Glassnode Warns of Increased Volatility in Cryptocurrency Market

The cryptocurrency market may face heightened volatility due to liquidation risks and an uncertain macroeconomic landscape, according to Glassnode.

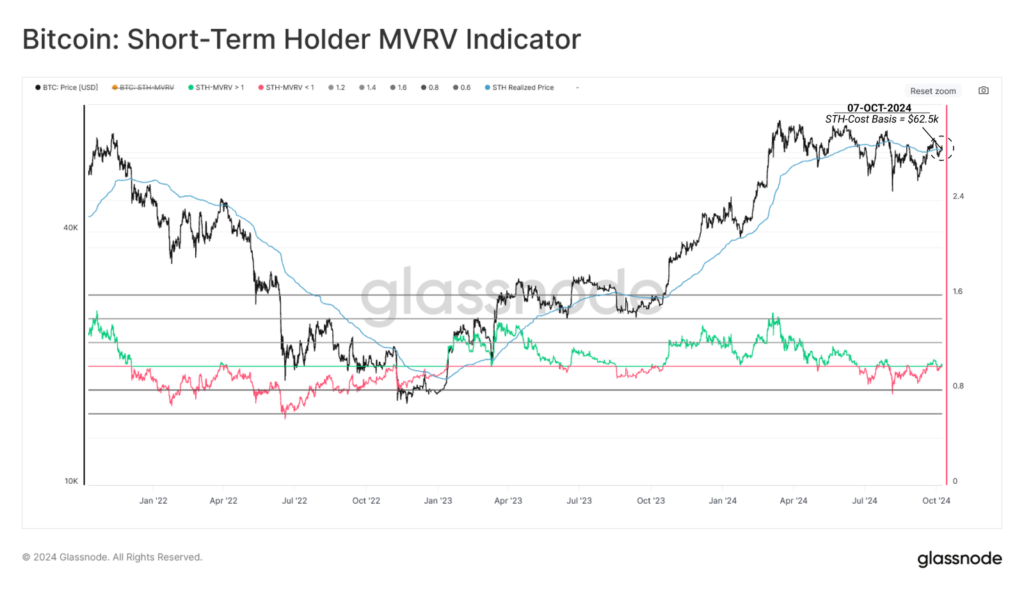

Following a 10% price correction, the #Bitcoin market has rebounded back to the $63k level in an attempt to reclaim the critical Short-Term Holder cost-basis.

Discover more in the latest Week On-Chain below?https://t.co/E3bufV5aaE pic.twitter.com/BUFi1friu9

— glassnode (@glassnode) October 8, 2024

Analysts noted that after one of the largest daily corrections since 2022, on October 1, Bitcoin fell by 3.7% to $60,000. Subsequently, bulls managed to push the price back to $62,500, aligning with the average acquisition cost for short-term investors.

Experts warned that forming a new wave from this level could pressure recent buyers, especially given the challenging conditions of recent months.

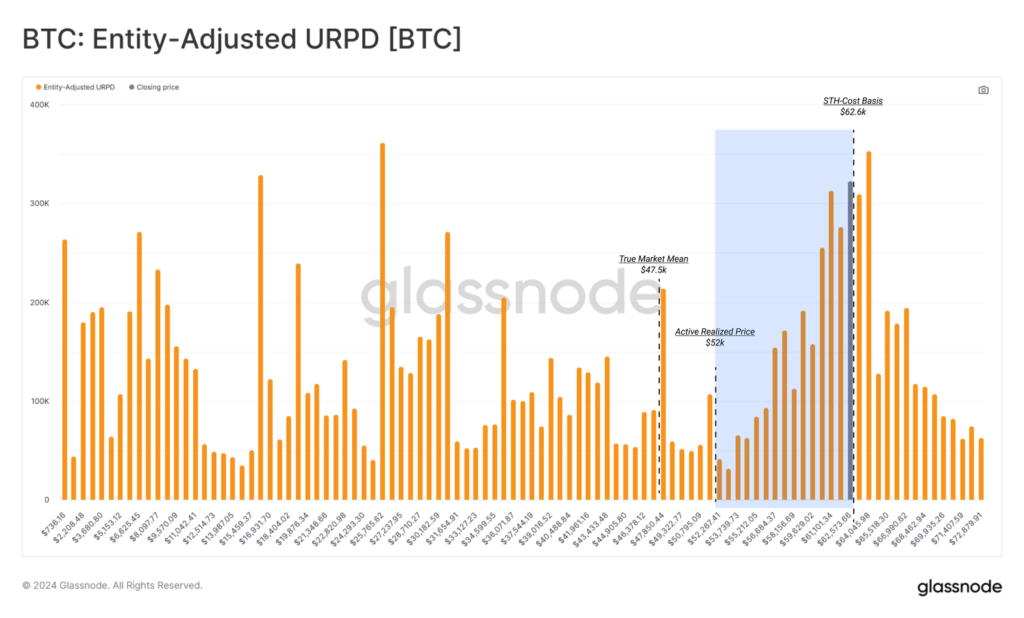

Experts cited the True Market Mean ($47,000) and Active Investor Price ($52,500) as medium-term benchmarks should the upward momentum be lost.

Since the beginning of the year, prices have remained above these levels except for the sell-off on August 5. This indicates a relatively stable market that supports demand during downturns, specialists explained.

An analysis of the realized price profile in the context of UTXO (URPD) showed that the current rate is within a large cluster of coins. In other words, small fluctuations could affect the profitability of a significant number of investors.

Specialists explained that two major supply nodes are located at the True Market Mean and Active Investor Price levels. In close proximity are large “air gaps,” where very few coin transactions have occurred. These could potentially become areas of interest in the event of downward volatility.

“This paints a picture of a market on ‘fragile ground’ with a large volume of supply that will be sensitive to the next major price movement,” commented Glassnode.

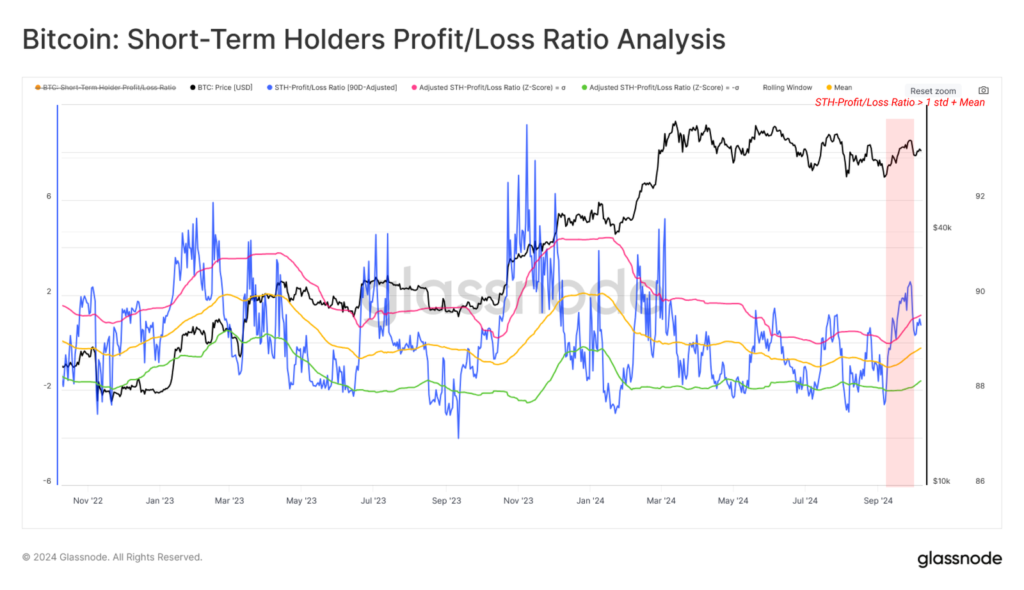

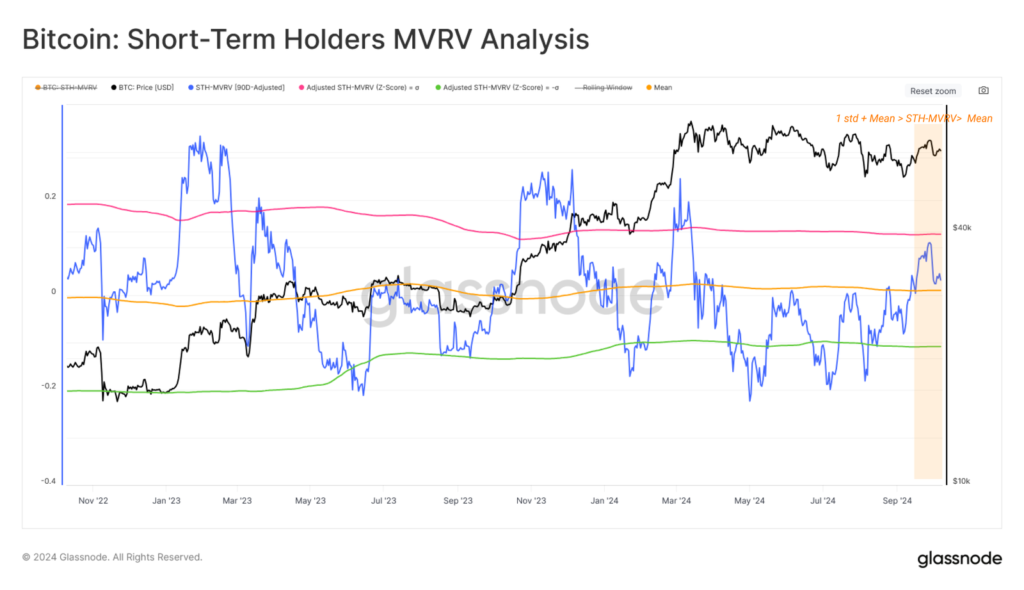

Experts reminded that speculators determine the local trend, and the ratio of “profitable” to “unprofitable” coins is useful for identifying extremes in price dynamics.

Currently, the corresponding ratio stands at 1.2, exceeding the 90-day average by more than one standard deviation. This indicates a positive rise in investor sentiment. A similar situation has formed with the MVRV indicator.

Experts emphasized that such conditions create incentives for profit-taking. Currently, this process remains relatively small compared to the moment of updating the ATH in March 2024.

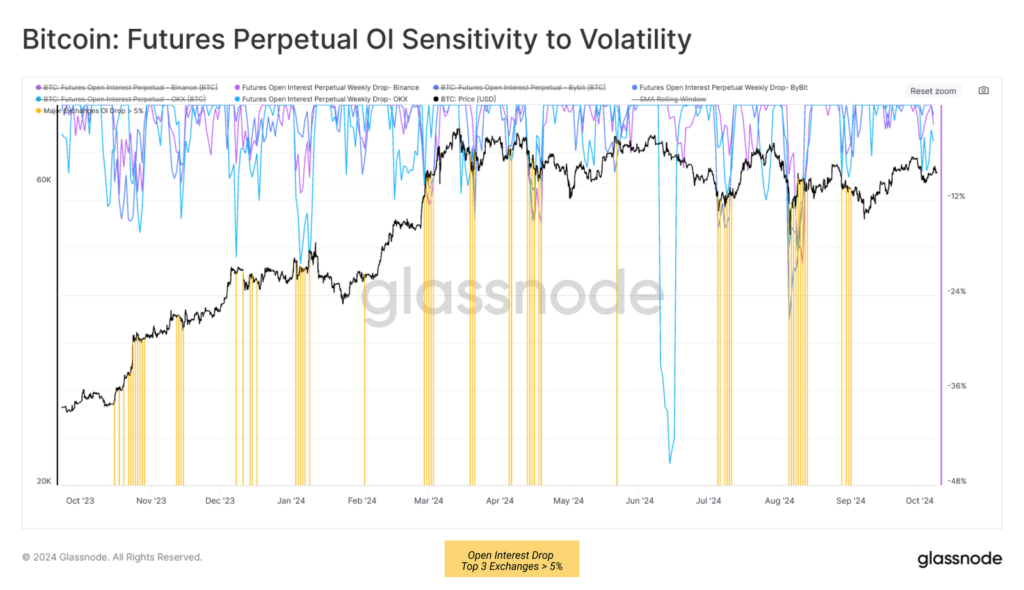

During the recent rally in the perpetual contracts market, open interest decreased by $2.5 billion due to short liquidations. The metric’s decline on the three leading perpetual exchanges did not exceed the threshold of 5%.

Based on this, analysts warned of the market’s continued susceptibility to increased volatility due to the risks of mass forced position closures.

Earlier, Glassnode noted the resilience of BTC-ETF holders amid the correction.

Bitfinex recently pointed to a reduced risk of Bitcoin’s “sudden drop.”

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!