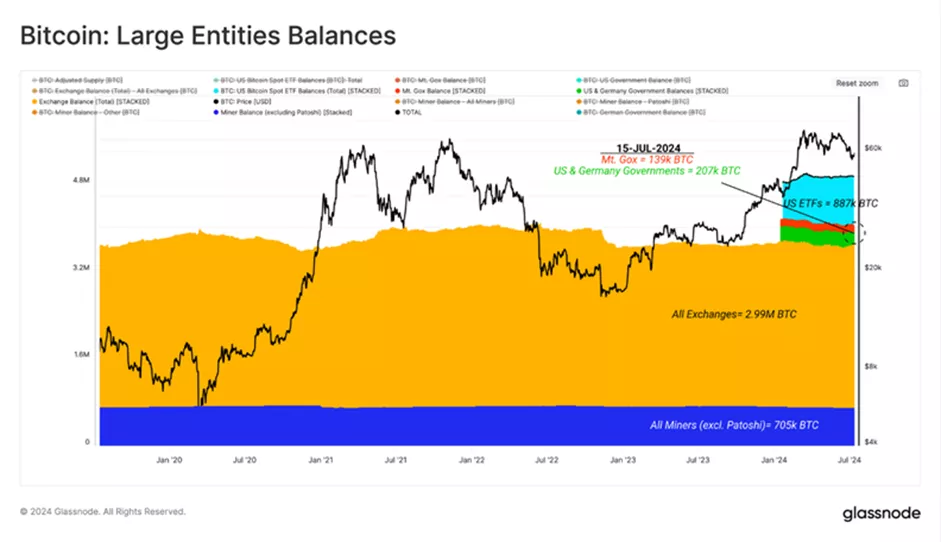

Currently, Bitcoin whales have accumulated approximately 4.9 million BTC, equivalent to 25% of the available supply.

The structure is as follows:

- ? centralized exchanges: 3 million BTC;

- ⬜ US ETF custodians: 887,000 BTC;

- ? miners, including participants from the Satoshi Nakamoto era: 705,000 BTC;

- ? governments: 207,000 BTC;

- ? Mt.Gox trustee: 139,000 BTC.

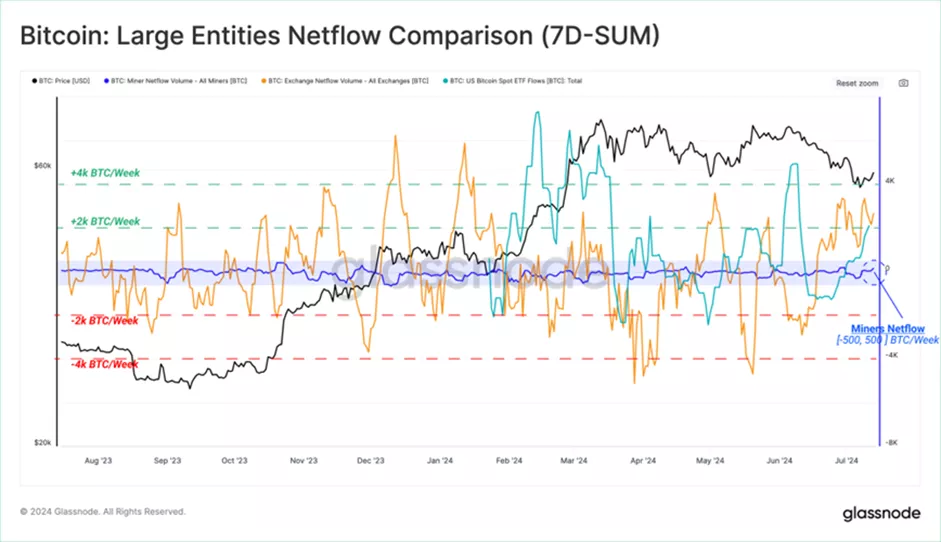

Historically, miners have been the main source of sell-side pressure, but with each halving, their influence has waned, noted Glassnode. To date, the net change in the cumulative balance for this market category does not exceed ±500 BTC per week.

The chart below compares miners’ net flows ? with deposits/withdrawals from centralized exchanges ?, as well as ETF inflows/outflows ?.

Experts found that the latter two components exhibit significant fluctuations of ±4000 BTC. In other words, their actions have approximately 4-8 times more impact on the market than miners.

Tracking this dynamic as a baseline, specialists assessed the intensity of the presumed bearish pressure from Bitcoin whales.

They made three key observations:

- An increase in miner sales coincides with heightened volatility.

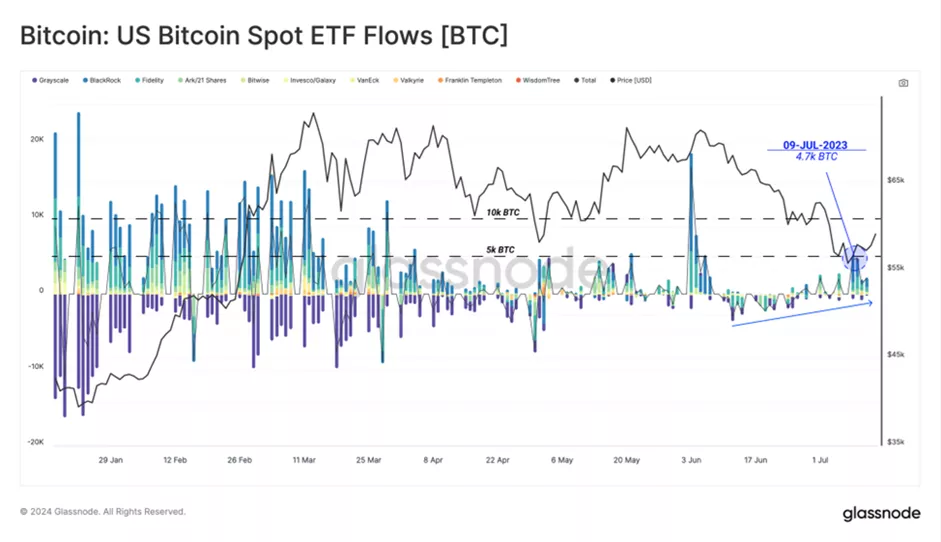

- After reaching the ATH in March, outflows from ETFs became predominant. The driver was GBTC.

- In recent weeks, significant sales volumes have been observed from the German government. Most outflows occurred after the price fell to $54,000, indicating an effective market response to the news.

The chart below shows the cumulative net outflow of coins from various market directions since reaching ATH. It demonstrates a comparatively low volume of sales from miners (5700 BTC).

The largest and most consistent source of pressure on quotes remains CEX (78,500 BTC). The second most significant “bear” is the German government (54,800 BTC). BTC-ETF issuers accounted for 20,800 BTC.

Focusing on the actions of the German government, analysts found that exchanges/market makers distributed the majority of coins (39,800 BTC out of 54,800 BTC) in a very short window between July 7 and 10 — after the drop to a local low of $54,000.

Stability and Speculation

After a “prolonged period of unstable trading within a narrow range,” cumulative net flows for Bitcoin ETFs showed a sustained period of outflows.

At a certain point, the spot price fell below the average acquisition cost of exchange-traded funds ($58,200). This triggered a sharp activation of buyers. A week earlier, cumulative inflows exceeded $1 billion.

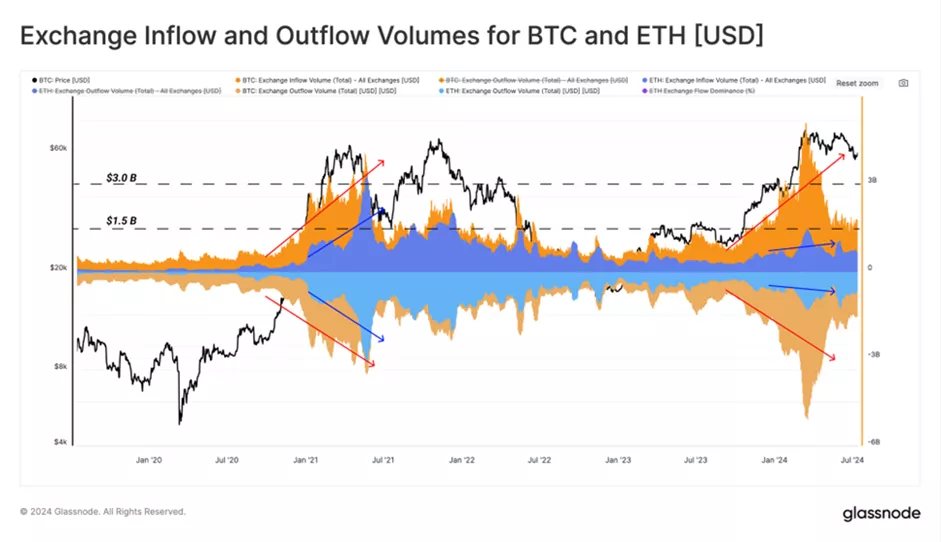

The dynamics of CEX flows serve as a reliable indicator of investor interest and market liquidity, specialists reminded. After the ATH update in March, they recorded a noticeable decline in the metric. Thus, daily Bitcoin volumes ? stabilized around $1.5 billion.

Compared to digital gold, interest in Ethereum ? has noticeably decreased relative to the bull market of 2021, where the indicators of the two main cryptocurrencies were almost equivalent.

This indicates a weakness in the speculative wave for Ethereum in 2024, which aligns with the slowdown in the overall ETH/BTC dynamics since the cycle lows of 2022, experts noted.

The magnitude of realized profits and losses can also serve as an indirect indicator of demand. According to this metric, analysts observed a similar picture, where significant demand supported the rally to ATH, followed by a period of contraction and consolidation.

“This highlights the balance between supply and demand over the past three months. Realized losses have not significantly increased so far, indicating restrained panic despite a correction of more than 25%,” specialists explained.

Investor Profitability Remains High

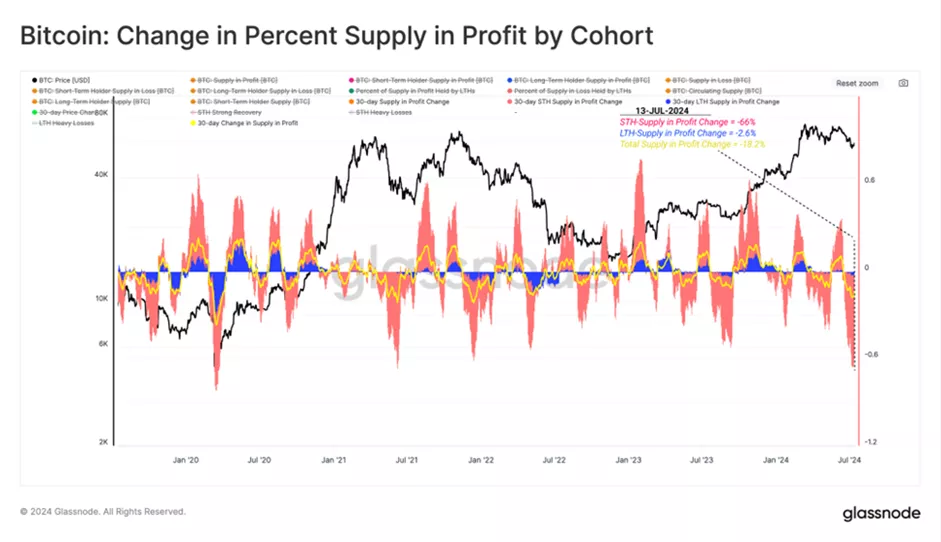

When the price fell to $53,500, the share of unrealized losses rose to about a quarter of the total supply of digital gold. As a result, the opposite indicator of profitable coins returned to its average value of 75% — a level it historically reached during previous bull run corrections.

Analysts compared both metrics between long-term and short-term holders to assess the impact of price rollback on these market participant groups.

Over the past 30 days, speculators experienced a sharp decline in profitability: more than 66% of their coins became “unprofitable” — one of the largest drops in this category’s indicator in history.

For hodlers, the share of “profitable” Bitcoins changed insignificantly. In other words, a relatively small number of investors from the peak of the 2021 bull run still hold their coins.

According to analysts, speculators remain sensitive to volatility spikes, as their average purchase cost is ~$64,300.

As the German government’s sales concluded and the Mt.Gox factor was largely priced in, many experts predicted that Bitcoin would recover lost levels in the coming months.

Standard Chartered maintained expectations for the first cryptocurrency’s return to its all-time high in August and subsequent rise to $100,000 by the US presidential elections in November.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!