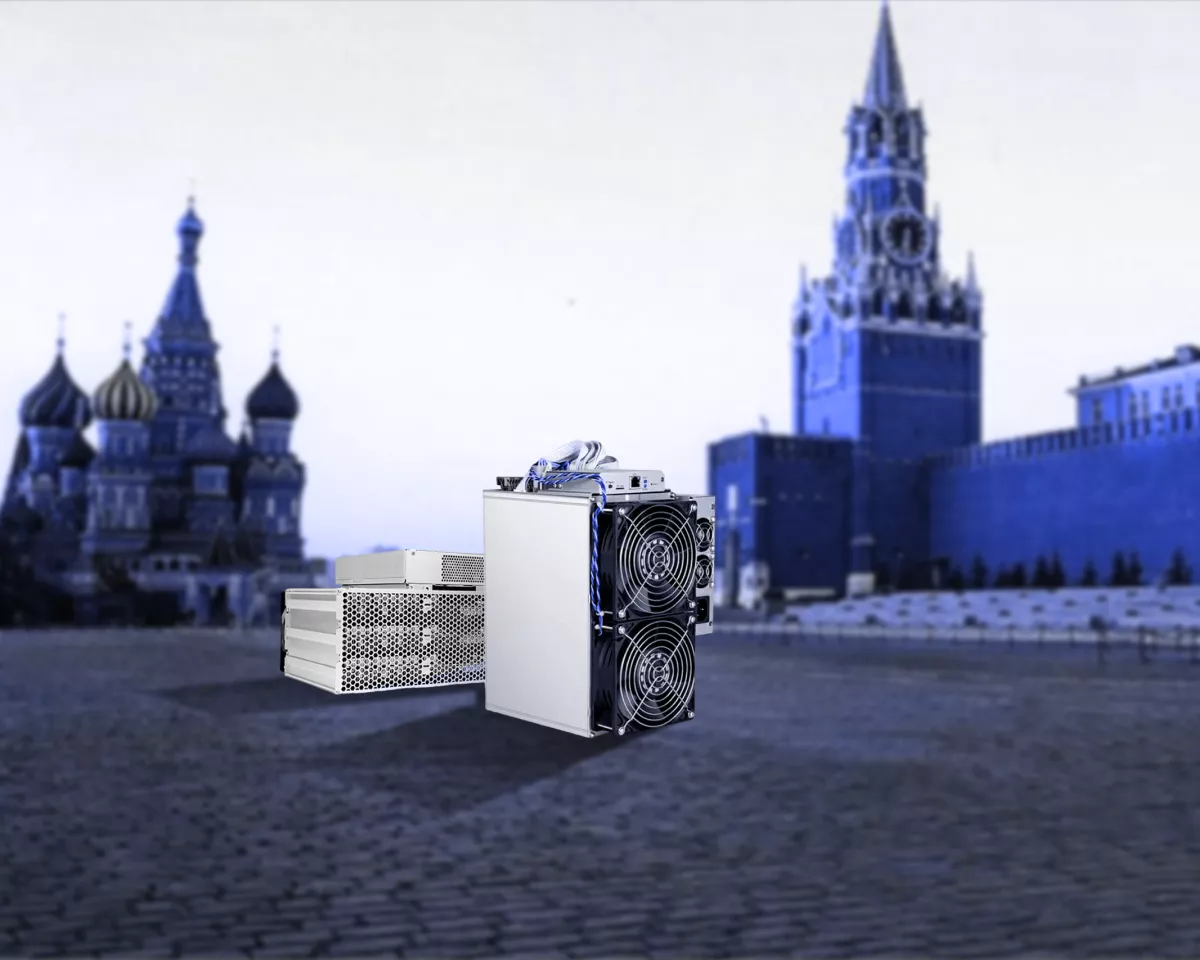

Russia Recognises Digital Currencies as Property for Tax Purposes

On Friday, November 15, the Russian government approved amendments to the draft law on mining, regulating the taxation of cryptocurrency. Digital currencies have been recognised as property for taxation purposes.

Income in the form of cryptocurrencies obtained through mining will be accounted for at market value at the time of receipt. However, these can be reduced by the expenses incurred during the mining process.

“Following discussions with businesses, it was decided that taxing the financial result from mining is the most equitable reflection of this activity’s outcomes. This approach aims to balance the interests of businesses and the state,” the press release states.

Transactions with digital currency will not be subject to VAT. Income from cryptocurrency transactions will be included in the same tax base as income from securities transactions.

The maximum rate of PIT on cryptocurrency taxation will not exceed 15%.

“Mining infrastructure operators will be required to report to tax authorities information about individuals who conduct mining using their infrastructure,” the statement reads.

On November 1, a provision for creating a registry of miners came into effect in Russia. Basic regulation of cryptocurrency mining in the country was adopted in July. ForkLog analysed its impact on the industry in a separate article.

Additional amendments outline the government’s authority to restrict mining in certain areas. Earlier, the Russian Ministry of Energy identified regions for potential bans on cryptocurrency mining.

Russia has also set a limit on energy consumption for individual miners.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!