Cryptocurrency Firms Pay $32 Billion to US Regulators

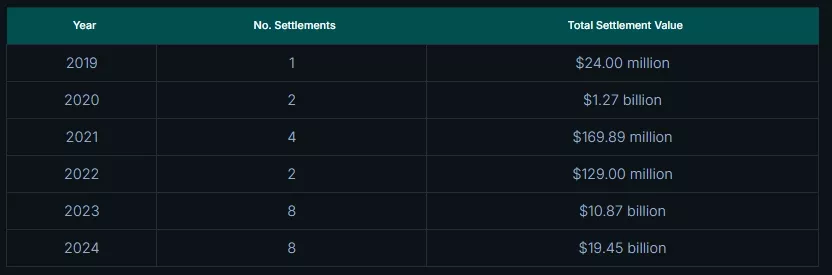

US authorities have extracted $32 billion from cryptocurrency companies in settlements over compliance issues, according to a report by CoinGecko.

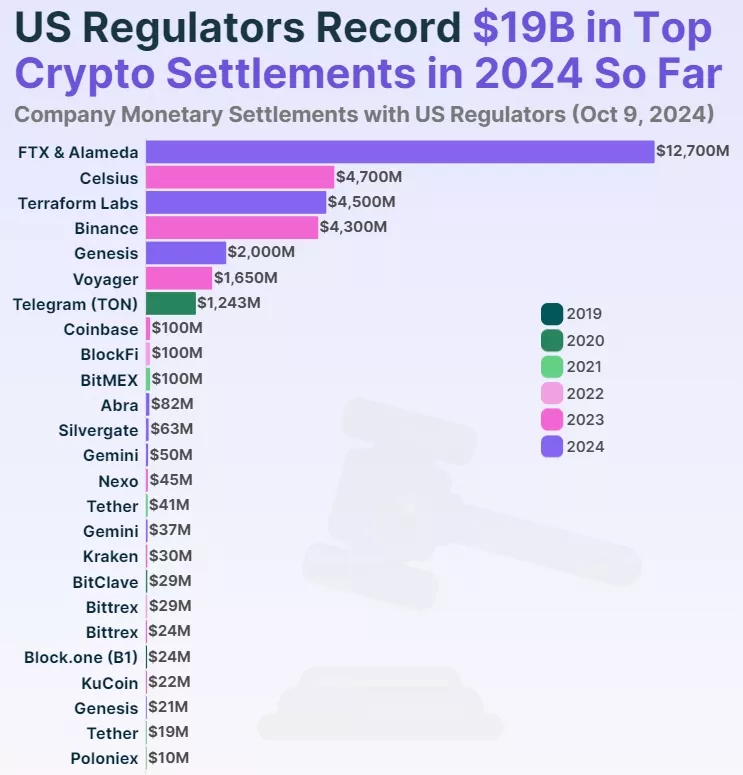

Top Crypto Settlements by US Regulators ?⚖️

1. FTX & @AlamedaResearch — $12.70B

2. Celcius — $4.70B

3. Terraform Labs — $4.50B

4. @binance — $4.30B

5. Genesis — $2.00B

6. Voyager — $1.65B

7. @telegram — $1.24B

8. @coinbase — $100M

9. @BlockFi — $100M

10. @BitMEX — $100M— CoinGecko (@coingecko) October 9, 2024

The report excludes several personal fines imposed by the Commodity Futures Trading Commission on individual top executives.

Of the total, a record $19.45 billion was collected in 2024, largely due to a $12.7 billion payment from FTX and Alameda. These funds are intended to settle $11.2 billion in creditor claims.

Additionally, regulators received $4.5 billion from a settlement with Terraform Labs during the same period.

Among the largest fines were $4.3 billion from Binance and $4.7 billion from Celsius, both in 2023.

CoinGecko experts noted that the collapse of the Terra ecosystem in May 2022 triggered a bear market, followed by the bankruptcy of Celsius, culminating in the FTX collapse in November.

Of the listed crypto platforms, only Binance continues to operate, remaining the largest centralized exchange by trading volume.

Analysts highlighted that a sharp increase in settlement amounts occurred in 2023, with US government agencies collecting $10.87 billion from eight cases.

A similar number of cases have been recorded this year.

Historically, in 2019, the SEC fined Block.one, the company behind the EOS blockchain, $24 million for an unregistered securities sale during its ICO. A year later, the agency imposed a $1.24 billion penalty on Telegram for a similar violation regarding the Gram token offering through its subsidiary TON Issuer. However, approximately $1.22 billion was a return of illegally obtained income, with only $18.5 million as a civil penalty.

In September 2024, the SEC imposed financial sanctions of $700,000 on Mango DAO and Blockworks Foundation, the organizations managing the DeFi platform Mango Markets.

In October 2022, a group led by Avraham Eisenberg attacked Mango Markets, manipulating a price oracle to extract about $116 million in digital assets.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!