Bitwise Reports 44% of Asset Managers Increased BTC-ETF Holdings

In the period from April to June, 44% of asset managers increased their investments in spot Bitcoin ETFs, while another 22% maintained their existing positions. These figures were reported by Bitwise, based on filings with the SEC.

A few initial thoughts after reviewing the Q2 Bitcoin 13-F filings:

1) The Institutions Are Still Coming; Total Filings Are Up: I count 1,924 holder<>ETF pairs across all 10 ETFs, up from 1,479 in Q1. That’s a 30% increase; not bad considering prices fell in Q2.

Of course, this…

— Matt Hougan (@Matt_Hougan) August 14, 2024

Meanwhile, 21% of companies reduced their investments in digital gold-based exchange products, and 13% liquidated their holdings.

During this period, the value of the leading cryptocurrency fell by 14.5%.

Under current regulations, firms with an AUM exceeding $100 million are required to submit the relevant reports to the regulator.

Commenting on the data, Bitwise CIO Matt Hougan noted the growing popularity of the instrument among institutional investors, despite worsening market conditions. The top executive is confident that the trend will continue.

The expert highlighted hedge funds Millennium, Schonfeld, Boothbay, and Capula as leaders among BTC-ETF holders and expressed hope for increased interest in the product from pension funds, in addition to the structure from the state of Wisconsin (USA).

Current Summary

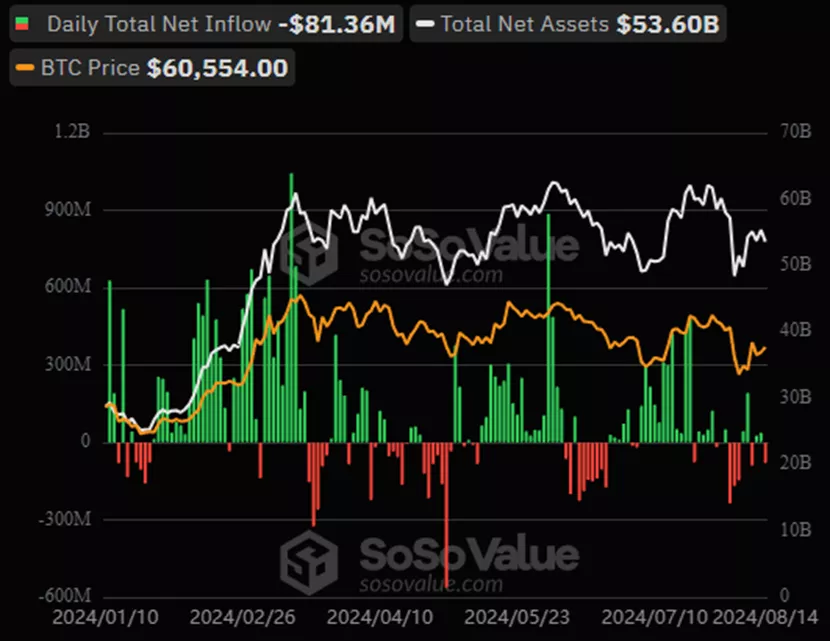

On August 14, the total outflow from spot Bitcoin ETFs amounted to $81.36 million, according to SoSoValue. After two days of inflows, the negative trend resumed.

- Investors withdrew $56.9 million from Grayscale’s GBTC;

- $18.1 million from Fidelity’s FBTC;

- $6.8 million from ARKB by Ark Invest and 21Shares;

- $5.8 million from Bitwise’s BITB.

Clients of BlackRock’s IBIT increased their positions by $2.7 million, and Wisdom Tree’s EZBC by $3.4 million.

No changes were recorded for other instruments.

The total inflow since the approval of BTC-ETF in January has decreased to $17.3 billion.

ETH-ETF

On August 14, inflows into spot Ethereum ETFs amounted to $10.8 million. The positive trend continued for the third consecutive day.

The total outflow from the Grayscale Ethereum Trust (ETHE) increased to $2.34 billion. On August 14, the figure rose by $17 million.

Inflows into BlackRock’s ETHA exceeded $966.5 million, including $16.1 million on the last reporting day.

Fidelity’s FETH attracted a total of $357.8 million ($6.65 million on the last day), Bitwise’s ETHW — $305.2 million ($2.7 million), Grayscale’s ETH — $222.9 million ($2.3 million).

Inflows into other instruments ranged from $10.8 million to $64.9 million. On August 14, no changes were recorded.

Previously, Morgan Stanley allowed advisors to recommend BTC-ETF to certain clients.

By the end of the first quarter of 2024, 13 of the 25 largest hedge funds in the US held Bitcoin-based products, according to River.

In May, BlackRock’s head of digital assets, Robert Mitchnick, stated expectations of a new wave of inflows into spot BTC-ETF due to institutional participation.

In April, a similar forecast was presented by Bernstein analysts.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!