QCP Capital Observes Bitcoin Call Options with $120,000 Strike Price

On the evening of October 16, there was a noticeable demand for March bitcoin call options with a strike price of $120,000. These purchases were accompanied by a rise in quotes above $68,000, noted QCP Capital.

Analysts saw this as a signal of the return of optimistic long-term buyers.

Experts noted the continued uncertainty surrounding the U.S. presidential elections in November. This is evidenced by a 10% premium in contracts expiring on these dates.

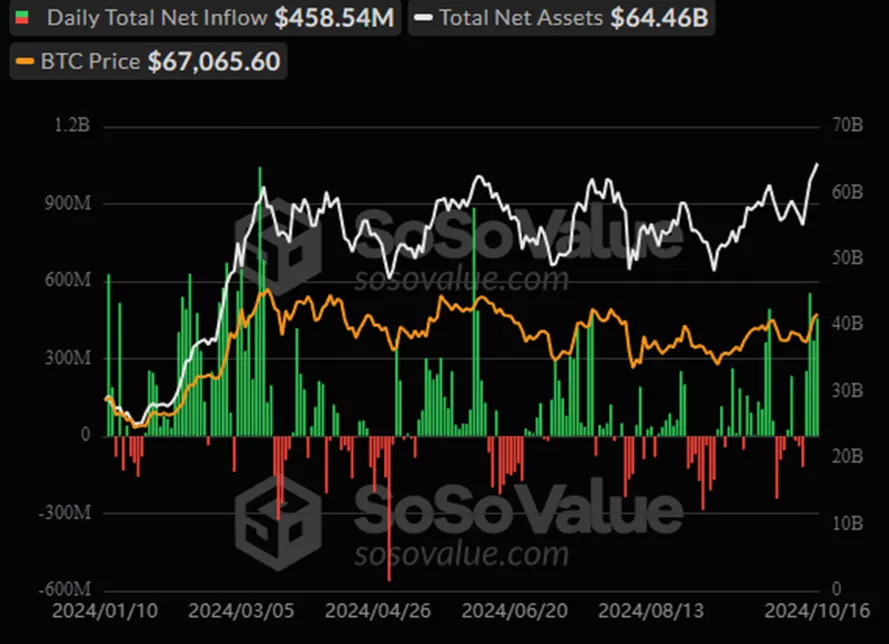

On October 16, inflows into spot bitcoin ETFs amounted to $458.5 million, according to SoSoValue. Over the past four days, the inflow reached $1.64 billion.

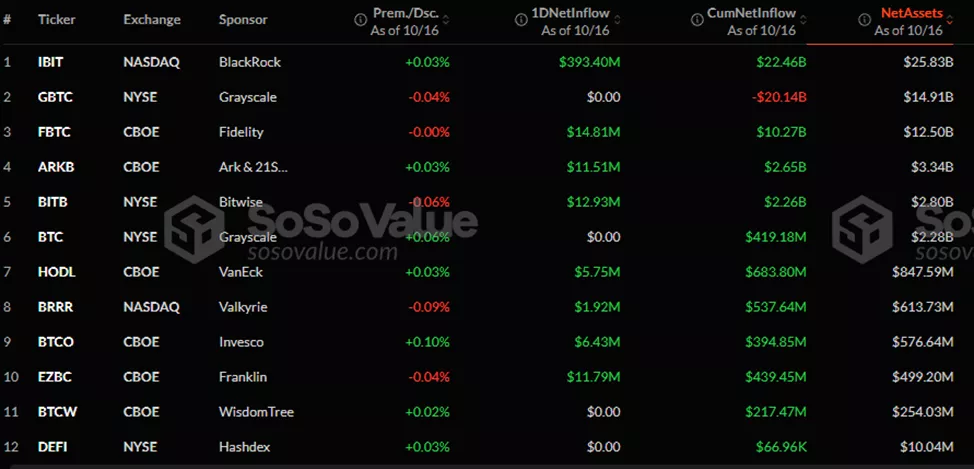

Positive changes were recorded in 8 out of 12 products, while the rest showed no movement.

The leader was IBIT from BlackRock ($393.4 million).

For other instruments, the inflow was as follows:

- FBTC from Fidelity — $14.8 million;

- BITB from Bitwise — $12.9 million;

- EZBC from Franklin Templeton — $11.8 million;

- ARKB from Ark and 21Shares — $11.5 million;

- BTCO from Invesco — $6.4 million;

- HODL from VanEck — $5.8 million;

- BRRR from Valkyrie — $1.9 million.

Cumulative inflows since the approval of BTC-ETFs in January have risen to $20.2 billion.

Earlier, inflows into cryptocurrency investment funds from October 6 to 12 amounted to $407 million. According to CoinShares, a key factor was the increased chances of Republican candidate Donald Trump in the presidential race.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!