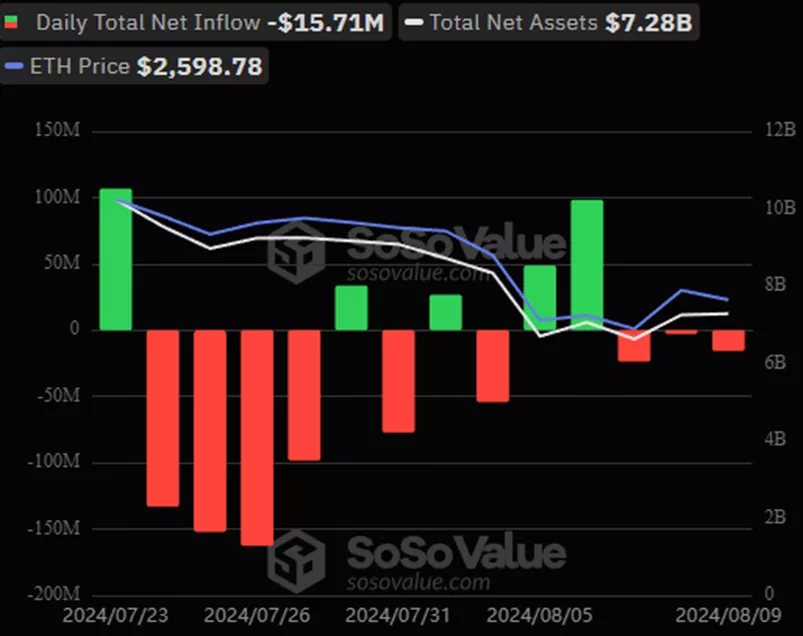

Ethereum ETFs See Positive Inflows for the First Time Since Launch

Between August 5 and 9, spot Ethereum ETFs saw inflows of $104.8 million, according to SoSoValue. This marks the first positive movement since the instruments were approved.

The net outflow for the entire period decreased to $405.9 million.

The total withdrawal from Grayscale Ethereum Trust (ETHE) increased to $2.3 billion, with a $41.7 million rise on August 9.

Inflows into BlackRock’s ETHA exceeded $900 million, including $19.6 million on the last reporting day.

Fidelity’s FETH attracted a total of $341.7 million, Bitwise’s ETHW $299.7 million, and Grayscale’s ETH $220.7 million.

Inflows into other products ranged from $10.8 million to $67.8 million.

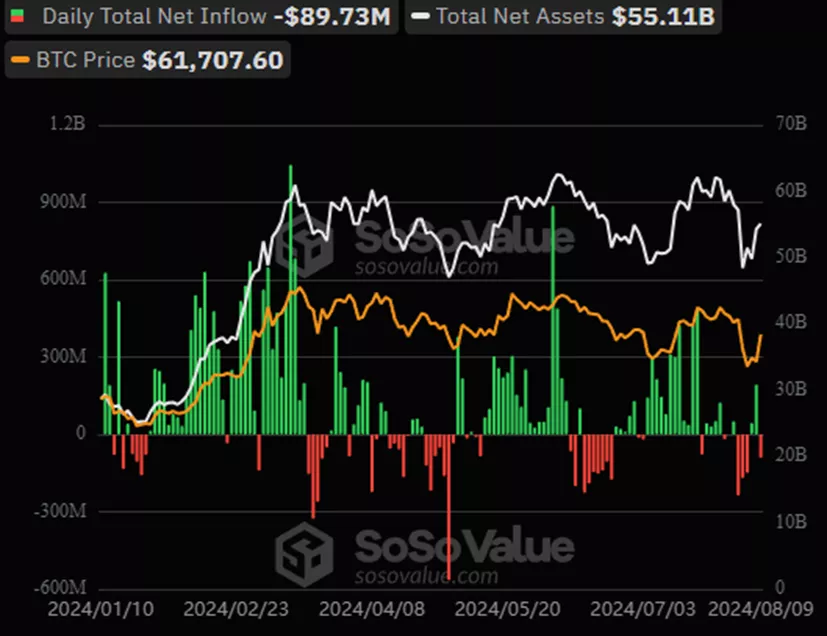

BTC-ETF

Spot Bitcoin ETFs continued to experience negative trends, with outflows totaling $169 million over the calendar week.

Clients withdrew $391.8 million from Grayscale’s GBTC, surpassing inflows into other funds.

The cumulative inflow since the approval of BTC-ETF in January has decreased to $17.3 billion.

Bloomberg had earlier forecasted the launch of options on BTC-ETF in the fourth quarter.

Previously, the NYSE approached the SEC with a proposal to amend rules that would allow it to list and offer trading options based on spot Ethereum ETFs from Bitwise and Grayscale.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!