US Inflation Surpasses Expectations, Bitcoin Falls Below $61,000

In September, annual inflation in the US reached 2.4%, compared to 2.5% the previous month. This figure exceeded market expectations of 2.3%.

On a monthly basis, the consumer price index rose by 0.2%, the same as in August. The consensus forecast had predicted an increase of 0.1%.

Excluding food and energy prices, the index rose by 0.3% from the previous month and by 3.3% compared to September last year. In the previous report, the figures were 0.3% and 3.2%, respectively.

Analysts had expected the annual rate to remain at 3.2% and the monthly rate to slow to 0.2%.

The negative impact of disappointing inflation data is tempered by a jump in unemployment benefit claims from 225,000 to 258,000, against a forecast of 231,000. This discrepancy can be attributed to the effects of hurricanes and strikes.

Prices for services excluding housing and energy rose by 0.4% following increases of 0.33% in August, 0.21% in July, and decreases of 0.05% and 0.04% in May-June. The Fed noted the importance of this metric in analyzing the inflation trajectory.

Another key indicator for monetary authorities, rental prices, increased by 0.2% after reaching a high of 0.49% in August and 0.36% in July.

The release of macroeconomic statistics has pushed Bitcoin towards a return to intraday lows. The price is testing the support zone at $60,900-61,000. The daily decline rate has intensified to 1.7%. A similar situation occurred with Ethereum, where the rate fell below $2400.

Bloomberg noted that higher-than-expected inflation figures rule out a 50 basis point rate cut in November. They also cast doubt on the Fed’s willingness to ease monetary policy by 150 basis points over the cycle.

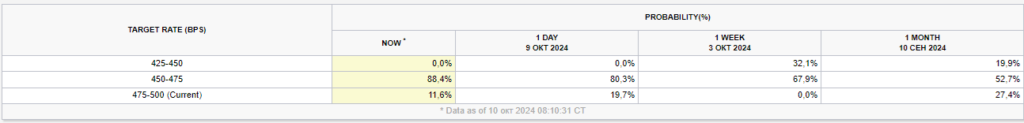

The swap market assesses the probability of a 25 basis point Fed rate cut in November at 85%, up from 80% at the start of the week. This dynamic reflects the impact of unemployment benefit claims data.

In the futures market, traders have increased the probability of a 25 basis point rate cut from 80.3% to 88.4%.

Earlier in October, Fed Chairman Jerome Powell announced further easing of monetary policy to stimulate economic growth and increase employment.

Previously, FalconX experts highlighted the benefits of a key rate cut for Ethereum.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!