Trump’s Rising Election Prospects Revitalize Crypto Fund Inflows

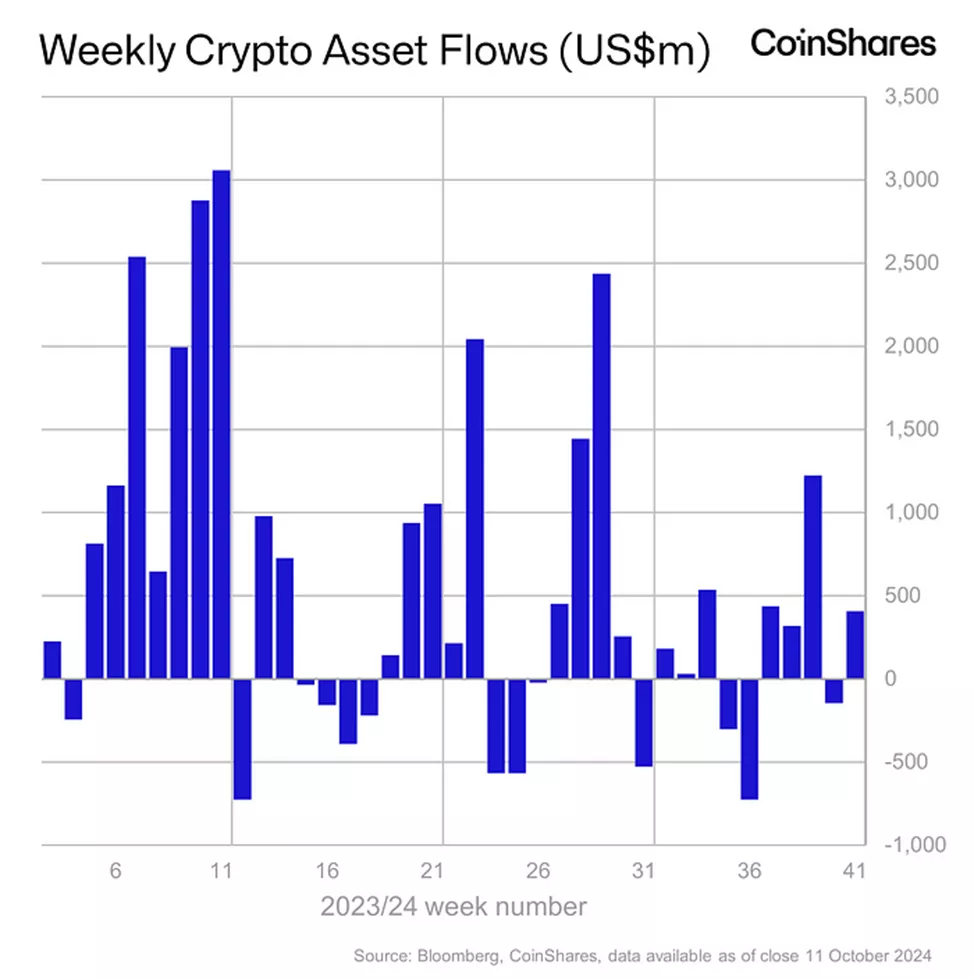

Inflows into cryptocurrency investment funds from October 6 to 12 amounted to $407 million, contrasting with an outflow of $147 million the previous week, according to data from CoinShares.

Experts suggest that the shift in the U.S. presidential race dynamics influenced investor decisions, rather than macroeconomic data releases or changes in the outlook for the Fed‘s policy.

Analysts pointed to the increased chances of Republican candidate Donald Trump, who has widened his lead over Democratic contender Kamala Harris. They noted that Trump is more favorable towards digital assets.

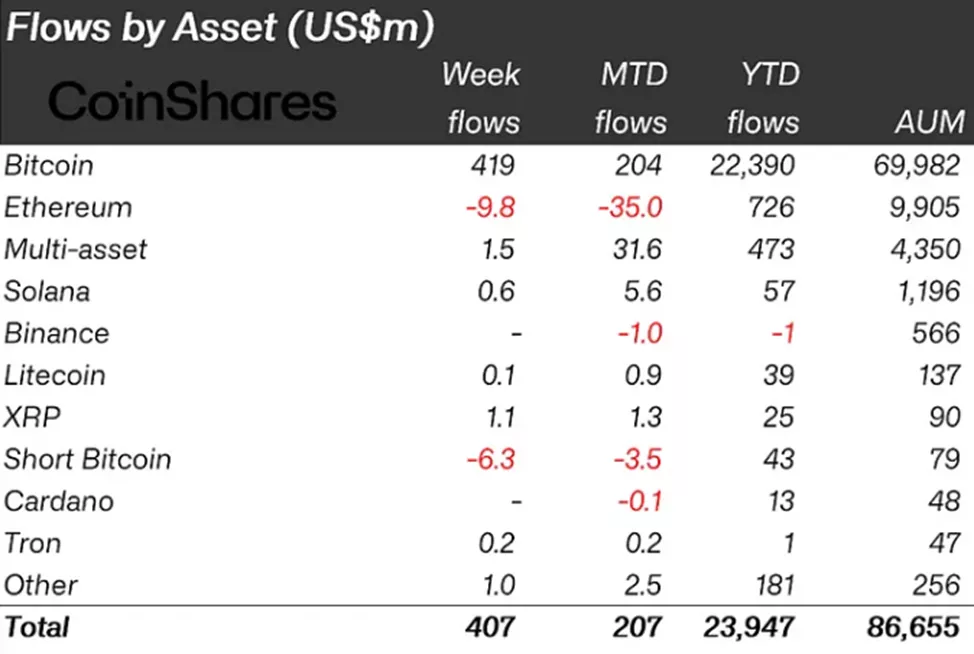

Bitcoin instruments saw inflows of $419 million following an outflow of $159 million the previous week.

Investors withdrew $6.3 million from structures allowing short positions on digital gold, after directing $2.8 million into them in the prior reporting period.

The series of outflows from Ethereum funds continued, with $9.8 million withdrawn after $29 million the week before.

Clients added $0.6 million and $1.1 million to Solana and XRP-based instruments, respectively.

Altcoin-based products attracted $1.7 million, marking the 17th consecutive week of inflows.

Earlier, Bernstein predicted a sideways market until the election results due to uncertainty surrounding the position of the SEC chair.

Previously, media outlets published a list of candidates for the head of the agency should Trump win.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!