Tether CEO Labels USDT as Catalyst for Bitcoin Price Surge

A strong correlation exists between bitcoin’s rise above $100,000 and the increased supply of Tether’s USDT stablecoin, according to the company’s CEO, Paolo Ardoino, in an interview with The Block.

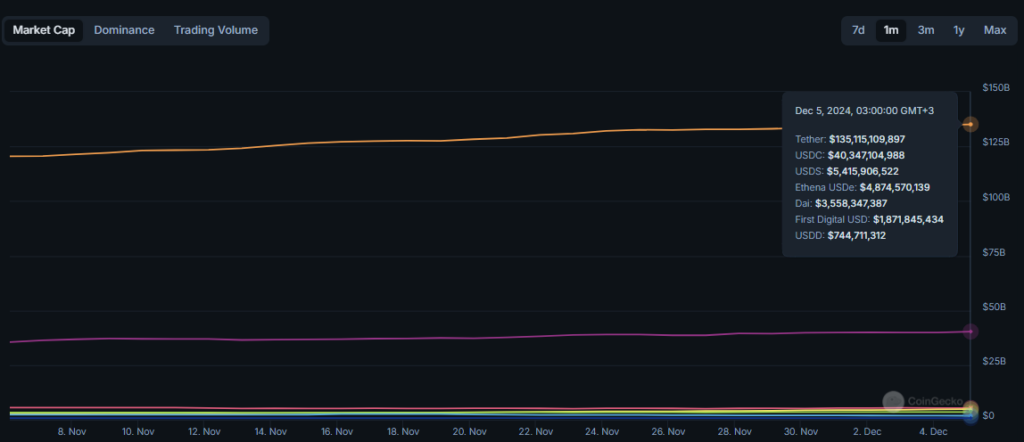

In the last 20 days alone, the market capitalization of the stablecoin has grown by approximately $16 billion, he noted.

This is partly due to capital inflows into spot bitcoin ETFs, as well as purchases of digital gold by MicroStrategy and its imitators, Ardoino added.

The company founded by Michael Saylor has additionally acquired 15,400 BTC for approximately $1.5 billion. MicroStrategy’s cryptocurrency reserves have reached 402,100 BTC.

Amid the inflow of funds into bitcoin-based exchange-traded funds, the asset volume under management by BlackRock’s IBIT has exceeded 500,000 BTC. According to SoSoValue, issuers of these products in the US collectively hold 5.54% of the total supply of the leading cryptocurrency.

Over the past 30 days, bitcoin prices have increased by nearly 49%, according to CoinGecko.

“This required an injection of liquidity from the traditional financial world into crypto trading, and such large inflows ultimately transform into USDT. That is why the market capitalization grew so quickly,” said Ardoino.

Over the month, the supply of Tether’s stablecoin increased by approximately 12.5%, reaching $135 billion. The market capitalization of Circle’s USDC grew by nearly 14% but remains less than a third of the leader’s figure at $40.4 billion.

Earlier, Tether decided to cease support for the euro-pegged stablecoin EURT due to low demand and increased regulation in the EU.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!