MARA Acquires Bitcoin Worth $618 Million

The largest publicly traded mining company, MARA Holdings, has acquired 6,474 BTC for approximately $618 million following the issuance of $1 billion in convertible bonds.

With our 0% $1 billion convertible notes offering, we are excited to share an update:

— Acquired an additional 703 BTC, bringing the total to 6,474 BTC, at an average price of $95,395 per BTC

— YTD BTC Yield Per Share 36.7%

— Total owned BTC: ~34,794 BTC, currently valued at… pic.twitter.com/bzbunlyBRN— MARA (@MARAHoldings) November 27, 2024

The average purchase price was $95,395 per coin.

The firm’s bitcoin reserves have reached 34,794 BTC, valued at approximately $3.3 billion. Since the beginning of the year, digital gold has provided a yield per share of 36.7%.

From the raised amount, MARA allocated $200 million to repurchase bonds maturing in 2026.

“The remaining ~$160 million, after transaction costs, is available for future BTC purchases during downturns,” the company stated.

On November 18, MARA announced a private placement of convertible bonds with a 0% coupon and a 42.5% premium to the weighted average share price, amounting to $700 million. Due to oversubscription and an additional option for initial buyers, the amount increased to $1 billion.

0% coupon with a 42.5% premium — highest premium % for a 0% coupon since 2021. Oversubscribed and upsized up to a total $1 billion. @MARAHoldings https://t.co/pnPVYBloS9

— Salman Khan (@theRealSalKhan) November 19, 2024

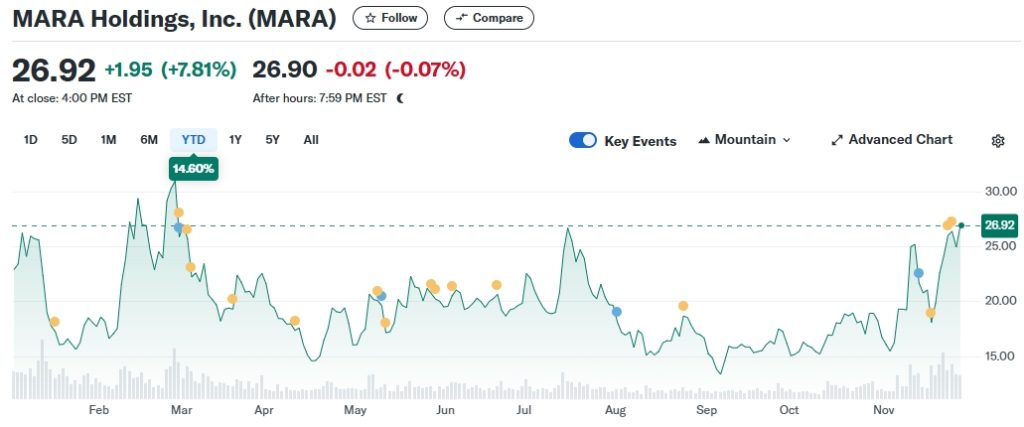

Following the announcement of the 6,474 BTC purchase, the company’s stock price rose by 7.81% during the trading session on November 27, reaching $26.92. MARA’s market capitalization exceeded $8.66 billion.

Since the start of the year, the stock has risen by 14.6%, while the price of digital gold has increased by approximately 130%.

In October, analysts at Matrixport highlighted the potential for miner stock prices to rise, considering the stabilization of revenue declines and their lag behind bitcoin’s performance.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!