Bitcoin Volatility Poised for Growth Amid CPI Data and Debates

Implied volatilities of bitcoin options remain elevated. Traders anticipate significant price swings in light of the Trump-Harris debates and consumer inflation (CPI) data, according to QCP Capital.

The events are scheduled for September 11 at 4:00 and 15:30 (Kyiv/Moscow).

Experts noted that until October, options market participants tend to take predominantly bearish positions. Optimists are forming longs targeting March 2025. Analysts recorded large purchases in calls with strikes at $85,000, $100,000, and $120,000.

Experts also observed a rise in bullish bets with December expiration following bitcoin’s rebound from $52,500.

Kaiko questioned whether the anticipated reduction in the key rate by the Fed would benefit risky assets.

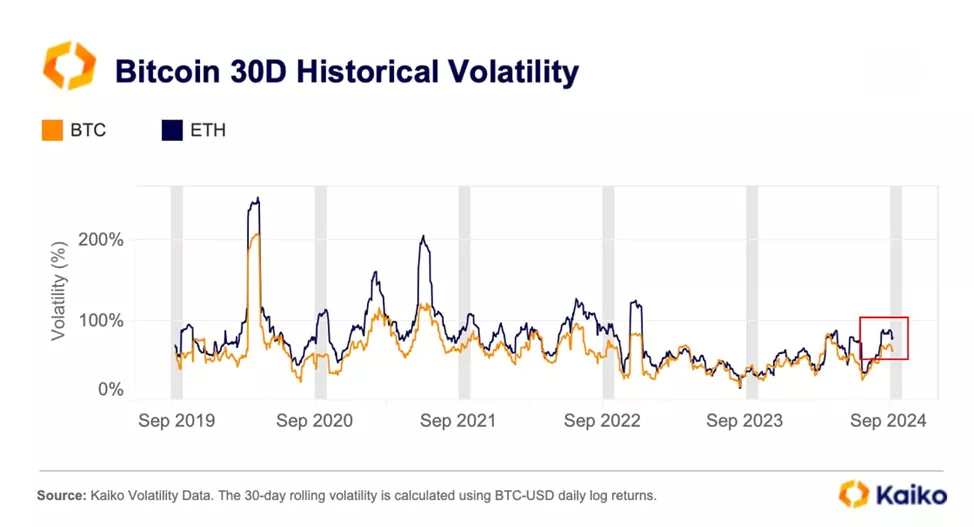

Analysts agreed with their colleagues at QCP regarding the prospects of significant price fluctuations in September, citing an increase in bitcoin’s historical volatility (30 DMA) to 70%. The figure is close to the March peak when quotes reached a new ATH, and seasonally it has always been lower at this time of year.

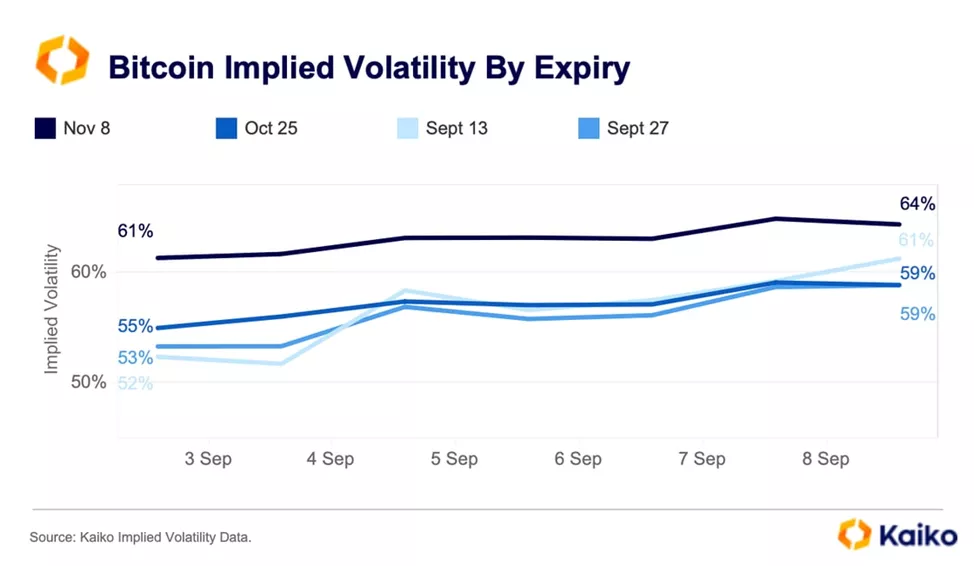

IV in contracts maturing on September 13 jumped from 52% to 61%, exceeding the values of options at the end of the month.

Typically, when short-term implied volatility exceeds long-term metrics, it indicates increased market tension and serves as a signal to reduce risk in positions, specialists reminded.

By the end of the year, bitcoin could reach $90,000 if Donald Trump wins the US presidential election or fall to $30,000 if Kamala Harris becomes the next head of the White House, according to Bernstein.

Earlier, analyst and MN Trading founder Michaël van de Poppe predicted “final corrections” before a bull run.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!