Long-term Bitcoin Holders Reduce Holdings Amid Price Surge

As Bitcoin approached $100,000, holders offloaded a “significant” 507,000 BTC. This figure is less than the March pace of 934,000 BTC, as some market participants anticipate higher prices before liquidating positions, according to Glassnode.

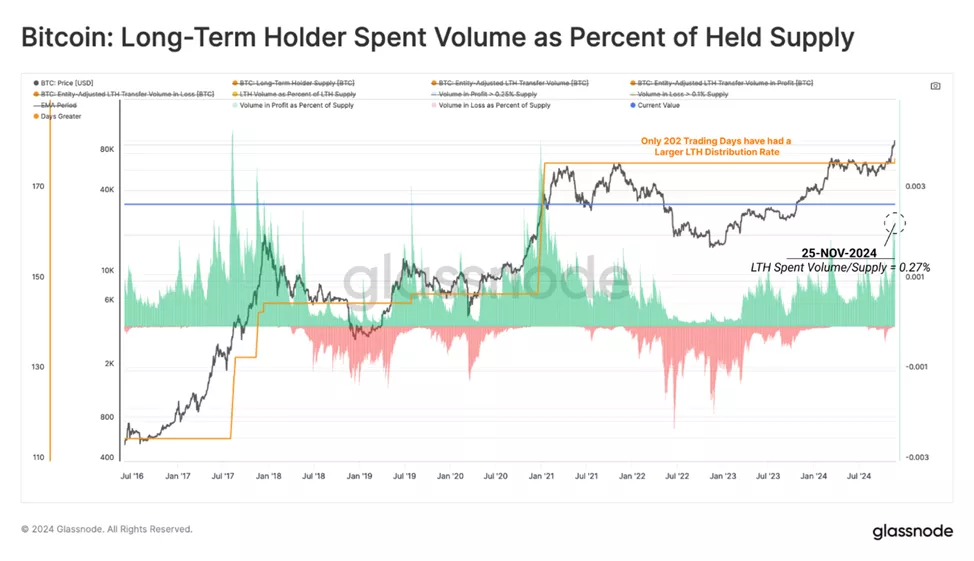

The daily distribution rate by this category of investors reached 0.27% of the coins they hold, surpassing March’s figures. Only on 202 trading days were these rates higher.

The daily realized profit for holders soared to a record $2.02 billion. To absorb this excess supply, active demand is necessary, which may require a period of reaccumulation, Glassnode emphasized.

For analyzing holder activity, experts used the Sell-Side Risk Ratio:

- High values indicate that investors are spending coins with significant profit or loss relative to their cost. This condition is typical during periods when the market likely needs to restore balance. Such a pattern usually forms after highly volatile price movements.

- Low values suggest that most coins are spent relatively close to their break-even cost. This indicates a certain balance and low volatility, signaling the exhaustion of “profits and losses” in the current range.

Currently, the metric has approached the threshold of high values, indicating significant profit-taking. The current level remains significantly below the terminal levels of previous cycles.

In other words, in previous bull markets, demand was sufficient to absorb supply even under similar relative distribution pressure, specialists explained.

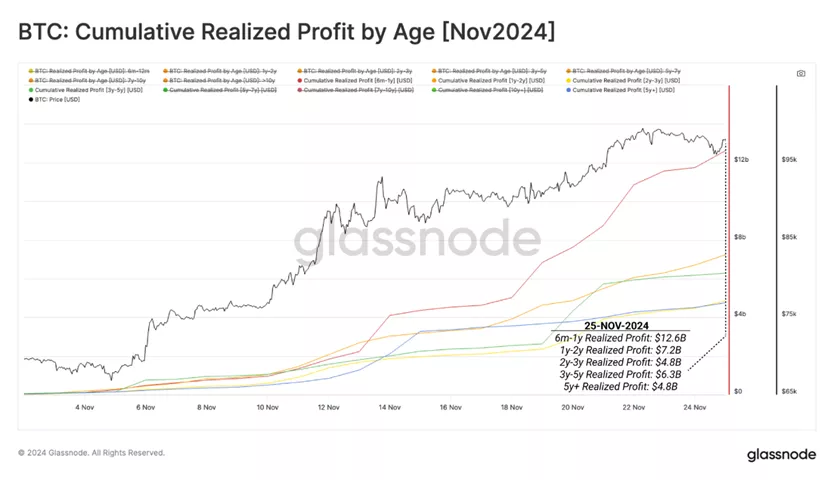

In the next stage, specialists examined the volume of realized profit since November 2024 based on the holding period of coins, yielding the following results:

- from six months to a year — $12.6 billion;

- from one to two years — $7.2 billion;

- from two to three years — $4.8 billion;

- from three to five years — $6.3 billion;

- over five years — $4.8 billion.

The data indicates that the majority of selling pressure came from coin holders aged six months to a year (35.3% of the total supply).

“More experienced investors remain restrained and may be patiently waiting for price increases. Such sales volumes may be characteristic of swing traders who accumulated funds after the launch of ETF and planned to ‘ride’ only the next market wave,” the review states.

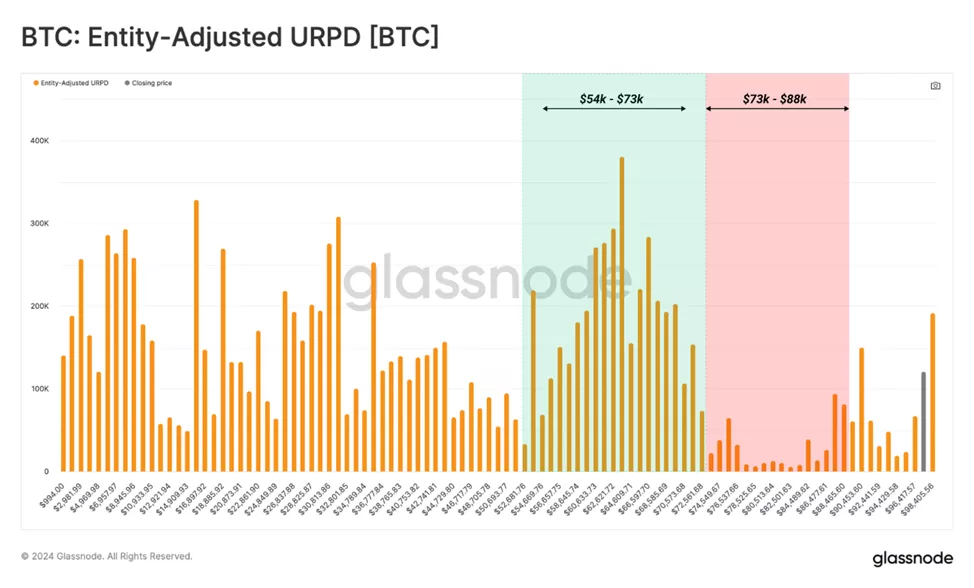

In conclusion, analysts examined the structure of realized price levels in the context of UTXO (URPD) to identify areas with high concentration of costs. They found that few coins changed hands in the range of $76,000 to $88,000.

Glassnode noted that this range has formed an “air gap,” which could become an area of interest if the market retraces before attempting to move above $100,000 again.

Previously, experts described the current Bitcoin pullback as a pause before a rise to $100,000.

Earlier, Pantera Capital predicted the price of the leading cryptocurrency could rise to $740,000.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!