Altcoin Liquidations Reach Highest Level Since 2021

On December 10, altcoin liquidations amounted to $1.75 billion, marking the largest since May 19, 2021. In the crypto derivatives market, liquidations reached a record $12.8 billion, according to a review by K33 Research.

Experts noted that cascading liquidations were a feature of the 2021 bull run and appear to be repeating this pattern now.

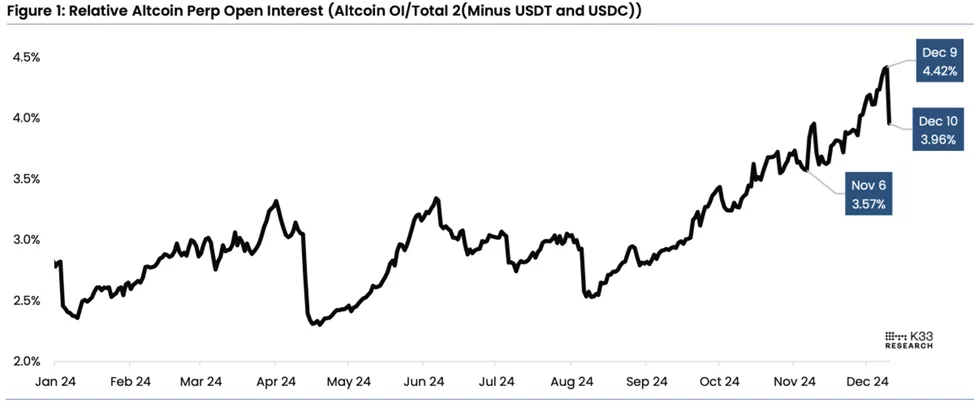

Expressed in terms of capitalization, open interest in perpetual contracts on altcoins rose from 3.57% to 4.42% before plummeting to 3.96%.

As a result, Ethereum’s funding rate fell from 0.0229% to 0.0076% — the lowest since November.

This signaled a reduction in excessive leverage and set the stage for more sustainable price movements, according to Bitfinex. Experts estimate that current metric values are characteristic of a bull market.

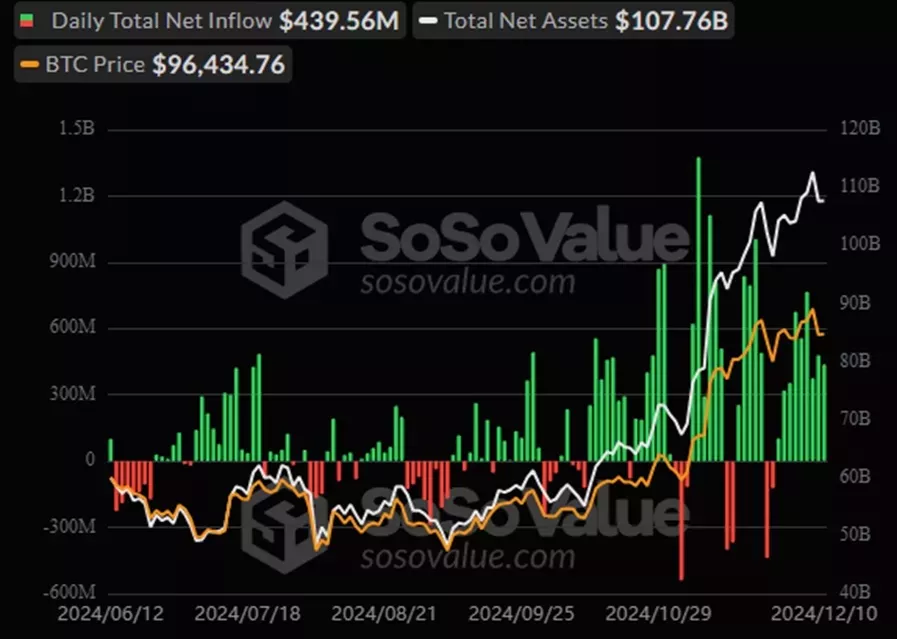

Specialists remain optimistic about the prospects for Bitcoin and Ethereum. They noted the inflow of funds into ETFs as a key source of support amid profit-taking by hodlers.

On December 10, $439.6 million flowed into exchange-traded funds based on digital gold, and $305.7 million into those based on the second-largest cryptocurrency by capitalization. In the first case, positive dynamics continued for the ninth consecutive day, and in the second, for the twelfth.

CryptoQuant has warned of a potential pause in the digital gold rally.

Earlier, Real Vision’s chief analyst Jamie Coates suggested Bitcoin might enter a correction in two to three months.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!