MicroStrategy Aims to Raise $42 Billion for Bitcoin Purchases

In its financial results for the third quarter, MicroStrategy reported a loss of $340.2 million and unveiled a plan to raise $42 billion to continue its bitcoin acquisition strategy.

The business analytics software provider’s revenue amounted to $116.1 million, falling short of the consensus estimate by about $8 million and down 10.3% from the same period last year. The firm attributed this decline to reduced income from product licenses and support.

Operating expenses for the quarter reached $514.3 million, primarily due to impairment losses on digital assets amounting to $412.1 million.

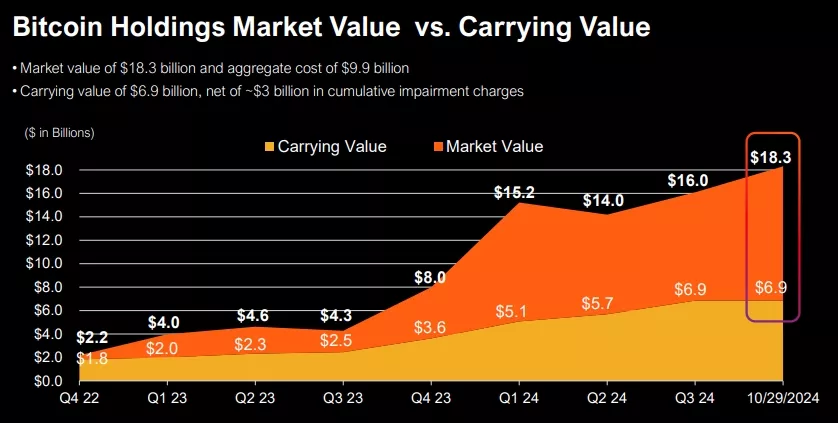

During the quarter, MicroStrategy acquired 25,889 BTC at an average price of $60,839, spending approximately $1.6 billion. As of September 30, MicroStrategy held 252,220 BTC with a market value of $16 billion.

The current figure is around $18.3 billion. Since August 2020, the firm has spent $6.9 billion on acquiring digital gold.

From July to September, MicroStrategy raised $2.1 billion through the issuance of common stock and convertible bonds. The company redeemed secured notes worth $500 million, resulting in its bitcoin reserves becoming 100% unencumbered. Annual interest expenses decreased by $24 million.

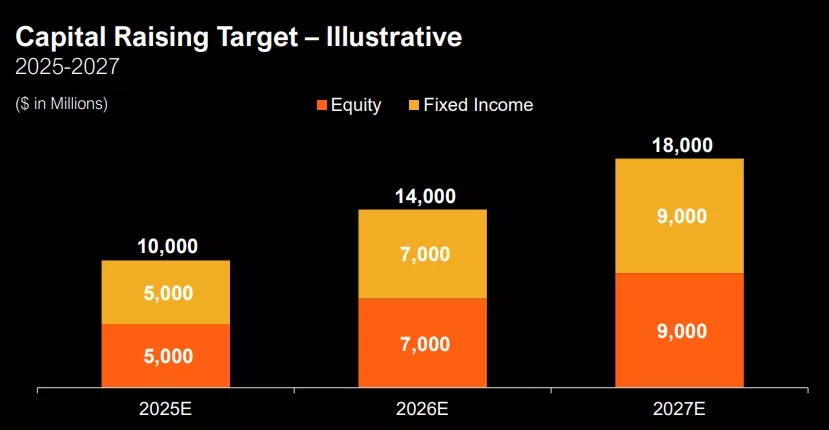

The firm introduced the “21/21 Plan,” aiming to raise $42 billion over the next three years. The funds, expected to be obtained equally through equity and debt issuance, are intended for further increasing bitcoin holdings.

According to Yahoo Finance, MicroStrategy’s market capitalization stands at $50.1 billion. The company’s shares have surged 508% over the past 12 months, while the price of bitcoin has increased by 111% (CoinGecko).

Earlier, company founder Michael Saylor expressed the intention to transform it into a bitcoin bank with a market value of $1 trillion.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!