Circle to Relocate Headquarters to New York

Circle Internet Financial, the issuer of the USDC stablecoin, will relocate its global headquarters from Boston to New York. This was announced by the company’s founder and CEO, Jeremy Allaire.

BREAKING NEWS: @circle has announced that we are moving our Global HQ to New York City, building out a flagship space on one of the top floors of 1 World Trade Center, an historically important landmark in standing for American global economic leadership. Details below the… pic.twitter.com/fCPzVMtBQw

— Jeremy Allaire — jda.eth / jdallaire.sol (@jerallaire) September 13, 2024

According to him, the headquarters will be located on “one of the upper floors” of the central building of the World Trade Center, also known as the Freedom Tower.

“This iconic tower, the tallest in the Western Hemisphere, symbolizes freedom, power, and the projection of America’s central role in the global economic system,” Allaire stated.

The move is scheduled for early 2025, but the company has already celebrated the event with its business partners.

The head of Circle noted that the new headquarters is being created not as a traditional office but as a space for meetings with partners interested in collaboration to create a “new financial internet system.”

Allaire believes that New York’s advantage lies in its concentration of major crypto companies and digital asset specialists.

“The year 2024 was pivotal for the industry, as stablecoins truly broke through in terms of scale, importance, and use cases. By 2025, they will all become mainstream,” stated the CEO of Circle.

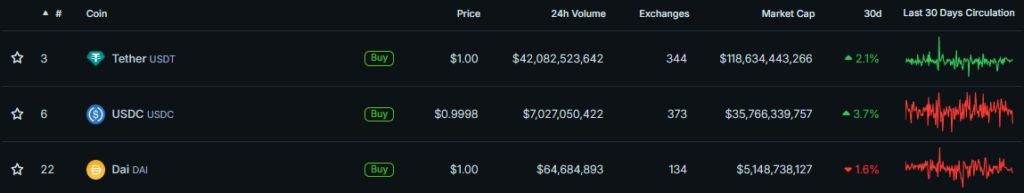

In terms of market capitalization, USDC is second only to the segment leader USDT from Tether — $35.8 billion and $118.6 billion, respectively.

In terms of daily trading volume, the gap is more significant — $7 billion versus $42 billion.

According to Bloomberg experts, more than 90% of stablecoin transactions by volume are conducted by non-real users. This figure casts doubt on the use of stablecoins as a means of payment.

Circle has not abandoned its plans to go public through an IPO.

At the end of 2022, the company terminated a deal with a SPAC. This was preceded by the collapse of FTX, which worsened the digital asset market conditions and weakened Wall Street’s interest in crypto firms.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!