How crypto-payment processing works for business, according to CryptoProcessing

Crypto-processing services are payment gateways that handle transactions on the blockchain and convert cryptocurrencies into fiat. They are a vital part of the industry, enabling rapid settlement and helping to drive mass adoption of digital assets.

With the team at CryptoProcessing, we explain how crypto processing works and how to integrate bitcoin payments into a business.

Why businesses need crypto processing

There are two ways to add support for cryptocurrency payments: build an in-house solution or connect to gateways for digital assets.

In the first case a company must hire developers and allocate a budget to build the infrastructure. To avoid that burden, many turn to firms offering ready-made crypto-payment processing. Typically, they operate as follows:

- a customer buys a product with cryptocurrency;

- the crypto-processing service accepts and processes the payment;

- the seller receives funds in a preferred form: to a bank account after conversion (for example, into dollars or euros) or directly to a cold crypto wallet.

With ready-made payment solutions, business owners need not worry about the secure acceptance and storage of crypto assets. CryptoProcessing has undergone audits by 10Guards and Hacken and uses transaction-screening systems from AML services Crystal and Chainalysis.

In July 2024, CryptoProcessing obtained the ISO/IEC 27001 security certification. It confirms the implementation of a risk-management system for data security and full adherence to the practices and principles of the International Organization for Standardization.

“It is safe to say that digital payments are not a passing trend but an established payment instrument. According to Statista, more than 580 million people worldwide already use cryptocurrency, and this number is constantly growing. Around 15,000 companies accept bitcoin, including giants such as Microsoft, PayPal, Tesla, Twitch and Shopify,” representatives of CryptoProcessing comment.

In their view, several factors are driving the popularity of crypto payments:

- Attracting new users. Holders of cryptocurrencies make payments globally, enabling companies to enter international markets and expand their customer base;

- Lower fees. Banks typically charge high fees for processing cross-border payments. In crypto, fees for such transactions can be under $0.01 depending on the blockchain and network congestion;

- Faster settlement. Traditional financial firms require several days for clearing and settlement. Payments in cryptocurrencies are typically processed within minutes.

- Brand awareness and positioning. Accepting digital assets can improve a company’s image, attract a tech-savvy younger audience and, as a result, differentiate the business from competitors and draw media attention.

CryptoProcessing also tackles cryptocurrency volatility by locking the exchange rate and enabling instant conversion into fiat.

Partnering with a licensed crypto processor will also help businesses accept crypto payments legally, avoid regulatory issues and focus on core operations.

How it works

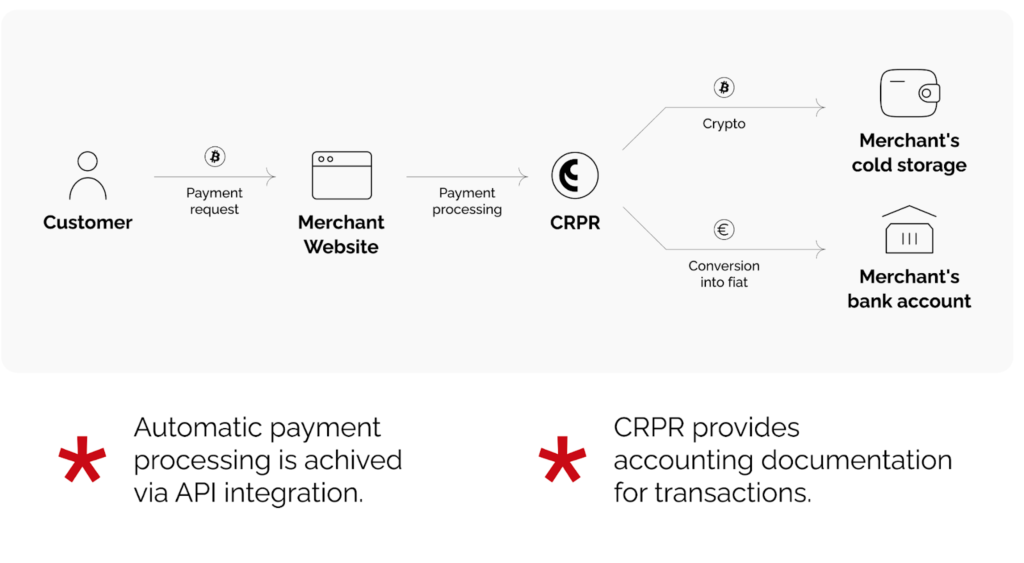

Consider payment processing via CryptoProcessing, which serves more than 800 merchants across industries. On the user side it consists of two steps:

- Initiating a payment. On the merchant’s website, the buyer chooses to pay with cryptocurrency, triggering the crypto-processing service;

- Processing via API. CryptoProcessing automatically generates a payment request through its API, checks the transaction details and its confirmation on the blockchain.

Further processing on the crypto-processor’s side can proceed in two ways, depending on the client’s settings:

- The merchant holds the cryptocurrency. CryptoProcessing transfers the cryptocurrency to a cold-wallet address to secure the client’s funds;

- Instant conversion into fiat. The service converts the cryptocurrency into fiat at the market rate and credits the funds to the merchant’s bank account.

“CryptoProcessing provides the necessary accounting documentation. Reports include transaction records, conversion rates, amounts, dates and other important details. We provide this information to the merchant for bookkeeping, ensuring transparency and ease of financial management,” the team explains.

CryptoProcessing offers three payment methods:

- Channels. Automated acceptance of cryptocurrencies without tying to a specific amount;

- Invoices. A deposit for a specified amount that must be paid within a stated period;

- Payment links. Works in the same way as an invoice but has no due date.

“CryptoProcessing charges no integration fee and has no hidden charges. The transaction fee is under 1%,” representatives of the service note.

Alongside payment processing, CryptoProcessing offers a wallet to manage crypto assets and an OTC desk for large trades.

Conclusions

Crypto payments can expand the customer base, reduce transaction fees and accelerate settlement. The market offers various solutions that simplify the integration of digital assets without building new architecture.

CryptoProcessing provides a gateway with the option to convert digital assets into fiat, suitable for medium-sized and large businesses. The service enables the acceptance of cryptocurrencies worldwide and withdrawals to cold wallets and bank accounts.

Company owners can request a free consultation from CryptoProcessing and receive a personalised proposal tailored to the needs of a specific product.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!