Bitcoin Shows No Signs of Overheating, Says Expert

From a fundamental perspective, bitcoin does not exhibit “signs of overheating,” according to a report by Galaxy Digital, as reported by Cointelegraph.

The expert noted the absence of a spike in funding rates for perpetual contracts and a moderate increase in OI across crypto derivatives.

According to Galaxy Digital, bitcoin and other cryptocurrencies are expected to trade “at levels significantly exceeding the historical maximum over the next 12-18 months.”

This optimistic view was supported by Nansen analyst Aurelie Barthere, who pointed to increased trading volumes during the update of the historical maximum rate.

Trader Matthew Hyland reported on bitcoin’s “aspiration to continue its upward momentum, citing consolidation above the previous ATH.”

The cryptocurrency market maintains the status quo following the Federal Reserve’s Fed rate cut by 25 basis points, which aligned with market and economist expectations.

TradFi in Play

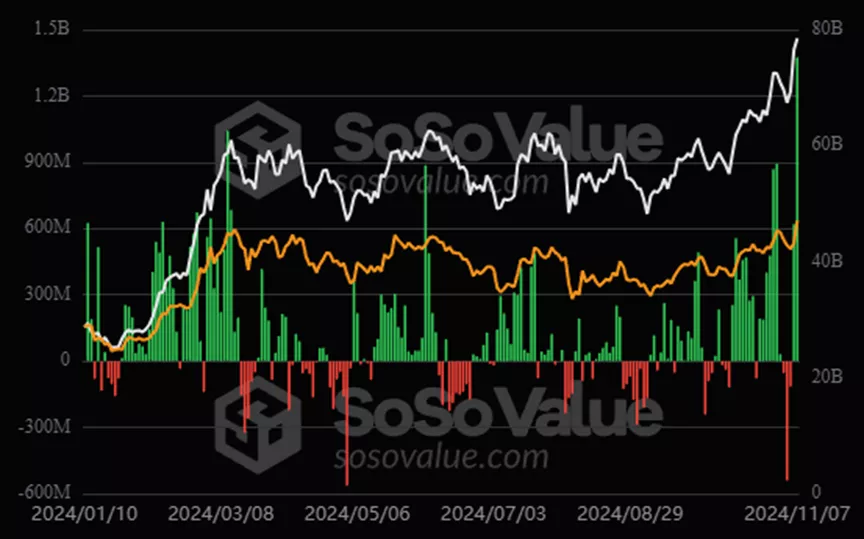

On November 7, inflows into BlackRock’s spot bitcoin ETF exceeded $1 billion for the first time, reaching $1.12 billion. In total, investors directed $1.37 billion into such products—a new historical maximum.

Eric Balchunas of Bloomberg admitted he was “surprised” by the inflow, which exceeded his expectations based on the previous day’s trading volume.

Told y’all it was prob gonna be big, altho even I am surprised it’s that big, by far biggest one day flow of any btc etf ever. https://t.co/Q5MPDMrTYv

— Eric Balchunas (@EricBalchunas) November 8, 2024

“Welcome to PumpVember,” — commented crypto influencer known as ImZiaulHaque.

Peter Brandt Joins the Bulls

Technical analyst Peter Brandt declared it an optimal moment to buy bitcoin.

Bitcoin $BTC is now in the sweet spot of the bull market halving cycle that should top in the $130k to $150K range next Aug/Sep. I measure cycles differently than most. For background see link here: https://t.co/XWxS0kT4pO pic.twitter.com/3oDYzIQf69

— Peter Brandt (@PeterLBrandt) November 6, 2024

In his view, the asset will appreciate by another 73-100% and form the cycle’s peak in August or September 2025.

The expert based his analysis on the timing of previous bull runs triggered by halving. The last market cycle—from the FTX collapse in November 2022 to the halving in April 2024—lasted 518 days. Potentially, a similar duration is required to complete the growth phase.

Outlook on Altcoins

Brandt also considered the prospects for Ethereum and Solana.

$ETHUSD vs. $SOLUSD (same period)

A trader’s perspective

Both are poised for upside BOs to join Bitcoin

But notice, SOL breaking out into new highs

ETH chewing into overhead resistance (supply)

I always favor new highs and prefer SOL

Only those supporting @elonmusk can reply pic.twitter.com/rzQCZOjP9c— Peter Brandt (@PeterLBrandt) November 7, 2024

“Both cryptocurrencies are ready for an upward breakout to join bitcoin. […] SOL is aiming for new highs. ETH is facing overhead resistance (supply). I always favor new highs and prefer SOL,” — commented the specialist.

Previously, Brandt saw potential for a 27-fold increase in Solana—to $4500.

Earlier, Syncracy Capital co-founder Daniel Chung predicted the launch of a SOL-ETF in the first quarter of 2025 following Donald Trump’s victory in the US presidential election.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!