US Presidential Election Boosts Inflows to Crypto Funds

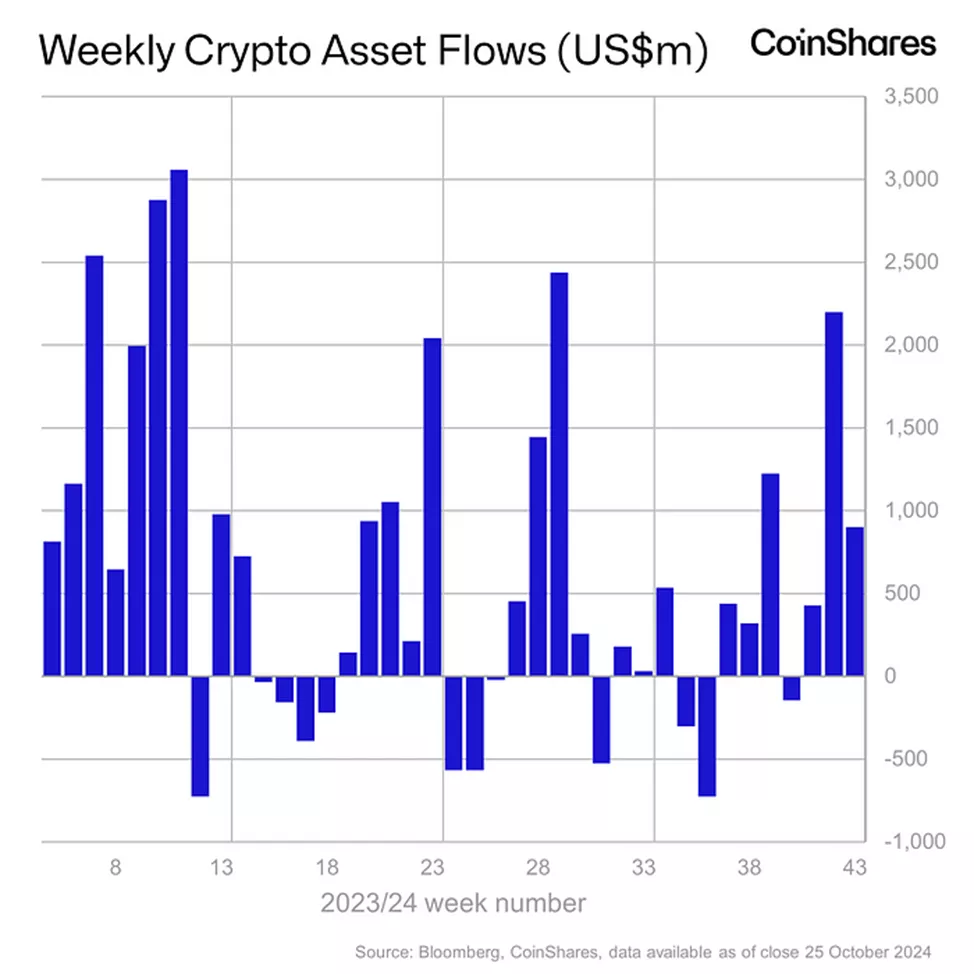

Inflows into cryptocurrency investment funds from October 20 to 26 amounted to $901 million, following a peak of $2.2 billion the previous week, the highest since July. These figures were reported by CoinShares.

Since the beginning of the year, total inflows into these products have exceeded $27 billion, nearly three times the record set in 2021 ($10.5 billion).

“Bitcoin flows are heavily influenced by US politics. The current surge in interest is linked to the growing chances of the Republicans,” the report states.

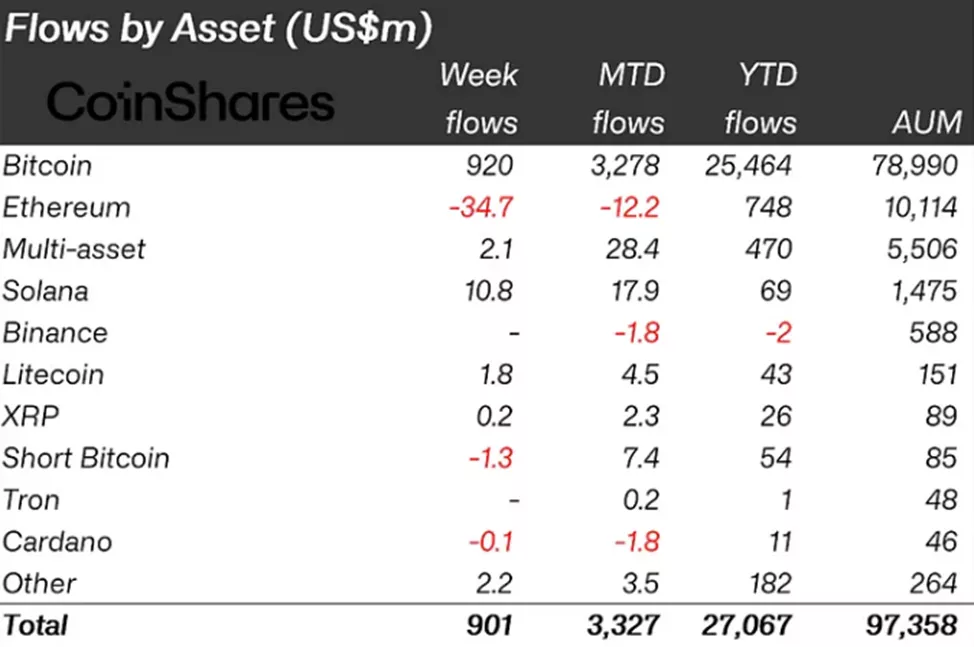

Bitcoin instruments saw inflows of $920 million, following $2.13 billion the previous week.

Investors withdrew $1.3 million from structures that allow shorting digital gold, after adding a peak of $12.3 million since March in the previous reporting period.

In Ethereum funds, the negative trend resumed with an outflow of $34.7 million following an inflow of $57.5 million.

Clients increased investments in Solana, Litecoin, and XRP-based instruments by $10.8 million, $1.8 million, and $0.2 million, respectively.

Altcoin-based products received $2.1 million.

Earlier, BTC-ETF issuers acquired 976,873 BTC ($66.2 billion), equivalent to nearly 5% of the available supply.

Bitcoin options market participants have prepared for a “bullish” scenario following the US presidential election and the Federal Reserve meeting, increasing OI on November calls with strike prices above $80,000.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!