Bitcoin Surpasses $63,000 Mark

The leading cryptocurrency has continued its upward trajectory, surpassing the $63,000 mark.

The four-hour chart below shows that the upward movement is occurring amid declining trading volumes; the RSI indicator has already entered the overbought zone. This may indicate risks of a short-term correction.

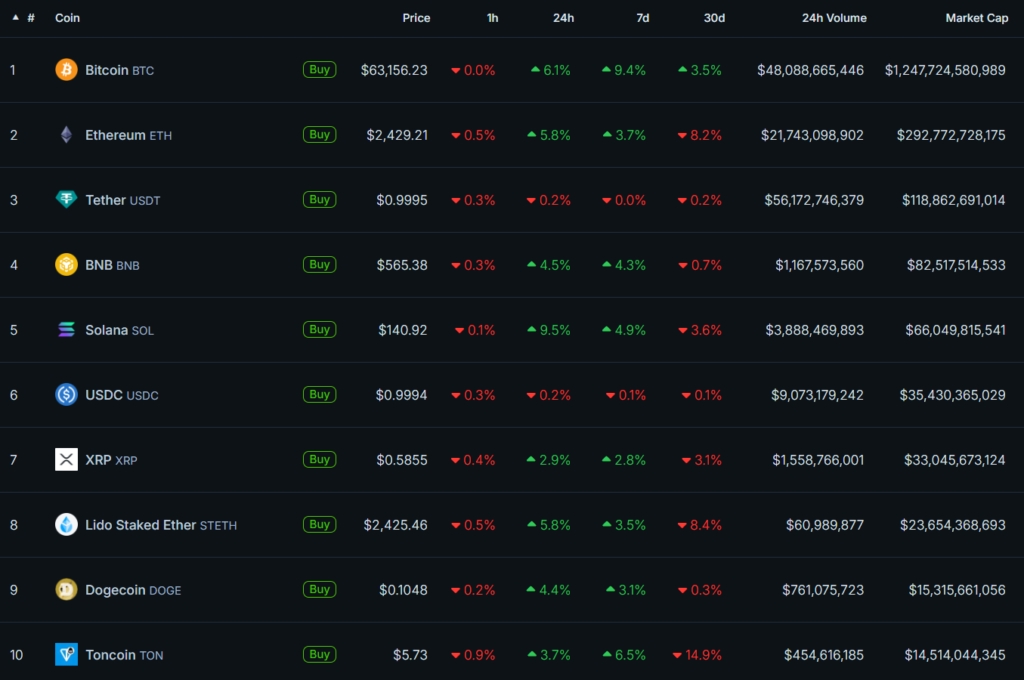

As is often the case, the flagship’s rise has invigorated the rest of the market. Here is the top 10 crypto assets by market capitalization:

Noticeable activity began ahead of the latest Federal Open Market Committee (FOMC) meeting; on September 18, the Fed lowered the key rate range to 4.75–5% per annum for the first time since 2020, which spurred the continued rise of the leading cryptocurrency.

According to BitMEX co-founder Arthur Hayes, investors are now focused on the Bank of Japan meeting scheduled for September 20.

The Fed cut, now all eyes are on BOJ meeting decision due this Friday.

Watch USDJPY like a hawk.

In the very short term:

$JPY weak = $BTC strong $JPY strong = $BTC weak

— Arthur Hayes (@CryptoHayes) September 19, 2024

“Weak yen — strong bitcoin. Strong yen — weak bitcoin,” the expert shared.

Analyst and MN Trading founder Michaël van de Poppe expects further monetary easing from the American regulator, “to keep the economy moving forward.”

The FOMC meeting was massive.

50bps rate cut.

However, the dotplot assumes that another 50-75bps of rate cuts are likely to be happening in the coming months —> bullish for #Crypto & $ETH.

The most significant thing: FOMC doesn’t expect a massive impact on unemployment.

This…

— Michaël van de Poppe (@CryptoMichNL) September 19, 2024

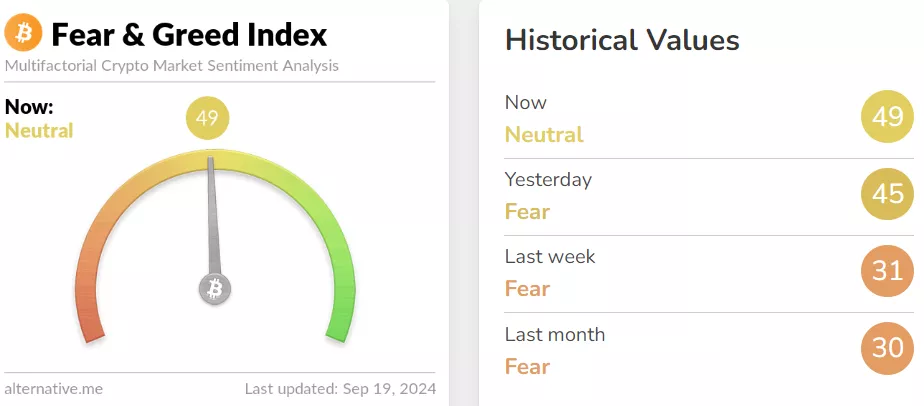

Despite the confident recovery of crypto asset prices, the fear and greed index remains in the neutral zone. Previously, the indicator had long pointed to panic among a significant portion of investors.

At the time of writing, the total market capitalization stands at $2.28 trillion with a bitcoin dominance index of 55%, according to CoinGecko.

BlackRock, the world’s largest asset manager, has described the leading cryptocurrency as a “unique diversifier.”

According to analysts, digital gold “reflects minimal fundamental exposure” to macroeconomic factors affecting most traditional financial instruments.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!